- Gamestop (GME) hasn't gone away yet as another war beckons!

- GME heavily discussed again on /Wallstreetbets on February 20/21.

- Roaring Kitty the catalyst as he is still bullish on GME.

Update February 25: The frenzy around the shares of GameStop Corp. (NYSE: GME) refuses to die down, as the video gaming company is back in the spotlight after it skyrocketed over 100% into Wednesday’s closing, settling around $92. The trading in the GME shares was halted twice due to the 100% explosion. Throughout the day, GME reported a modest advance but rallied hard in the last hour of trading alongside the surge in fellow Reddit favorites AMC, Blackberry and Tilray. The stock soared an additional 83% to $168 in the post-market trading, See all equity news

It’s being reported that the shares exploded after Board Member Ryan Cohen tweeted a photo of a McDonald’s ice cream cone with a frog emoji for a caption. Investors likely see the tremendous surge in GME as a short-squeeze 2.0 after the r/WallStreetBets,-led retail-trade craze. The bulls ignored the announcement of the resignation of GME’s Chief Financial Officer, Jim Bell, late Tuesday.

Gamestop stock news

The ramifications from the Gamestop episode are yet to be fully played out. The White House is to investigate if a tax on stock trading is worth considering in the wake of the Gamestop (GME) saga, according to reports from CNN. This would be a significant revenue source for the US as share trading has exploded during the pandemic. The US currently does not impose a tax on share trading for individuals, unlike the UK and many EU countries, where the rate varies from 0.5 to 1%. A $1.9 trillion stimulus package also needs to be funded!

However, there was news from the testimony of Keith Gill, aka Roaring Kitty, aka DeepF********Value on /wallstreetbets, that has the retail community ready to go to war again in Gamestop. Gill said of Gamestop during testimony to Capitol Hill lawmakers, “I do find that it’s an attractive investment at this price point". Gill also appeared to have bought another 50,000 shares of GME as he shared a screenshot on /wallstreetbets on Friday afternoon.

This emboldened /wallstreetbets traders with further impetus to "go again", and at the time of writing, shares in Gamestop have rallied 11% to $44.89 during Monday's pre-market session.

Gamestop (GME) stock forecast

For now, sentiment appears to be favouring bulls, but it is hard to say for how long. Given increased institutional attention, it is harder for retail to dominate the Gamestop pitch like before. But the trend is your friend, so jump on and just make sure to manage risk carefully. Making a forecast in this one is not for the faint-hearted and beyond the capabilities of this author!

Previous updates

Update February 24: GameStop Corp.(NYSE: GME) has kicked off Wednesday's trading session with a jump of around 4% to $46.78 at the time of writing. While broader stock indexes are falling, equity of the videogaming company is on the rise. A week after the grilling on Capitol Hill, lawmakers have moved from scrutinizing the frenetic action around GameStop to the testimony of Jerome Powell, Chairman of the Federal Reserve. Action on Reddit forums – by Roaring Kitty and others – remains a force in shaking shares.

Gamestop appeared to be fading into the background after last week's Capitol Hill testimony. Payment for order flow is to be examined again as Citadel Securities made public the 40% share of retail orders they process. Vlad Tenev, CEO of Robinhood, also apologized for not doing things perfectly and admitted it could have been a lot worse if Robinhood had not managed to secure $3 billion in funding for collateral with clearing brokers for the huge volume of Gamestop trading.

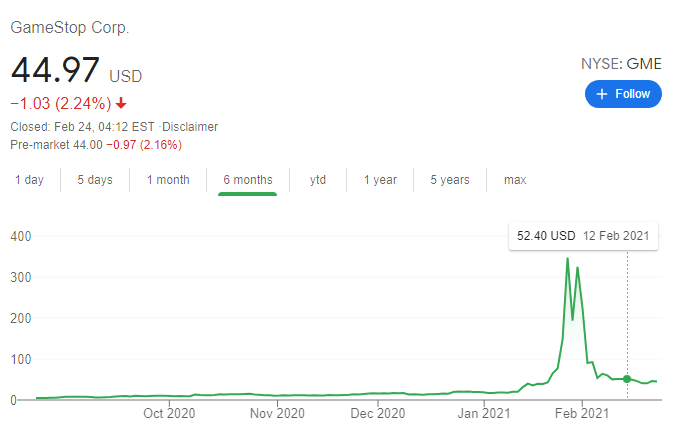

February 24: GameStop Corp (NYSE: GME) has been on the back foot, falling by 2.24% on Tuesday to end the day at $44.97. At the time of writing, shares of the Texas-based videogaming veteran are changing hands at the round $44 level, another loss of 2%. It is essential to note that despite falling tumbling from the frenetic highs around $400, those investing in GME early in the year have more than doubled their investment. Is the current slide a prelude to even greater falls? Or perhaps a"buy the dip" opportunity? Federal Reserve Chair Jerome Powell lifted spirits and stock markets with a soothing message, and he appears in Congress again on Wednesday.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.