Fed Minutes: Officials determined that they needed to adopt and maintain a more restrictive policy stance

The Federal Open Market Committee minutes of September's meeting have been released:

Fed officials determined that they needed to adopt and maintain a more restrictive policy stance in order to achieve their goal of lowering elevated inflation.

Many participants raised their assessment of the federal funding path required to meet committee objectives.

Many participants indicated that once the policy had reached a sufficiently restrictive level, it would be appropriate to keep it there for a period of time.

Several participants predicted that as policy became more restrictive, risks would become more two-sided.

Several participants emphasized the importance of maintaining a restrictive stance for as long as necessary.

Despite a slowing labour market, officials are committed to raising interest rates.

On the margin, these minutes could be taken as somewhat less hawkish than the rhetoric that we have heard from Fed speakers and lean towards a pivot:

"Several participants noted that... it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook."

Market Update

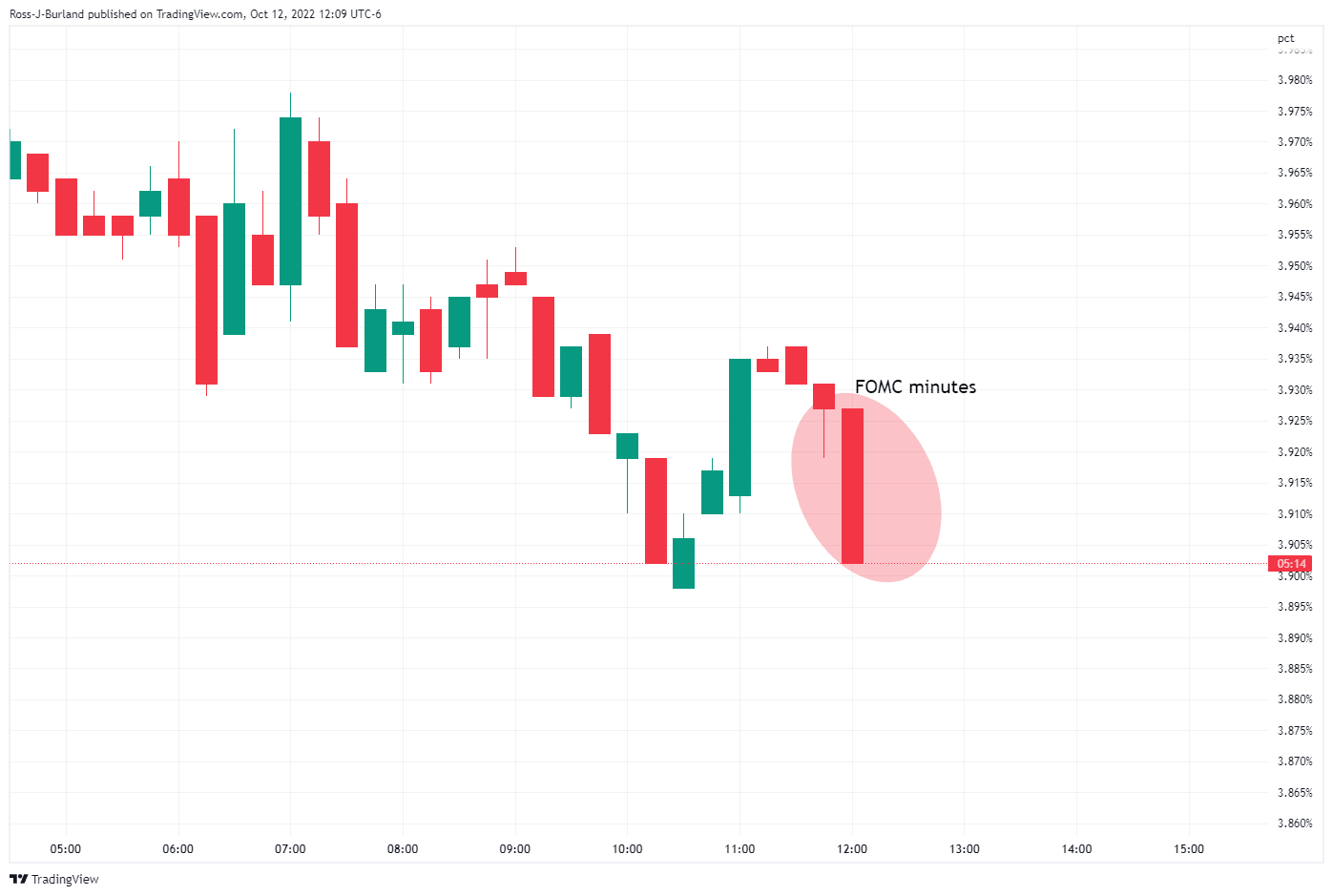

US bond yields are softer with the 10-year in decline:

Meanwhile, the attention will now turn to the US inflation data on Thursday. On Wednesday morning, US producer prices increased more than expected in September, further boosting the dollar, especially against the yen where the market's attention is focused the most. The producer price index for final demand rebounded 0.4%, above the forecast for a 0.2% rise. In the 12 months through September, the PPI increased 8.5% after advancing 8.7% in August.

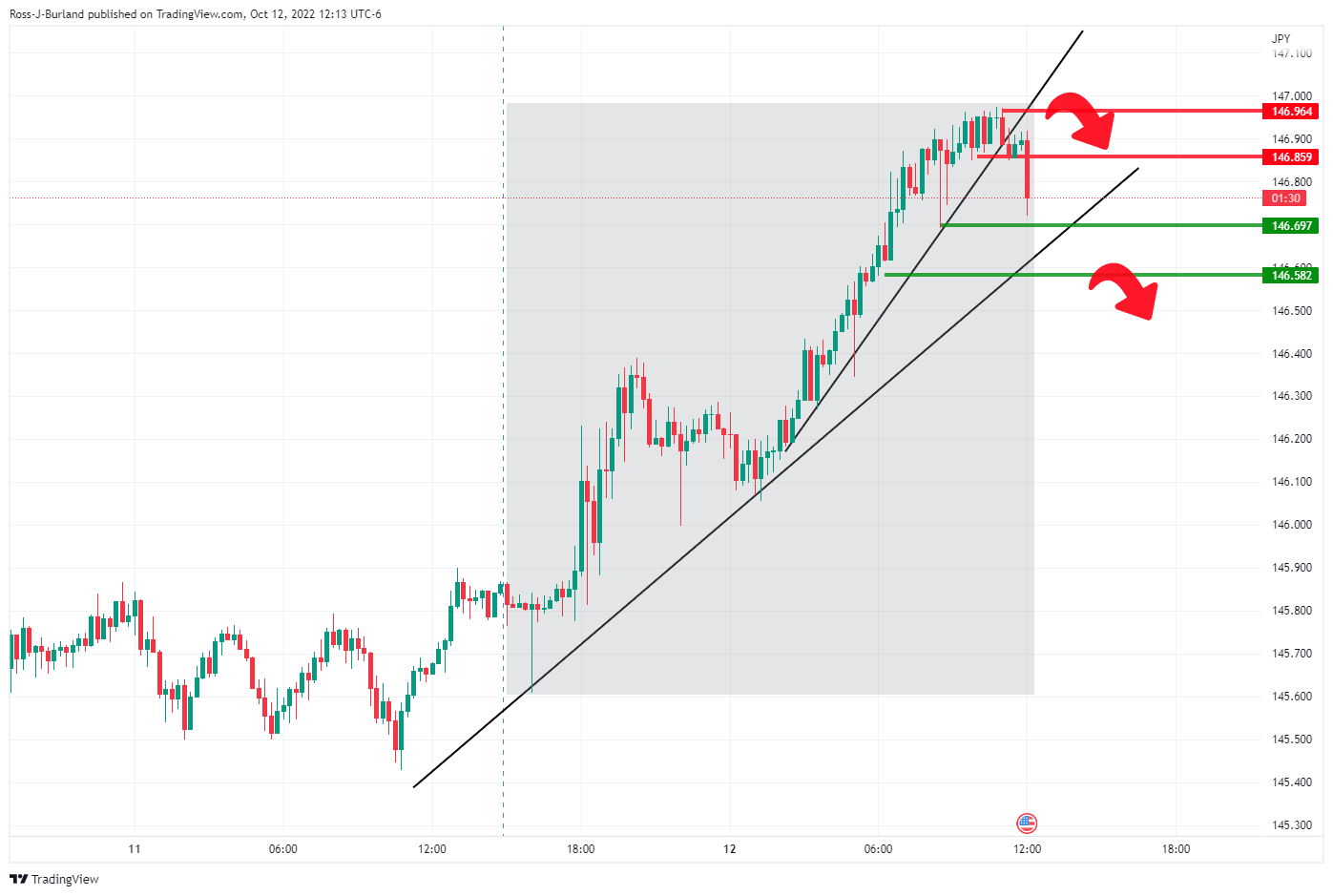

Following the US PPI data, the greenback rose as high as 146.88 yen. The DXy index has reached a peak of 113.59 ahead of the FOMC minutes. USD/JPY remains near its strongest level since August 1998. It was last up 0.7% at 146.84, marking a fifth straight session of gains to a high of 146.09 so far. However, there is a hint of downside pressure coming through now that the markets are digesting the minutes as follows:

About the FOMC Minutes

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.