- NASDAQ:FCEL adds 4.86% to close the week as the NASDAQ soars to new all-time highs.

- FuelCell reported larger losses than expected but beat Wall Street revenue expectations.

- FuelCell CEO is bullish moving forward with the new Biden administration in the White House.

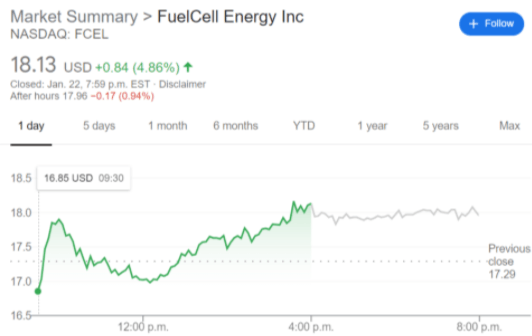

NASDAQ:FCEL paced the renewable energy sector even though the recent quarterly earnings report returned mixed results. On Friday, FuelCell Energy added 4.86% to close the final trading session of the week at $18.13, which puts it back within reach of the 52-week high price of $20.94. Shares are now up a whopping 68% so far in 2021 and a total of 850% over the past 52-weeks as the bullish sentiment surrounding clean energy firms is skyrocketing now that President-elect Biden is officially in the Oval Office.

FuelCell reported its quarterly earnings earlier this week and the stock took a dive after results were mixed. While the alternative energy provider was able to top Wall Street’s revenue expectations, its losses were calculated to be $0.08 which was slightly more than the consensus $0.07 estimate. FuelCell CEO Jason Few put emphasis on the company’s revenue growth and cited optimism for significant opportunities on the horizon for FuelCell, and described four products that it was focussing on in the short term: distributed generation, distributed hydrogen, long-duration hydrogen storage, and power generation.

FCEL stock forecast

Like many other alternative energy companies, Few also reiterated his excitement over President-elect Biden and his emphasis on green energy as a focus for America. The FuelCell CEO stated optimism that the United States is now positioned to make up ground on Asia and Europe in terms of its clean energy policies. Despite industry rivals like Bloom Energy (NYSE:BE) recently receiving analyst downgrades as a sector that is too richly valued, FCEL continues to see its price climb back towards a new all-time high.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD clings to recovery gains below 0.6550 on weaker USD, upbeat mood

AUD/USD holds sizeable gains below 0.6550 in the Asian session on Monday. A sharp pullback in the US bond yields prompts some US Dollar profit-taking after US President-elect Trump named Scott Bessent as Treasury Chief. Moreover, the upbeat market mood supports the risk-sensitive Aussie.

USD/JPY trims losses to regain 154.00 as USD sellers pause

USD/JPY trims losses to retest 154.00 in the Asian session on Monday. Retreating US Treasury bond yields drags the US Dollar away from a two-year top high and drives flows towards the lower-yielding Japanese Yen, though the BoJ uncertainty could limit losses for the pair.

Gold: Is the tide turning in favor of XAU/USD sellers?

After witnessing intense volatility in Monday's opening hour, Gold's price is licking its wounds near $2,700. The bright metal enjoyed good two-way trades before sellers returned to the game after five straight days.

Elections, inflation, and the bond market

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.