Final rejection, then what

I duly didn‘t trust S&P 500 upswing, and downside reversal midsession followed – the divergence indicating daily lack of breadth (low cyclicals participation) provided one of the hints – while Nasdaq overcame mid Oct highs, S&P 500 clearly did not, and Russell 2000 was trading very subdued on top.

5,912 didn‘t come nearly close, and semiconductors stopped working in Nasdaq‘s favor midsession as well. Market breadth and the percentage of stocks trading above their 50-day moving averages is at risk of giving the sellers green light, yet at the same time, the compressing, wedge-approximating price action is characterized by less forceful pushing to the downside. In other words, the signs are mixed, and I outline the resolution I favor in the client section.

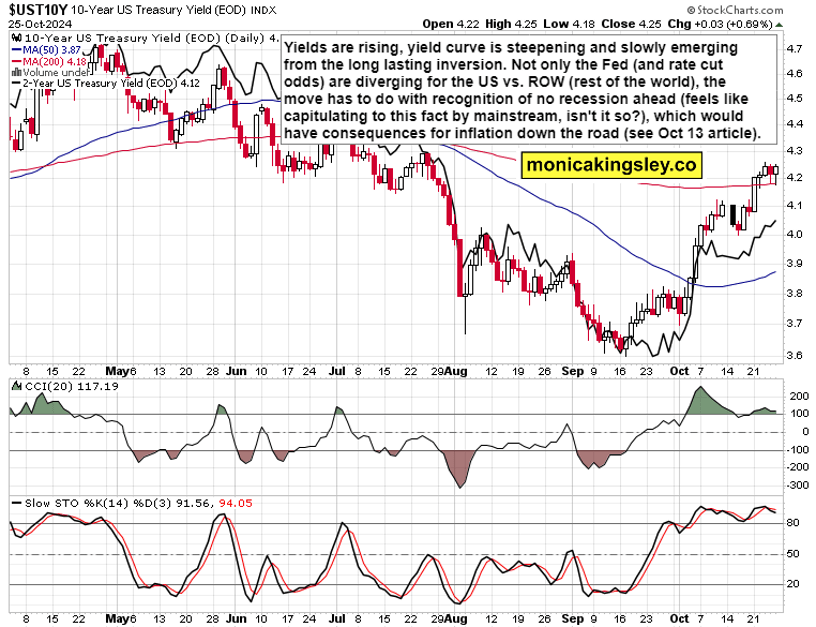

Checking the bond market, the steepening yield curve and decent economy recognition (XLY is doing well) can be taken as accounting for rising future inflation, but in the near term, the low, disinflationary view is winning, and that makes earnings growth perception positive – this applies to long-term view with non-Mag 7 characteristics becoming more appealing with breadth to broaden, and that will have positive influence on equal weighted S&P 500 and valuations in general alike.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.