US markets took Thursday off for the Thanksgiving holiday, keeping the Greenback at bay and setting up European-session traders for a fresh round of preliminary pan-European HICP inflation figures for November.

Here’s what you need to know on Friday, November 29th:

The US Dollar Index (DXY) slumped into a flat day on Thursday, trading flatly near the 106.00 handle as holiday-thinned market volumes took the wind out of US market session sails. The Greenback’s broad-market index has eased from year-plus highs set late last week, but rushing too quickly into a bearish USD stance could catch short-term traders off-guard with a snap back into the high side.

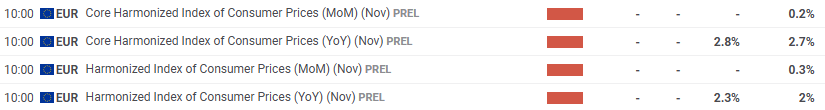

EUR/USD also traded flat through most of Thursday’s market action, hobbled just south of the 1.0600 handle. Euro traders will be looking ahead to Friday’s wide docket of European economic data, but the key figures for Fiber will be pan-EU Harmonized Index of Consumer Prices (HICP) inflation. Core HICP inflation is forecast to tick upwards to 2.8% YoY in November from the previous 2.7%, which will throw a wrench in the works for several European Central Bank (ECB) officials who have hit newswires this week trying to soothe investors with promises of further rate cuts in December and heading into 2025.

GBP/USD struggled to make much progress in either direction, but Cable still managed to inch closer to the 1.2700 handle on Thursday. The UK has a clean data docket on Friday, although the Bank of England (BoE) is expected to release its latest Financial Stability Report.

USD/JPY reclaimed some lost ground on Thursday after a clean bounce off of the 200-day Exponential Moving Average (EMA) near 150.50 during the mid-week market session. However, bullish momentum remains absent as Yen traders gear up for Japanese inflation figures early Friday. Core Tokyo Consumer Price Index (CPI) inflation is expected to tick higher to 2.1% for the year ended in November, compared to the previous period’s 1.8%. While rising inflation will help push the Bank of Japan (BoJ) closer to increasing rock-bottom interest rates, investors have noted that Japan’s Unemployment Rate is also expected to tick up to 2.5% in November from 2.4%, a move that will give permadove BoJ policymakers all the fuel they need to continue holding rates in the basement for an undefined period.

AUD/USD remained stuck near the 0.6500 level, and a quiet data docket for the Antipodeans means the Aussie is likely to remain stuck near recent lows. AUD/USD fell over 7% top-to-bottom from September’s highs near 0.6940, and Aussie bulls are struggling to develop meaningful momentum.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes near 1.0550 despite soft German inflation data

EUR/USD fluctuates in a narrow range near 1.0550 in the American session on Thursday. Soft inflation data from Germany makes it difficult for the Euro to gather strength, limiting the pair's upside, while US markets remain closed in observance of the Thanksgiving Day holiday.

GBP/USD trades below 1.2700 on modest USD recovery

GBP/USD struggles to gain traction and moves sideways below 1.2700 on Thursday. The US Dollar corrects higher following Wednesday's sharp decline, not allowing the pair to gain traction. The market action is likely to remain subdued in the American session.

Gold at risk of falling

Gold extends its shallow recovery from Tuesday’s lows as it trades in the $2,640s on Thursday. The yellow metal is seeing gains on the back of cementing market bets that the Fed will go ahead and cut US interest rates at its December meeting.

Fantom bulls eye yearly high as BTC rebounds

Fantom (FTM) continued its rally and rallied 8% until Thursday, trading above $1.09 after 43% gains in the previous week. Like FTM, most altcoins have continued the rally as Bitcoin (BTC) recovers from its recent pullback this week.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.