Gamestop (GME) Stock Price and News: Shares collapse from $95 to $60 as volume remains high

- GME shares collapse again from earlier highs on Friday morning.

- Robinhood had earlier on Friday boosted GME by removing any restrictions.

- GME quickly gives up gains, falling over $30.

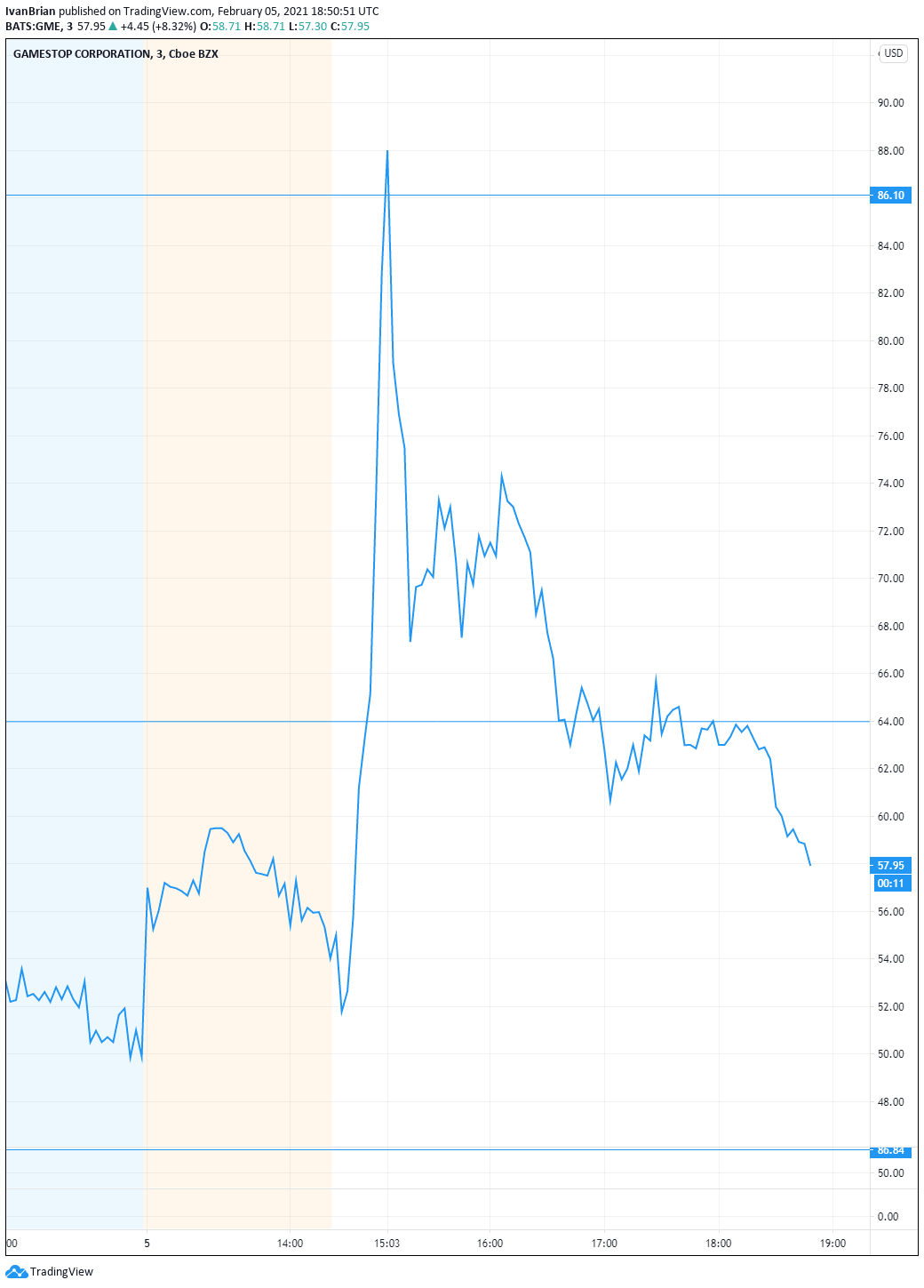

Update 2, Friday, February 5: Gamestop shares fell all the way back to below $60 late on Friday as the early rally fizzled out. Robinhood caused a surge of interest shortly after Fridays open, with GME surging from $54 to $95. Robinhood announced it had removed all restrictions on Gamestop shares sparking the rally.

Update Friday, February 5 post-market open: GameStop Corp (NYSE: GME) has been surging on Friday by over 55% to above $82 after short-sellers seemed to have cashed in and new money is coming in. Another factor boosting shares is RobinHood´s removal of trading restrictions from shares of the video gaming firm and also AMC, another favorite of WallStreetBets. It is essential to note that GME is still down from the peak seen last week. The move has triggered volatility short-circuit cut. Follow all stocks updates

Update Friday, February 5: Short-sellers continued to wreak revenge on Gamestop (GME) on Thursday, with a 40% loss for the stock. GME shares closed at $53.50 on Thursday from a high of nearly $500 on January 28. Ortex Data, which tracks short interest, reports that GME short sellers made $3.6 billion this week so far. Short-sellers in Gamestop lost $12.5 billion for January.

Gamestop (GME) continues its bumpy ride on Thursday as traders continue to grapple with volatility and retail traders battle new short positions.

Gamestop has been under pressure most of this week as the retail trend appears to be waning and the short interest in Gamestop (GME) declines. Borrowing costs for new short positions has also declined as reported by S3 partners yesterday.

Regulators meet to discuss the Gamestop phenomenon

US Treasury Secretary Janet Yellen is due to meet regulators later on Thursday to discuss the Gamestop retail trading phenomenon.

The SEC had said on Wednesday that it was hunting fraud in social media posts that drove the price of GME higher.

Not all hedge funds suffered

Senveat Management led by Richard Mashaal and Brian Gonic made over $700 million in the Gamestop rally, the Wall Street Journal reported on Wednesday. The hedgefund bought shares in GME in September and watched as the shares exploded. “When it started its march, we thought, something’s percolating here,” said Mashaal — adding, “But we had no idea how crazy this thing was going to get.”

“It is not just little people on the long side here. There are huge players playing both sides of GameStop,” said Thomas Peterffy, Chairman of Interactive Brokers Group Inc, the Wall Street Journal reported.

Hedge fund firm Mudrick Capital Management LP made $200 million on AMC shares during the recent rise.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.