- Gamestop moved 27% higher last week but has stalled since.

- The meme stock forms a bullish flag pattern, hinting a continuation trend.

- GME now lagging other meme stocks such as AMC and SKLZ.

Is GameStop ready to break out again? Last week the stock surged over 27% as meme stocks returned to the forefront of trader's minds. Since then, though, the meme traders appear to have forgotten about the former king and focused on the shiny new toy of AMC.

On Tuesday, further insult was added to the Gamestop throne with a new kid on the block, SKLZ, showing how it is done with an 11% breakout move. GME stock by comparison had a modest 4% gain, while AMC registered nearly 9% up on the day. Is GME now ready to recapture its meme-stock throne?

GME key statistics

| Market Cap | $16.1 billion |

| Price/Earnings | |

| Price/Sales | 2.7 |

| Price/Book | 31.3 |

| Enterprise Value | $11 billion |

| Gross Margin | 0.24 |

| Net Margin |

-0.02 |

| 52 week high | $483 |

| 52 week low | $4.56 |

| Average Wall Street Rating and Price Target | Sell $88.33 |

GME stock forecast

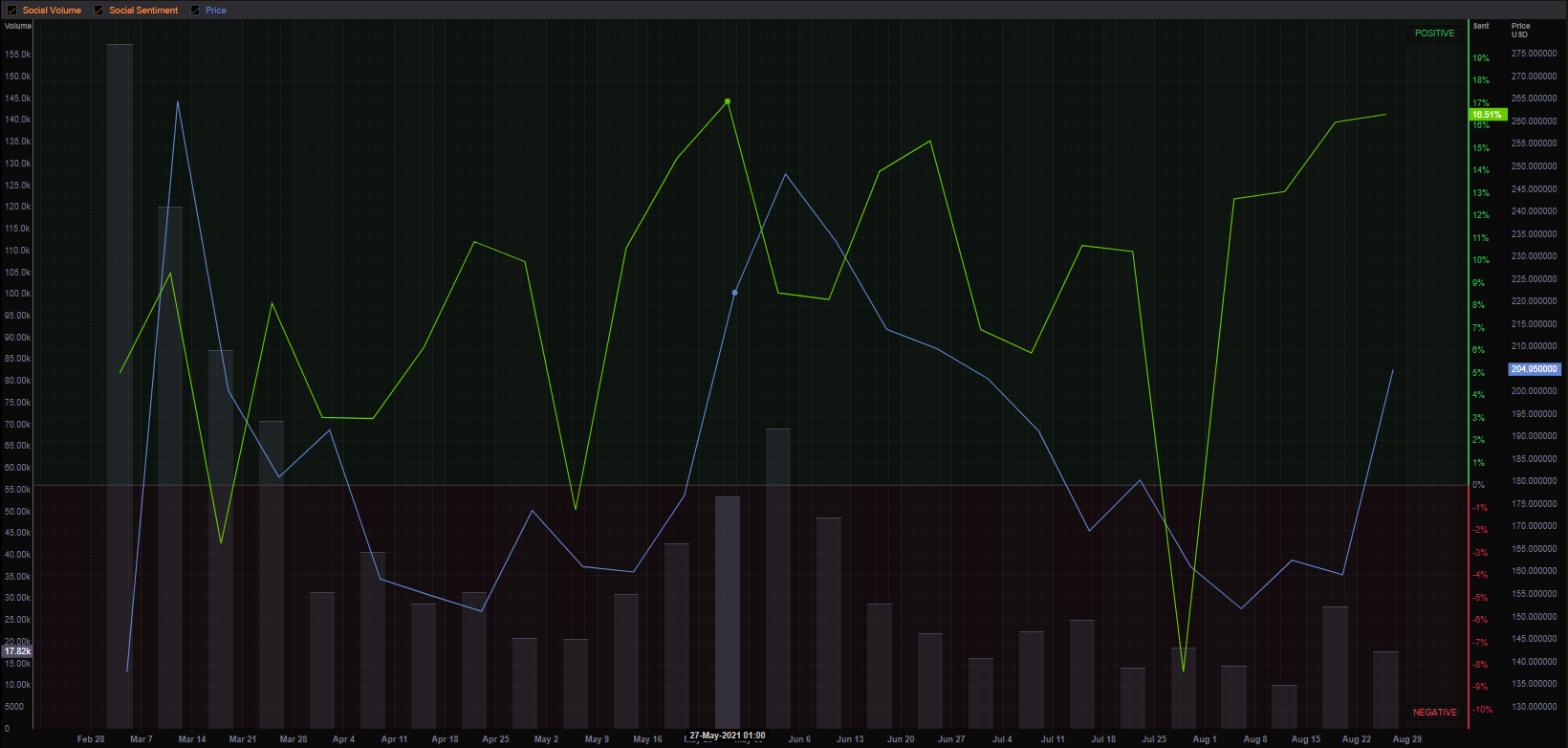

There is a reasonable level of correlation between social media sentiment and the underlying GME share price. You may think it is higher given that GME was the original poster stock for meme stock madness, but there is so much data to filter it can be difficult to get an accurate picture. The Refinitiv social media chart below shows the volume of mentions on social media to possibly be a more accurate tool, and these are still well down from levels seen back in February. Sentiment, though, has clearly increased lately.

The chart below does show some nice potential with the formation of a bullish continuation flag. Regular readers will note my drawing skills have improved remarkably from the earlier flag drawing on the Palantir chart, see here. A perfect breakout occurred with the 27% surge on August 24. This was a meme stock day with AMC also popping over 20% that day before stocks settled down ahead of the Jackson Hole speech. Now that risk is back on and rates are not rising anytime soon, stock rallies are back on and nothing rallies better than a meme stock.

GME has then formed a consolidation phase after the breakout and this is usually a continuation trend, as the stock pauses to attract more buyers and interest. The volume profile bars show that GME really wants to get above $250 to enter an area of low volume and low resistance. The key support to hold is a neat $200 round number psychological level, but this is importantly the low of the flag formation.

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD falls to fresh daily lows below 1.0400 after upbeat US data

EUR/USD came under selling pressure early in the American session following the release of United States macroeconomic figures. The December ISM Services PMI unexpectedly surged to 54.1, while November JOLTS Job Openings rose to 8.1 million, also bearing expectations.

GBP/USD extends retracement, struggles to retain 1.2500

GBP/USD lost further traction and battles to retain the 1.2500 mark after hitting an intraday high of 1.2575. Stock markets turned south after the release of upbeat American data, providing fresh legs to the US Dollar rally.

Gold holds on to modest gains amid a souring mood

Spot Gold lost its bullish traction and retreated toward the $2,650 area following the release of encouraging US macroeconomic figures. Jumping US Treasury yields further support the US Dollar in the near term.

Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resign

Bitcoin edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Federal Reserve Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.