GameStop Stock News: GME extends rally as NASDAQ hits 17,000 for first time

- GameStop ends share sale that began on May 17.

- GameStop sold all 45 million shares for $933 million.

- NASDAQ reaches 17,000 for first time in history.

- Market analysts are growing bullish despite stubborn Fed.

On Tuesday, GameStop (GME) stock rallied more than 25% on news that the videogame retailer and meme stock had finished selling nearly $1 billion worth of new shares in an at-the-market secondary sale.

When meme stock godfather Keith Gill woke from hibernation earlier this month to post a meme of a man leaning forward in his chair, chaos broke out immediately. GameStop, alongside other meme stocks like AMC Entertainment (AMC), saw its share price surge. Management then used that opportunity to raise some much needed cash at better prices.

The NASDAQ, up 0.6%, is leading a mixed market on Tuesday with Nvidia (NVDA) and other tech stocks trending higher. Alphabet’s (GOOGL) rumored takeover of HubSpot (HUBS) sent both stocks higher after CNBC’s David Faber said he has been told it’s an all-stock deal. The tech-infused NASDAQ reached the 17,000 level for the first time ever.

GameStop stock news

GameStop sold 45 million shares of GME common stock for about $933.4 million. This means the average share was sold at $20.74. Since GME shares closed at $19.00 last Friday, they had a lot to do to reach this level.

“GameStop intends to use the net proceeds from the ATM Program for general corporate purposes, which may include acquisitions and investments,” the Texas-based company said in a statement.

At the end of January, GameStop reported just under $603 million in total debt, so the current cash raise puts the company in a better position. Still, there is no word that management will use the funds to pay off a chunk of debt, and questions emerge about what type of investment or acquisition the c-suite has in mind.

Management announced the at-the-market share sale on May 17 during a period when GME stock was sliding heavily following its unexpected three-digit rally on May 13 and 14. This makes it tough to tell how much the share sale injured the share price, but the market now seems happy to forget about it.

Previous to the share sale, about 305.7 million shares of GME were outstanding. That means that the share sale diluted the stock by another 14.7%.

Gamestop FAQs

GameStop is a retailer of video games and gaming merchandise through its approximately 4,400 branded stores worldwide. More than 2,900 of these locations are in the United States. The company was founded in Dallas, Texas, in 1984 as Babbage’s but changed its name to GameStop in 1999. The company had revenue of $5.93 billion in 2022 but has been falling over the past decade as physical game purchases have been declining in favor of digital downloads directly from hardware providers like Sony’s Playstation, Microsoft’s XBox, Nintendo and the Steam platform. The company trades under the GME symbol on the New York Stock Exchange.

In January of 2021, retail stock traders that organized on Reddit’s r/WallStreetBets forum realized that GameStop’s short ratio exceeded its float through the use of naked shorts. This information circulated until a group of traders decided to buy up the small amount of shares that were available. This caused the price to jump 1,500% in a famous short squeeze that month when short-sellers were forced to repurchase shares to close their short positions at higher and higher prices. Traders like Keith Gill walked away with millions of dollars in profits, while hedge funds like Melvin Capital and White Square Capital would eventually shutter due to extreme losses on their short positions. Traders on the Reddit forum made memes to proselytize their bets on GameStop, which helped the long trade proliferate. Later many of these same traders would glom onto new “meme stocks” like AMC Entertainment and Bed, Bath & Beyond.

In its most recent quarter, Q1 2023, GameStop saw revenue decline 10% YoY to $1.237 billion, which is pretty much par for the course. Much of the reduction in sales is due to declining game and collectible revenue, while hardware and merchandise sales have actually been increasing. GameStop has been making the most of the situation by cutting back on labor costs (SG&A) to the tune of $100 million YoY. These cost-cutting measures led GameStop to cut its net loss YoY by two-thirds to about $50 million. With more than $1 billion in cash on its balance sheet, so its backers think it has enough runway to become profitable again. Out of 12 recent analyst marks, the vast majority gave GME stock a “Hold” rating, while four analysts gave it a “Buy” or “Strong Buy”.

Ryan Cohen, the founder and former CEO of Chewy.com, made a large investment in GameStop in December 2020, preceding the stock’s epic short squeeze. Cohen became one of the most high-profile investors in the meme stock and later became Executive Chairman of the company. His tenure has resulted in a number of high-profile changes to management. A number of executives left GameStop once Cohen arrived, and he is said to have used his perch to install new executives from Chewy and Amazon in key positions. Cohen owns approximately 12% of the company.

GameStop stock forecast

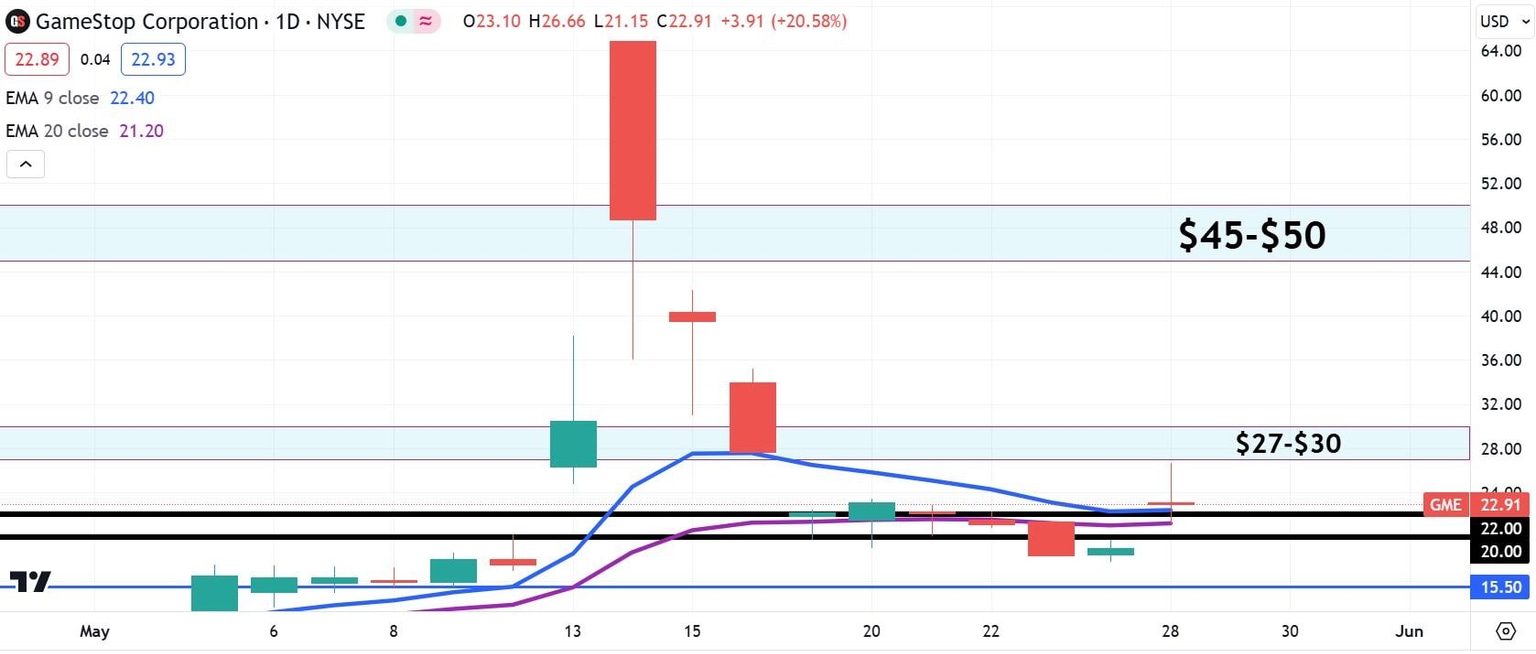

GameStop stock has been using the $22.00 level as support, a price that has worked well for it in the past going back to the first half of 2023. The primary move for meme stock traders is to push GME back into the $27 to $30 resistance window that worked in 2022 and 2023.

Once again, however, GME stock looks poised to closer lower than the stock's morning price action. This is a sign that the rally may not have hardy enough legs to continue. GME reached an intraday high of $26.66.

GME daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.