Fed's Waller: Sees further aggressive rate hikes in inflation battle

Governor Christopher Waller said on Thursday in a hawkish speech that he sees little reason to ease the pace of Fed policy tightening.

The US Federal Reserve needs to keep raising interest rates into early next year to bring down stubbornly high inflation, he argued.

"Inflation is far from the FOMC’s goal and not likely to fall quickly," Waller said.

"I imagine we will have a very thoughtful discussion about the pace of tightening at our next meeting," he said, noting that there has been little progress on inflation and "until that progress is both meaningful and persistent, I support continued rate increases, along with ongoing reductions in the Fed’s balance sheet, to help restrain aggregate demand."

Key notes

I support continued rate hikes until we see meaningful, persistent progress on US inflation.

Monetary policy can and must be used aggressively to bring down inflation.

Likely not enough data before the November meeting to significantly alter my view of economy.

I anticipate additional rate hikes into early next year.

The stance of policy is slightly restrictive, beginning to see some adjustment in sectors like housing.

Will have a 'very thoughtful discussion' about the pace of tightening at the next meeting.

The availability of swap lines, and the existence of standing repo facilities are stabilizing forces.

Not considering slowing rate increases or halting them due to financial stability concerns.

Markets are operating effectively.

US economy set for below-trend growth in 2h 2022.

The labour market is strong and very tight.

The focus of monetary policy needs to be fighting inflation.

Cannot dismiss the possibility of a larger drop in demand, and house prices before the market normalize.

Friday's jobs report likely will not alter the view fed should be 100% focused on reducing inflation.

Inflation is much too high, and not likely to fall quickly.

US dollar update

The US dollar, despite downbeat Initial Jobless Claims, rose and extended its gains from the previous day.

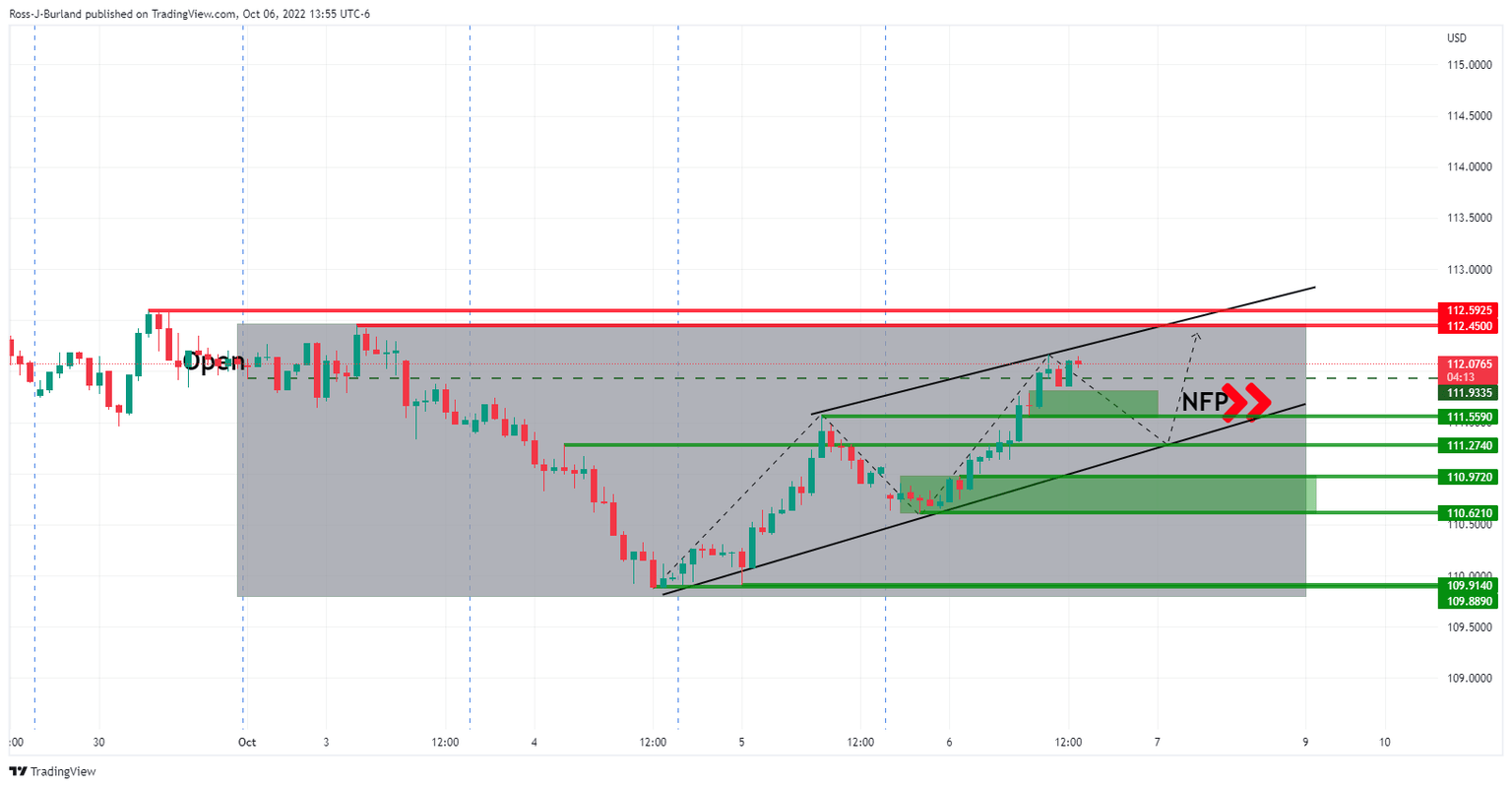

On Thursday, ahead of today's Nonfarm Payrolls data in the US session, the greenback is back above 112.00, recovering from when it was initially falling against most majors at the start of the week before regaining ground:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.