FTSE 100 (UK) Elliott Wave technical analysis [Video]

![FTSE 100 (UK) Elliott Wave technical analysis [Video]](https://editorial.fxstreet.com/images/Markets/Equities/FTSE/ftse-100-index-17327640_XtraLarge.jpg)

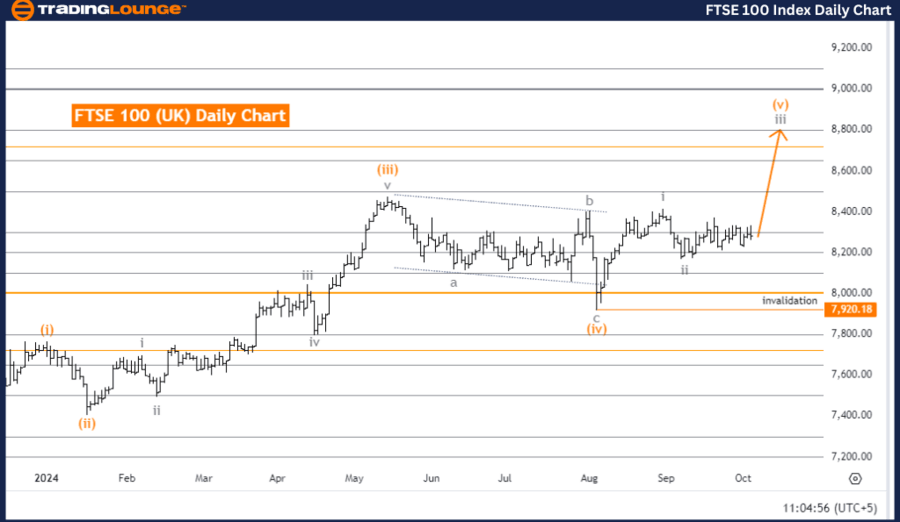

FTSE 100 (UK) Elliott Wave Analysis - Trading Lounge Day Chart

FTSE 100 (UK) Elliott Wave technical analysis

Function: Bullish Trend.

Mode: Impulsive.

Structure: Gray Wave 3.

Position: Orange Wave 5.

Direction: North.

Next higher degrees: Gray Wave 3 (started).

Details: Gray Wave 2 appears completed. Gray Wave 3 is now active.

Wave cancelation level: 7,920.18.

The FTSE 100 Elliott Wave Analysis for the daily chart outlines a bullish trend, showcasing a solid upward market movement. The mode of this movement is impulsive, meaning that the market is advancing with momentum in the direction of the dominant trend. Currently, the wave structure under focus is Gray Wave 3, which is progressing within the larger bullish sequence.

At this point, the market is situated in Orange Wave 5, a component of the broader Gray Wave 3. The analysis suggests that Gray Wave 2 has concluded, marking the end of its corrective phase. Now, Gray Wave 3 is actively progressing, signaling continued upward momentum as the market enters the next impulsive stage. According to Elliott Wave Theory, Wave 3 is typically the strongest and most extended within an impulsive trend, suggesting further potential market gains.

The next significant movement expected is Gray Wave 3, which adds to the expectation of sustained bullish momentum in the market. The current Orange Wave 5 further supports the notion that the market is in the advanced stages of this bullish push.

The key invalidation level to watch is 7,920.18. A market drop below this level would invalidate the current Elliott Wave Analysis, necessitating a reevaluation of both the wave structure and the overall market trend. This invalidation point acts as a crucial marker for confirming the continuation of the upward movement.

Summary:

The FTSE 100 Elliott Wave Analysis for the daily chart reflects a bullish trend, with Gray Wave 3 and Orange Wave 5 in progress. The market is anticipated to continue its rise, driven by the strong structure of Wave 3. Traders should keep an eye on the invalidation level of 7,920.18 to verify the ongoing bullish trend.

FTSE 100 (UK) Elliott Wave Analysis - Trading Lounge Weekly Chart.

FTSE 100 (UK) Elliott Wave technical analysis

Function: Trend.

Mode: Impulsive.

Structure: Orange Wave 5.

Position: Navy Blue Wave 3.

Next lower degrees: Navy Blue Wave 4.

Details: Orange Wave 4 appears completed. Orange Wave 5 is now in progress.

Wave cancelation level: 7,920.18.

The FTSE 100 Elliott Wave Analysis for the weekly chart outlines an impulsive trend, indicating a strong upward movement in the market. The focus of this analysis is on the structure of Orange Wave 5, which is part of a larger bullish trend. Currently, the market is positioned in Navy Blue Wave 3, a significant phase in this impulsive trend.

The prior phase, Orange Wave 4, is now considered complete, signaling the end of its corrective period. Orange Wave 5 is currently active, pointing to a continuation of the upward movement. According to Elliott Wave Theory, Wave 5 typically marks the final stage of an impulsive structure, indicating that the market might be nearing the end of its current bullish cycle. However, this phase can still deliver substantial upward momentum.

Once Navy Blue Wave 3 completes, the next anticipated movement is Navy Blue Wave 4, which is expected to introduce a corrective phase before any further advances. This correction would come after the completion of the ongoing Wave 5, but until that point, the market is expected to continue its rise.

The critical invalidation level for this analysis is 7,920.18. If the market dips below this level, the current Elliott Wave structure would become invalid, requiring a reassessment of the wave pattern. This level serves as a critical threshold for confirming the continuation of the upward trend.

Summary:

The FTSE 100 Elliott Wave Analysis for the weekly chart shows that Orange Wave 5 is currently unfolding, following the completion of Orange Wave 4. The market is positioned in Navy Blue Wave 3, with expectations of further upward movement. The invalidation level of 7,920.18 should be closely monitored to ensure the ongoing bullish trend.

Technical analyst: Malik Awais.

FTSE 100 (UK) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.