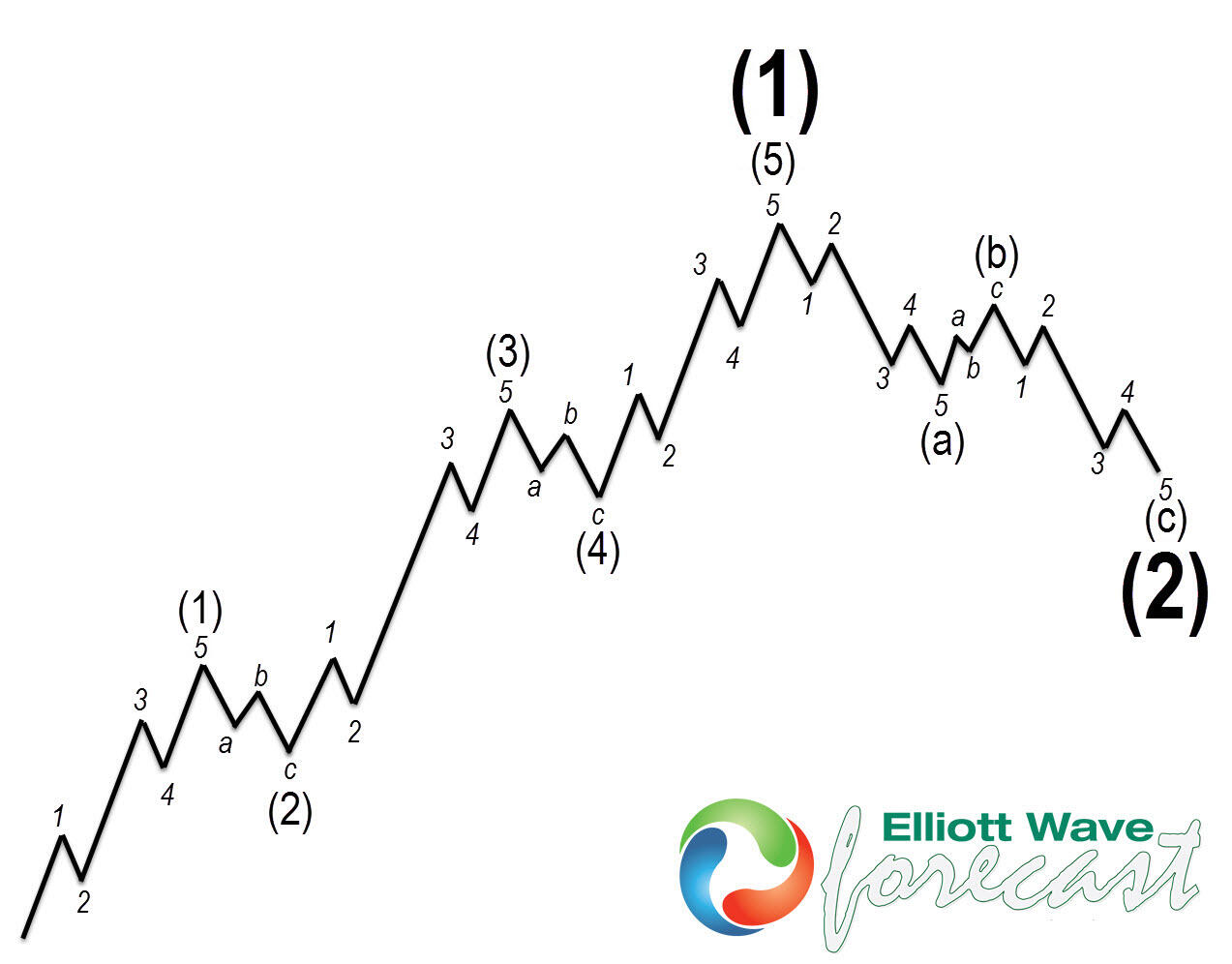

The Financial and banking sector (XLF) was all over the news last month. It is currently no longer part of the daily news cycle. We believe trouble is underway for the second part of the year. Price action across the sector points to a massive sell-off after an initial trap. Many traders believe the market moves in a straight line but that it is far from reality. When a recovery like the one from the middle of March happens, they get trapped and stop looking at the facts. The Elliott Wave Theory’s main pattern is that the Market move in five waves and will correct the five with a three, seven, or eleven structure. Here is the main pattern in a chart:

Elliott Wave 5 waves rally and 3 waves corrective pattern

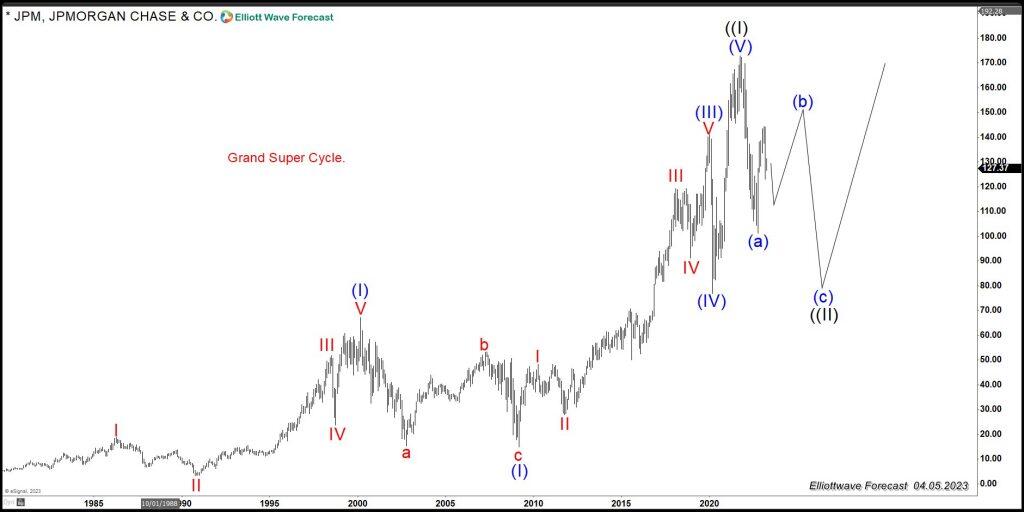

The pattern above shows a very clear and well-defined price action. It repeats in each time frame from the minute to the Grand Super Cycle. JPM (JP Morgan Chase) chart below shows the pattern within the Grand Super Cycle. It has already ended the 5 waves advance, and now in the process of correcting in three, seven, and eleven sequences.

JPM daily Elliott Wave chart

JPM Chart above shows it ended wave (a) and is correcting higher in wave (b). A massive sell- off in wave (c) will come again sometime later in 2023. In the end, it will provide another huge opportunity to buy the Grand Super Cycle wave ((II)). Another big bank BAC or Bank of America below shows the path within the correction. Since the peak in 2022, BAC shows what we call a bearish sequence. It happens when a three waves structure develops and incomplete. We have a new low below (a) with momentum divergence. Many traders call it positive divergence and buy or sell based on the divergency. But we don’t do it like that. For us, the break below wave (a) creates a lower low and incomplete bearish sequence from wave (I) favoring further downside.

BAC weekly Elliott Wave chart

The chart above shows the corrective structure in BAC. It can do corrective rally in wave ((2)) at some point before wave ((3)) lower resumes. Wave ((3)) will be a massive selling and will agree with JMP wave (c) lower. JPM and BAC are leaders within the banking sector. The Sector’s overall price action is showing an ABC in process. Wave ((A)) is clearly an impulse, and we should now be bouncing in wave (2), with wave (3) to happen sometimes in 2023.

XLF weekly Elliott Wave chart

Financial Sector ETF (XLF) chart above shows the proposed path lower within a zigzag structure. We can see the difference with BAC; even when they look very similar. BAC already took the lows in wave a, whereas XLF has not broken below wave ((A)). However, XLF reaction lower from wave ((B)) is an impulse., which supports our view for further downside.

Inc conclusion: We see many signs pointing to a massive sell-off across the banking sector sometime in 2023. This might catch some traders by surprise, but it will also affect the whole Market. This is one of the reasons we believe 2023 will still be a year in which Indices, Stocks, and ETFs will be erratic. It will provide many opportunities to both sides of the market. But we need to keep in mind the trend is always bullish within the Grand Super Cycle. Sometimes near the end of 2023, it may provide a huge one in a life time investment opportunity across the sector.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD rebounds from session lows, stays below 1.0600

EUR/USD recovers from the session low it set in the European session but remains below 1.0600 on Tuesday. Although the US Dollar struggles to gather strength following disappointing housing data, the risk-averse market atmosphere caps the pair's rebound.

GBP/USD remains under pressure below 1.2650 after BoE Governor Bailey testimony

GBP/USD trades in the red below 1.2650 on Tuesday, pressured by safe-haven flows. BoE Governor Bailey said a gradual approach to removing policy restraint will help them observe risks to the inflation outlook but this comment failed to boost Pound Sterling.

Gold remains propped up by geopolitics

Gold retreats slightly from the daily high it touched near $2,640 but holds comfortably above $2,600. Escalating geopolitical tensions on latest developments surrounding the Russia-Ukraine conflict and the pullback seen in US yields help XAU/USD hold its ground.

Bitcoin Price Forecast: Will BTC reach $100K this week?

Bitcoin (BTC) edges higher and trades at around $91,600 at the time of writing on Tuesday while consolidating between $87,000 and $93,000 after reaching a new all-time high (ATH) of $93,265 last week.

How could Trump’s Treasury Secretary selection influence Bitcoin?

Bitcoin remained upbeat above $91,000 on Tuesday, with Trump’s cabinet appointments in focus and after MicroStrategy purchases being more tokens.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.