St. Louis Fed President James Bullard said on Thursday that the Federal Reserve could raise interest rates as soon as March.

The official, known as an uber hawk and aligned with the market sentiment, explained that the Fed is now in a "good position" to take even more aggressive steps against inflation, as needed after a policy reset last month.

How comments follow yesterday's hawkish minutes and the spike in US yields and the greenback as a consequence.

In December, the Fed agreed to end its asset purchases in March and laid the groundwork for the start of rate increases that all policymakers, even the most dovish, now feel will be appropriate in 2022.

Today, Bullard explained that the Fed "is in good position to take additional steps as necessary to control inflation, including allowing passive balance sheet runoff, increasing the policy rate, and adjusting the timing and pace of subsequent policy rate increases," Bullard said in prepared remarks to the CFA Society of St. Louis.

''Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments," Bullard said.

The tone reinforces the idea that an initial rate increase could be approved "as early as the March meeting.

Reuters explained in a note following Bullard's comments that ''projections issued in December showed half of the Fed policymakers expect three quarter-percentage-point rate increases will be needed this year.''

''Inflation is now running at more than twice the Fed's 2% target, and Bullard said that the inflation 'shock' experienced by the country means the central bank should be able to satisfy its inflation targeting goals now for several years to come.''

Covid will not throw Fed of course

Additionally, Bullard said he did not think the current wave of cases would throw the US economy or the Fed off course.

He explained that Infections in the United States "are projected to follow the pattern where the variant was first identified," while citing projections that daily case counts may peak late this month.

Key notes

St. Louis Fed's Bullard says the first interest rate hike could come in March.

Bullard says the Fed is now in a 'good position' to address inflation with rate increases, balance sheet runoff if needed.

Bullard says expects omicron infections to peak late this month, following a path similar to that seen in South Africa.

Bullard says the recent inflation shock means Fed's average 2% target should be met for next several years.

Bullard says focus on returning US labour force participation to pre-pandemic levels ignores trend decline.

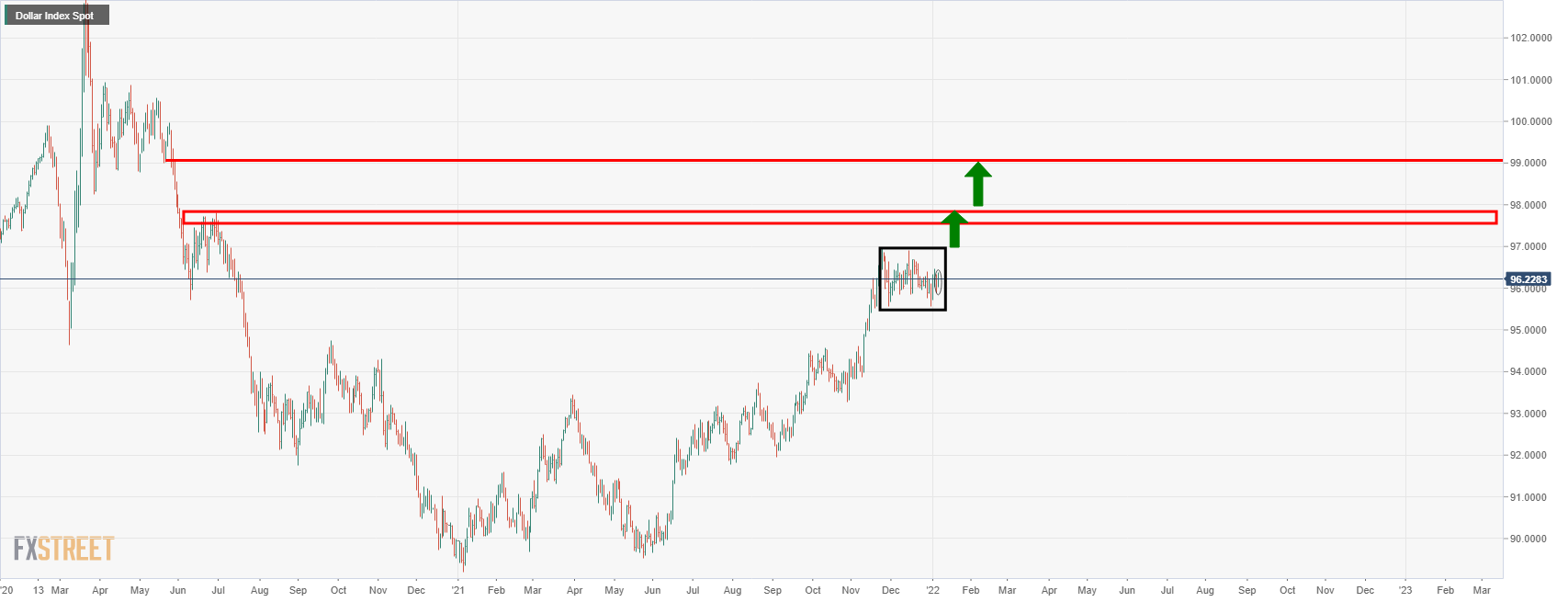

US dollar remains in a familiar consolidated range

Despite the hawkishness, the greenback remains in the familiar consolidation on the daily chart.

However, if this is a phase of reaccumulation, then 98 the figure and then 99 the figure would be expected to be revisited in due course:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD rebounds on Thursday after midweek pullback

EUR/USD tuned back into the high end on Thursday, getting bolstered by a broad-market selloff in the Greenback. US data that printed better than expected helped to ease concerns of a possible economic slowdown within the US economy looming over the horizon.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Ethena Labs launches new UStb stablecoin backed by BlackRock's BUIDL token

Ethena Labs announced on Thursday that it has released a new stablecoin product, UStb. The new stablecoin will be fully collateralized by BlackRock's USD Institutional Digital Liquidity Fund and function similarly to a traditional stablecoin.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.