The US financial services sector is having a strong bearish June: the main ETF #XLF, or the Financial Select Sector SPDR Fund, in fact, decreased by almost 7% from the highs of the beginning of the month.

Even worse have done some stocks with major retracements from May highs: Allstate Corporation (#ALL) -10%, JP Morgan Chase (#JPM) -10%, Citigroup (#C) -15%, Regions Financials Corporation ( #RF) -17% and Huntingon Bancshares (#HBAN) -20% just to name a few.

Bullish opinion: this retracement is positive as it allows individual stocks to exit the overbought territory and offer investors attractive entry points at least for the short to medium term.

Bearish opinion: a strong retracement that substantially nullifies the gains of the previous month is a strong alarm bell. This could in fact lead to a reversal of the trend and further fluctuations in the short to medium term.

Both points of view are correct and as often happens the truth is positioned right in the middle: it is difficult to think that the entire financial services sector will collapse by 40% -60% as it did in March 2020 and it is equally, perhaps, too optimistic to think of explosive growth of 20-30% in the following months.

In fact, we believe that the following months and especially the month of July will offer interesting opportunities in the financial sector aiming for returns between + 10% and + 15%.

Our thesis is supported by two main studies: the seasonality of the sector and the relative strength in relation to the reference index.

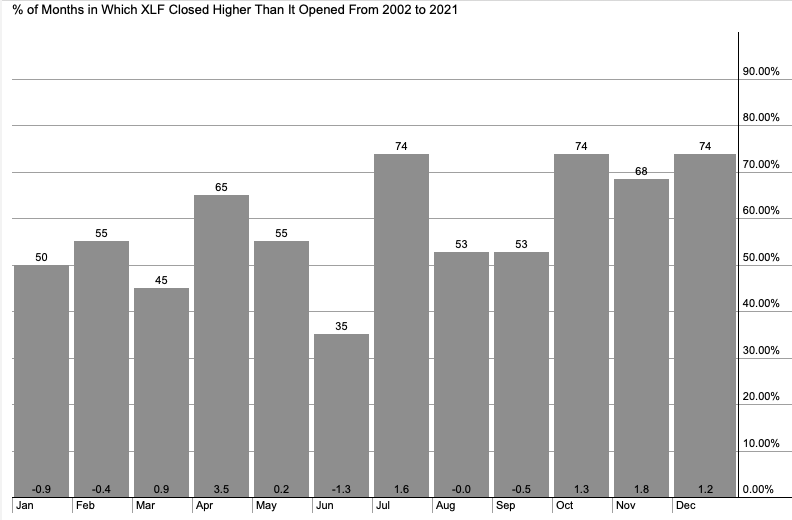

Seasonality: Financial sector #XLF

Analyzing the data of the last 20 years it can be seen that the month of June has always been characterized by a strong bearish current: in fact, only 35% of the time it was possible to record a positive performance compared to the month of May.

Completely different situation in July: in the last 20 years, 75% of the time, the financial sector represented by the XLF ETF has recorded a positive performance.

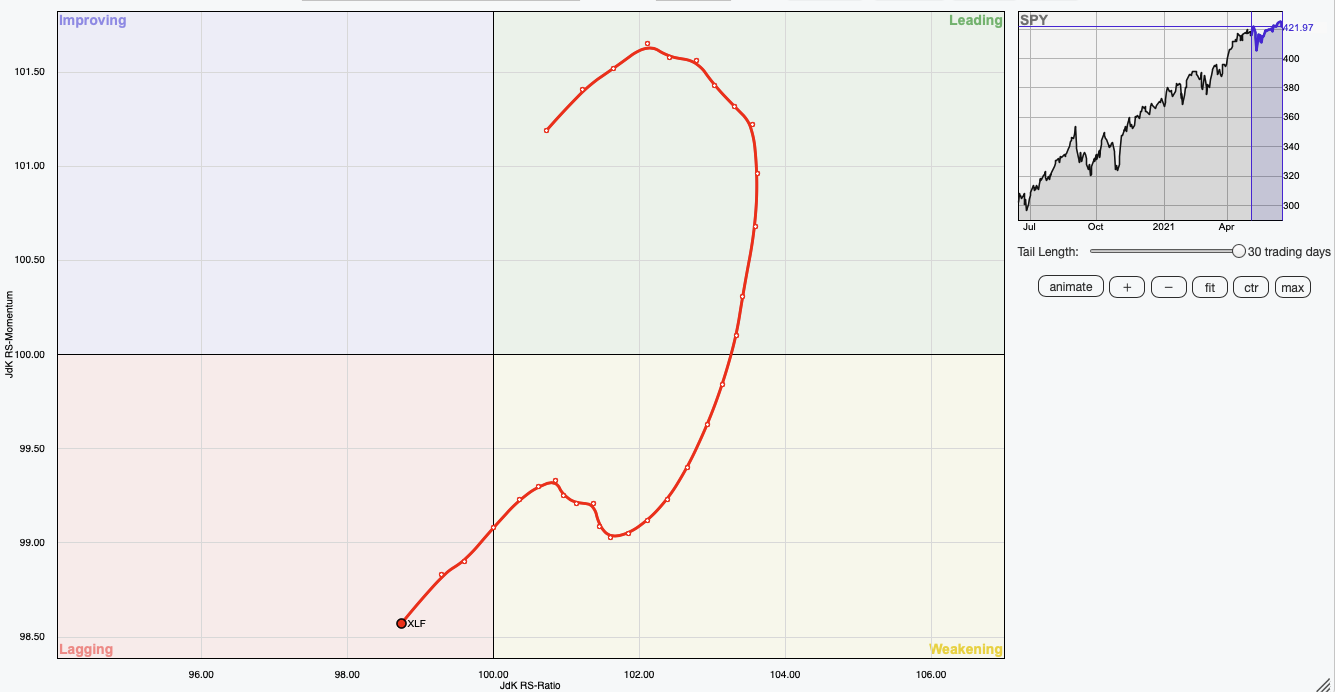

Relative rotation graph: #XLF

The Relative Rotation Graph (RRG) shows the last 30 trading days of XLF, where it moved from leading sector to the lagging sector. That is, from a sector with momentum and performance above the S&P500 (the benchmark index) to a sector with momentum and performance below the S&P.

While picturing two different time frames: that of seasonality, the last 20 years, and the RRG the last 30 days, we can see a strong correlation.

Both show a very positive end of April which then gradually lost vigor and momentum to reach the "lows" in June.

We conclude our article with the conviction that the Financial Sector, in the month of July, will be able to offer interesting opportunities: combining the relative strength of the last 30 days, together with seasonality of the last 20 years, we will identify those stocks that better position for bullish upsides in the short term.

To date, we are tracking 10 stocks that could turn out to be good opportunities in the month ahead:

ALL-STATE CORPORATION (#ALL).

ARTHUR J. GALLAGHER & CO (#AJG).

FRANKLIN RESOURCES (#BEN).

CITIGROUP (#C).

HUNTINGTON BANCSHARES INCORPORATED (#HBAN).

PROGRESSIVE CORPORATION (#PGR).

EVEREST RE GROUP (#RE).

REGIONS FINANCIAL CORPORATION (#RF).

WILLIS TOWERS WATSON (#WLTW).

W.R. BERKLEY CORPORATION (# WRB).

The information contained in this article and the resources available is not intended as, and shall not be understood or construed as, financial advice. The opinions expressed are from the personal research and experience of the author.

Recommended content

Editors’ Picks

EUR/USD recovers toward 1.0600 on renewed USD weakness

EUR/USD regains its traction and rises toward 1.0600 after spending the early European session under pressure. The renewed US Dollar (USD) weakness following disappointing housing data helps the pair push higher, while markets keep a close eye on geopolitics.

GBP/USD stays near 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red at around 1.2650 on Tuesday. Although BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook, the sour mood doesn't allow the pair to gather recovery momentum.

Gold extends recovery toward $2,640 as geopolitical risks intensify

Gold price builds on Monday's gains and rises toward $2,640 as risk-aversion grips markets amid intensifying geopolitical tensions between Russia and Ukraine. Meanwhile, the 10-year US Treasury bond yield is down more than 1% on the day, further supporting XAU/USD.

Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.