- Facebook (NASDAQ:FB) shares have risen over 5% to hit an all-time high.

- The move comes after the social media giant launches a competitor to TikTok.

- American sanctions against Hong Leader Carrie Lam also have a positive impact on the social network's shares.

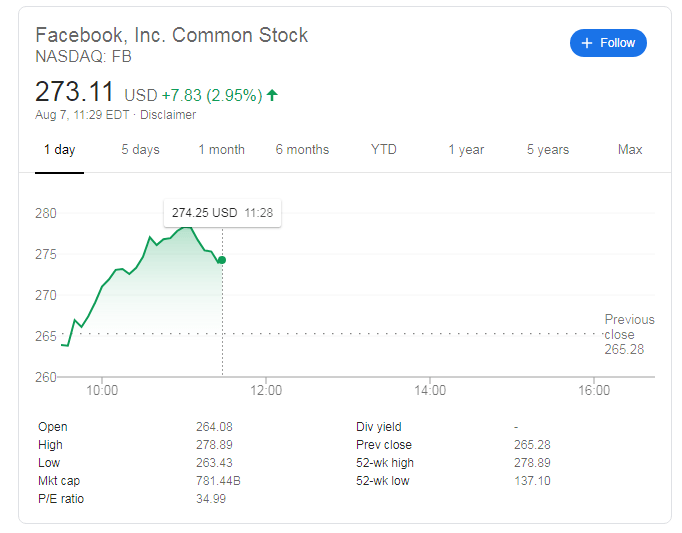

Update: Facebook Inc. is trading around $273 on Friday, up some 3%. Mark Zuckerberg's social network behemoth is gradually approaching the $1 trillion valuation mark. In addition to the action against TikTok, the US is slapping sanctions against Hong Kong leader Carrie Lam and other officials. That adds to Sino-American decoupling fears which are benefitting NASDAQ: FB.

Facebook news today

Facebook (NASDAQ:FB) shares have rocketed on Thursday moving over 6% higher. The move comes after the firm launched Reels is a short-form video feature that allows Instagram users to make short videos with a musical background and add augmented reality effects. This could be great news as the US and other world governments are looking to blacklist the Chinese social media firm (TikTok) due to espionage fears. The app was launched in Brazil in November 2019 but yesterday the company rolled out the new product on Wednesday in the US. TikTok claims to have around 100 million users in the US and if Facebook manages to capture some of that market it would be great for their brand. Microsoft are looking to buy the US arm of TikTok so there could be some weakness if that deal gets confirmed but for now, the only way is up.

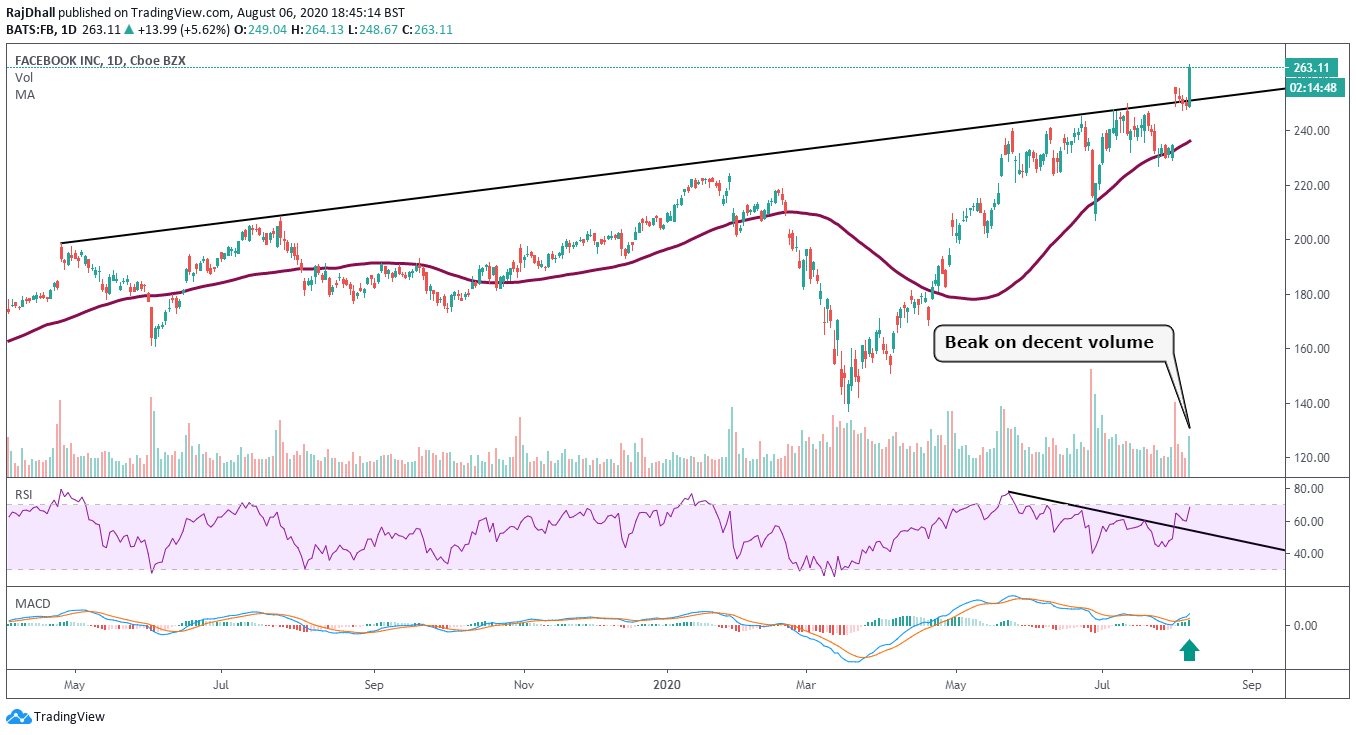

Facebook daily chart

Looking at the chart. the price has accelerated above the technical trendline to hit an all-time high. Interestingly the price broke the trendline after the earnings update on 31st July but moved back below. The price then used the trendline as a support zone to hold above the 250 area.

There were some other bullish technical signals too, The Relative Strength Index also had a trendline at the top of the waves. The indicator broke out of the trendline on the day of the earnings release and continued in its upward trajectory. Another good confirmatory signal is the increase in volume on the break. This indicates that this move is the "real deal" and not a false break higher.

The MACD histogram bars are also growing and the signal lines are diverging apart. More importantly, the signal lines remain above the zero level which shows that the uptrend is still intact.

Overall this is a very strong uptrend and it would take a brave trader to short the stock from here. The market is still making higher highs and higher lows and until that changes and the 250 level is broken to the downside all is well with this trend.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD declines below 1.0300 ahead of US data

EUR/USD stays under heavy selling pressure and trades below 1.0300 on Wednesday. News of US President-elect Donald Trump planning to declare an economic emergency to allow for a new tariff plan weighs on risk mood and boosts the USD ahead of key data releases.

GBP/USD drops to fresh multi-month lows below 1.2400

GBP/USD remains on the back foot and trades at its weakest level since April below 1.2400. The risk-averse market atmosphere on growing concerns over an aggressive tariff policy by President-elect Donald Trump drags the pair lower as focus shifts to US data.

Gold stabilizes near $2,650; upside seems limited ahead of FOMC Minutes

Gold price (XAU/USD) fluctuates in a narrow range at around $2,650 on Wednesday. The benchmark 10-year US Treasury bond yield holds at its highest level since late April near 4.7%, making it difficult for XAU/USD ahead of FOMC Minutes.

ADP Employment Change expected to show modest slowdown in December

The ADP Employment Change report for December will be released on Wednesday at 13:15 GMT. It’s expected to show that the US private sector added 140K new jobs after gaining 146K in November.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.