Forex Today: Eyes on mid-tier data ahead of key central bank meetings

Here is what you need to know on Tuesday, May 3:

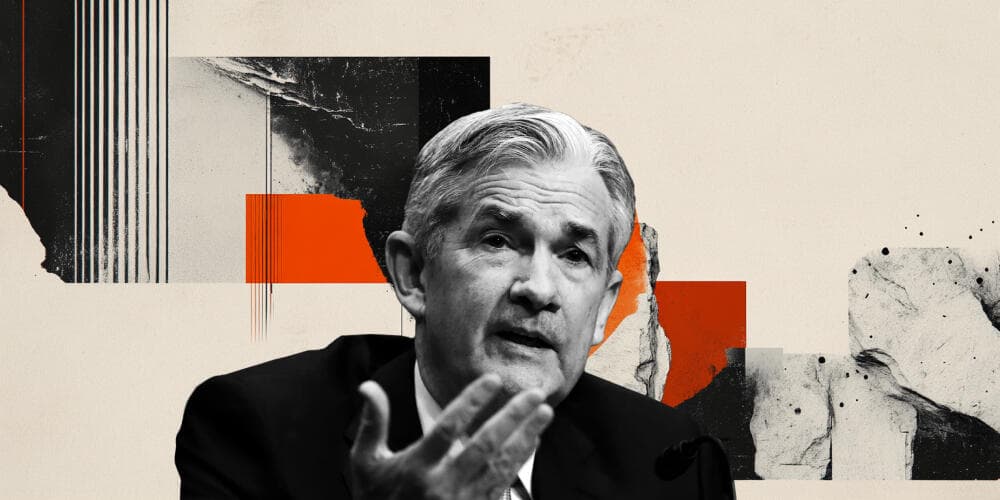

Markets stay relatively quiet early Tuesday as investors refrain from making large bets ahead of the Federal Reserve's and the Bank of England's (BOE) policy announcements later in the week. The benchmark 10-year US Treasury bond yield continues to move sideways within a touching distance of 3% and the dollar holds its ground against its rivals. Meanwhile, the market mood remains cautiously optimistic with US stock index futures rising between 0.3% and 0.4%. Unemployment and Producer Price Index (PPI) data from the euro area and March Factory Orders from the US will be looked upon for fresh impetus.

On Monday, the German economy minister said that they were not against a ban on Russian oil imports and the climate minister noted they have been preparing for a ban. Germany's DAX 30 Index lost more than 1% on Monday but Wall Street's main indexes managed to register modest gaily gains.

After touching its weakest level in nearly four months at 0.7030 on Monday, AUD/USD rose sharply during the Asian trading hours on Tuesday and was last seen rising 1% on the day above 0.7100. The Reserve Bank of Australia (RBA) hiked its policy rate by 25 basis points (bps) to 0.3% following its policy meeting, surprising investors who were expecting the bank to raise its rate by 15 bps. In its policy statement, the RBA noted that they remain committed to doing what is necessary to ensure that inflation in Australia returns to target over time. Additionally, RBA Governor Philip Lowe said that further increases in the policy rate will be necessary over the months ahead.

EUR/USD closed the first day of the week with small losses and was last seen fluctuating in a tight range slightly above 1.0500. European Union’s (EU) top diplomat Josep Borrell said earlier in the day that more Russian banks will leave the SWIFT payment network as a part of a new sanctions package.

GBP/USD is sticking to modest recovery gains above 1.2500 after having lost nearly 100 pips on Monday. S&P Global's Manufacturing PMI (final) for April will be featured in the UK economic docket later in the session.

Gold slumped to its lowest level since mid-February near $1,850 on Monday before going into a consolidation phase at around $1,860 early Tuesday. Market participants remain increasingly concerned over the slowdown in China's economic activity spilling over to other major economies.

For the third straight trading day, USD/JPY moves sideways in a narrow band near 130.00. Japanese markets were closed due to the Constitution Day holiday on Tuesday.

Bitcoin struggles to find direction and trades in a tight channel above $38,000. Ethereum is trading with modest losses near $2,800 early Tuesday after having gained nearly 5% in the previous two days.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.