Here is what you need to know on Wednesday, November 6:

The US Dollar (USD) gathers strength early Wednesday as markets react to US presidential election results, with the USD trading at its highest level since early July above 105.00. The US economic calendar will not feature any high-tier data releases and investors will continue to pay close attention to headlines surrounding the election outcome in key battleground states.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 1.78% | 1.21% | 1.62% | 0.57% | 1.41% | 1.11% | 1.13% | |

| EUR | -1.78% | -0.56% | -0.13% | -1.19% | -0.36% | -0.66% | -0.63% | |

| GBP | -1.21% | 0.56% | 0.40% | -0.63% | 0.20% | -0.11% | -0.08% | |

| JPY | -1.62% | 0.13% | -0.40% | -1.03% | -0.20% | -0.52% | -0.48% | |

| CAD | -0.57% | 1.19% | 0.63% | 1.03% | 0.84% | 0.53% | 0.56% | |

| AUD | -1.41% | 0.36% | -0.20% | 0.20% | -0.84% | -0.31% | -0.27% | |

| NZD | -1.11% | 0.66% | 0.11% | 0.52% | -0.53% | 0.31% | 0.03% | |

| CHF | -1.13% | 0.63% | 0.08% | 0.48% | -0.56% | 0.27% | -0.03% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

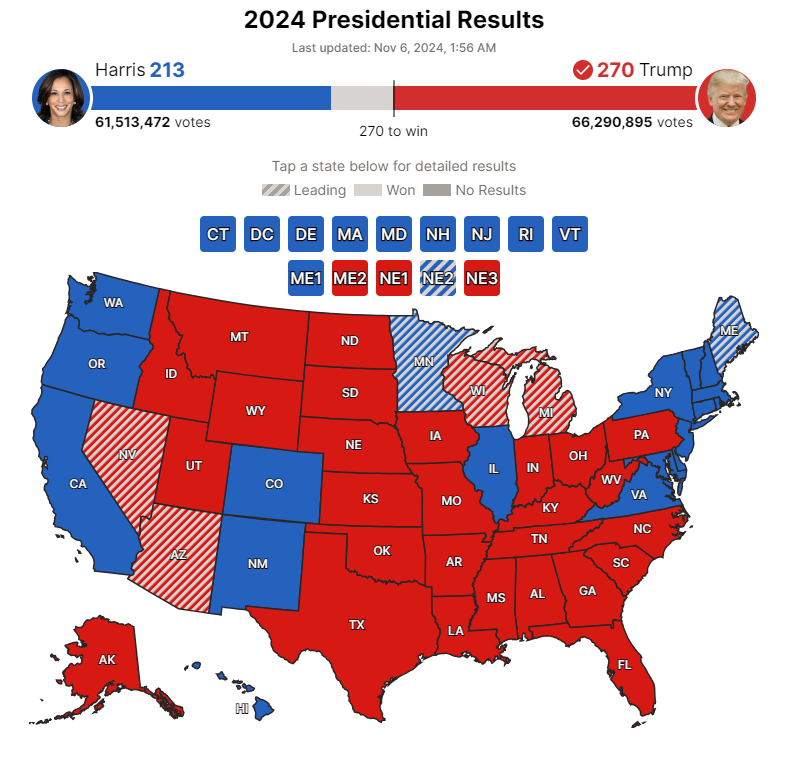

Donald Trump is projected to retake key battleground states that he narrowly lost in 2020. Almost every new major news outlet has called Georgia and North Carolina for Donald Trump. Just recently, Fox News has called Pennsylvania and Wisconsin for also Donald Trump. According to Decision Desk HQ, Trump is on track to become the 47th President of the United States. Furthermore, Republicans are projected to take the majority of the House after securing the Senate.

Source: Decision Desk HQ

In the meantime, the benchmark 10-year US Treasury bond yield is up more than 3% on the day above 4.4% and US stock index futures gain between 1.5% and 1.7%.

EUR/USD stays under heavy bearish pressure and loses nearly 2% on the day below 1.0750 in the early European session. Eurostat will publish Producer Price Index (PPI) data for September later in the session. European Central Bank (ECB) President Christine Lagarde is scheduled to deliver a speech at 14:00 GMT.

GBP/USD declines sharply on Wednesday and trades below 1.2900, pressured by impressive USD strength.

USD/JPY gathers bullish momentum and trades at its highest level since late July above 154.00.

Gold turns south after posting small daily gains on Tuesday and falls toward $2,700, dragged by the rallying US Treasury bond yields.

AUD/USD stays on the back foot and loses nearly 1.5% on the day, trading slightly below 0.6550. Similarly, NZD/USD was last seen losing 1.4% at 0.5930.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD challenges 1.1300, drops to daily lows

The US Dollar's recovery is now picking up extra impulse, sending EUR/USD back to the 1.1300 region and reversing at the same time two consecutive daily advances. In the meantime, investors continue to closely follow developments arounnd the US-China trade crisis.

GBP/USD faces some downside pressure, returns to the low-1.3100s

GBP/USD is now relinquishing part of its earlier advance toward the 1.3200 neighbourhood, receding to the 1.3130-1.3120 band on the back of the rebound in the Greenback and steady anxiety surrounding the tariff narrative.

Gold comes under pressure, breaches $3,200

Gold extends further its correction from earlier record highs near $3,250 amid some apparent alleviated trade concerns and the renewed buying interest in the Greenback. Declining US yields, in the meantime, should keep the downside contained somehow.

Six Fundamentals for the Week: Tariffs, US Retail Sales and ECB stand out Premium

"Nobody is off the hook" – these words by US President Donald Trump keep markets focused on tariff policy. However, some hard data and the European Central Bank (ECB) decision will also keep things busy ahead of Good Friday.

Is a recession looming?

Wall Street skyrockets after Trump announces tariff delay. But gains remain limited as Trade War with China continues. Recession odds have eased, but investors remain fearful. The worst may not be over, deeper market wounds still possible.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.