- GameStop stock surged over 30% on Tuesday.

- AMC stock is also on a high as it spikes 15%.

- GME stock ramps up on Wednesday as Ryan Chone steps in.

GameStop stock (GME) rallied an impressive 30% on Tuesday as retail investors piled back into some of their old favorites. AMC for example closed up 15%, and other meme and retail favorites also performed strongly. This move into risk assets has been set in motion by a strong Fed statement last week when Chairman Powell said the US economy was strong enough to withstand rate hikes and he saw continued strength in economic growth and employment. Investors seem to believe in the Goldilocks scenario painted by the Fed – that of a soft landing and control of inflation. A quick look back through history predicts this is highly unlikely. Inflation is usually not brought under control by rate hikes but by recessions. Nevertheless, we must trade what we see, and for now risk assets are definitely in favor. The key is to remember when this trend slows and then to book some profits.

GameStop Stock News: Share price up again on Ryan Cohen purchase

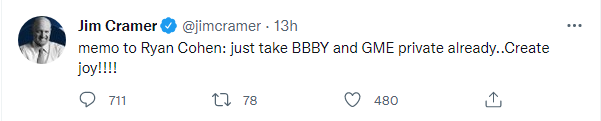

GME stock, not content with a 30% surge on Tuesday, is up a further 15% on Wednesday as news hit of CEO Ryan Cohen's RC Ventures buying 100,000 shares in GME. This takes his stake in the retailer up to 11.9%. Jim Cramer of CNBC was certainly getting in on the act as he tweeted:

He also invited Ryan Cohen to his show to discuss BBBY and GME, saying he will give him ten minutes on each. This refers to Ryan Cohen taking a recent stake in BBBY through his investment company earlier this month. BBBY stock spiked sharply on the news to $30 before quickly retracing to $20. So will it be the same for GME? Insider buying is generally a stronger predictor of future performance than insider selling.

GameStop Stock Forecast

This has certainly changed the technical picture. GME stock was suffering along with many techs and growth stocks in 2022. The recent recovery saw GameStop once again top the WallStreetBets chat and discussion of another short squeeze were high on the wish list of traders. GME rallied 30% before this news of Ryan Cohen. Now the move has taken GME back up to $140, clearing the congestion zone from $120 to $130. $140 is also the top of the Ichimoku cloud. The next big level comes at $160 from the series of highs in December and $174.78 from the spike high in January of this year. Key support is at $100 – the breakout level.

GME 20-hour chart

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD drops below 1.1400 after Germany and EU PMI data

EUR/USD struggles to hold its ground and trades below 1.1400 in the European session on Wednesday. PMI data from Germany and the Eurozone showed that the business activity in the service sector contracted in April. Markets await comments from central bankers and US PMI data.

GBP/USD stays weak near 1.3300 after disappointing UK data

GBP/USD stays under bearish pressure near 1.3300 in the European session on Wednesday. Pound Sterling struggles to find demand following the weaker-than-forecast April PMI data from the UK. BoE Governor Bailey will speak later in the day and the US economic calendar will feature PMI reports.

Gold price touches fresh weekly low, below $3,300 amid easing US-China trade tensions

Gold price extends its steady intraday descent through the first half of the European session and momentarily slips below the $3,300 mark in the last hour as the upbeat market mood conditions undermine demand for safe-haven assets.

Dogecoin lead double-digit gains across meme coins, with Shiba Inu, PEPE and BONK skyrocketing to new monthly highs

Top meme coins Dogecoin, Shiba Inu, PEPE and BONK lead the meme coin sector with double-digit gains on Wednesday following the crypto market recovery.

Five fundamentals for the week: Traders confront the trade war, important surveys, key Fed speech Premium

Will the US strike a trade deal with Japan? That would be positive progress. However, recent developments are not that positive, and there's only one certainty: headlines will dominate markets. Fresh US economic data is also of interest.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.