FTSE: Short-term five swing pattern favors additional gains [Video]

![FTSE: Short-term five swing pattern favors additional gains [Video]](https://editorial.fxsstatic.com/images/i/Equity-Index_FTSE-2_XtraLarge.jpg)

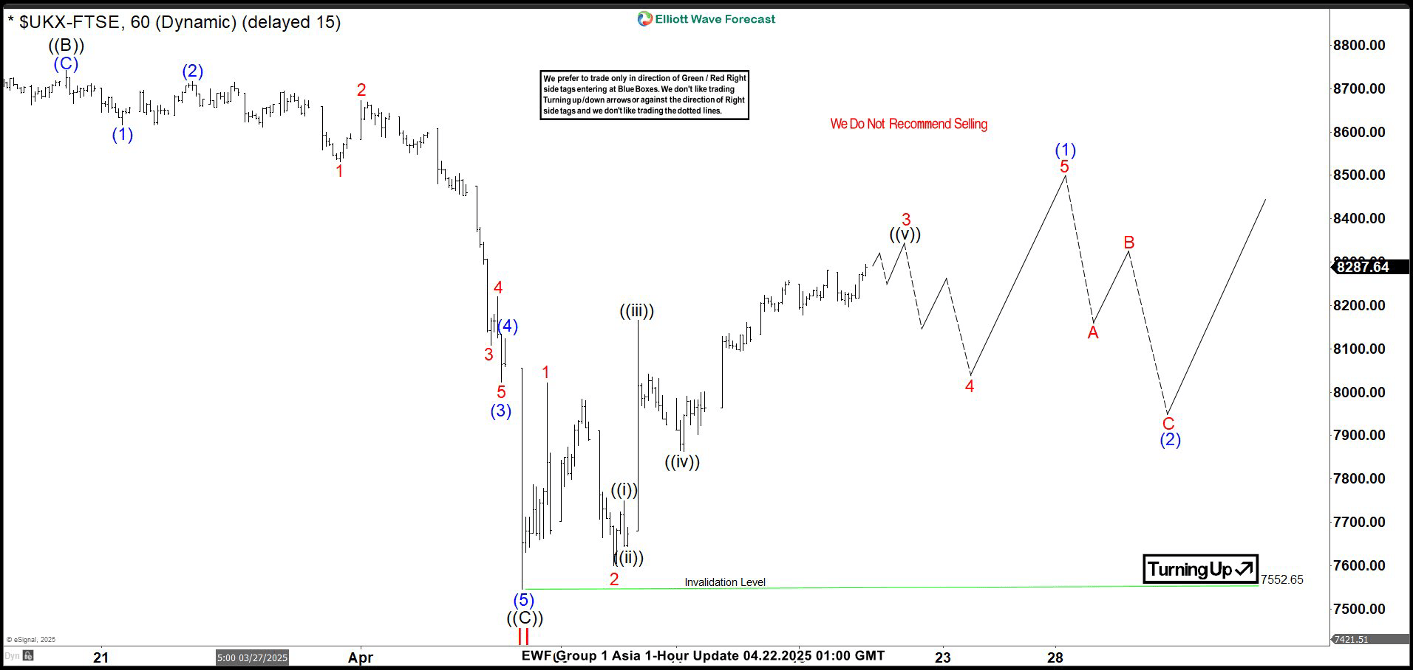

The FTSE index experienced a significant decline from its high on April 3, 2025, reaching a low of 7552.65. We identify this as the completion of wave II. This downturn followed a zigzag pattern, a common structure in Elliott Wave analysis. Starting from the April high, the decline unfolded in three phases: wave ((A)) dropped to 8481.1, wave ((B)) rebounded to 8742.75, and wave ((C)) fell further, structured as a five-wave impulse. Within wave ((C)), the sub-waves progressed as follows: wave (1) hit 8615.96, wave (2) recovered to 8717.03, wave (3) fell to 8023.45, wave (4) rose to 8123.27, and wave (5) concluded at 7547.69, finalizing wave ((C)) and wave II.

Since hitting this low, the FTSE has begun to recover. The ongoing rally from the wave II low is unfolding in a five-wave upward pattern, suggesting potential for further gains. So far, wave 1 of this rally peaked at 8021.77, and wave 2 pulled back to 7599.56. We anticipate wave 3 to push higher soon, followed by a wave 4 pullback, and then a final wave 5 to complete wave (1) of the broader upward move. In the short term, as long as the 7547.69 low holds, any dips are likely to attract buyers at key levels (often referred to as 3, 7, or 11 swings in Elliott Wave terms), supporting further upside.

FTSE 60 minute Elliott Wave chart

FTSE Elliott Wave [Video]

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com