Facebook Stock Price and Forecast: FB shares continue sell-off on Thursday

- Facebook shares continue their slide on Thursday.

- FB stock is now nearly 20% below all-time highs.

- The social media giant and other big tech companies coming under increased regulatory scrutiny.

UPDATE: Facebook shares opened about 0.9% lower on Thursday in a continued sell-off that has taken the stock down to $309.35, a price it has not seen since May. The downswing began in early September and drew fresh energy from a revenue miss earlier this week. The price decline is surprising as US indices are up across the board.

Facebook (FB) shares continue their descent from all-time highs reached back in September as the company continues to see increased regulatory scrutiny and still suffers from the fallout of the October service outage. The stock is now down nearly 20% from its peak, so is this a buy-the-dip opportunity or are the unknowns in the form of regulatory scrutiny too powerful to make an investment case? We have said many times here at FXStreet that the market hates uncertainty and this, in particular, is what is affecting the Facebook share price the most. However other big tech names also face regulatory scrutiny and those stocks are not being similarly affected. Alphabet (GOOG) is making fresh all-time highs post-earnings, while Apple (AAPL) releases earnings on Thursday and is poised near all-time highs.

Facebook (FB) stock news

| Market Cap | $878 million |

| Enterprise Value | |

| Price/Earnings (P/E) | 22 |

|

Price/Book | 7 |

| Price/Sales | 11 |

| Gross Margin | 80% |

| Net Margin | 36% |

| EBITDA | $54 billion |

| 52 week low | $244.61 |

| 52 week high | $384.33 |

| Average Wall Street rating and price target |

Buy $415 |

Facebook reported earnings on Monday with earnings per share (EPS) coming in ahead of estimates at $3.22 versus $3.19. Revenue, however, missed estimates at $29 billion versus the $29.57 estimate. Facebook (FB) shares fell nearly 4% after the earnings announcement. EPS barely beat and a revenue miss is in stark contrast to the average of nearly 84% of companies in the S&P 500 beating estimates.

The news kept on coming with the Wall Street Journal reporting on Wednesday that the US Federal Trade Commission is looking into disclosures that internal company research from Facebook had identified ill effects from its products. The White House on Thursday said it was not surprised that Facebook knew about vaccine misinformation on its platform. "We have seen the reporting, of course, and ... it is unfortunately not surprising for us to hear that Facebook knew of these problems," White House Press Secretary Jen Psaki said, according to Reuters.

Facebook (FB) stock forecast

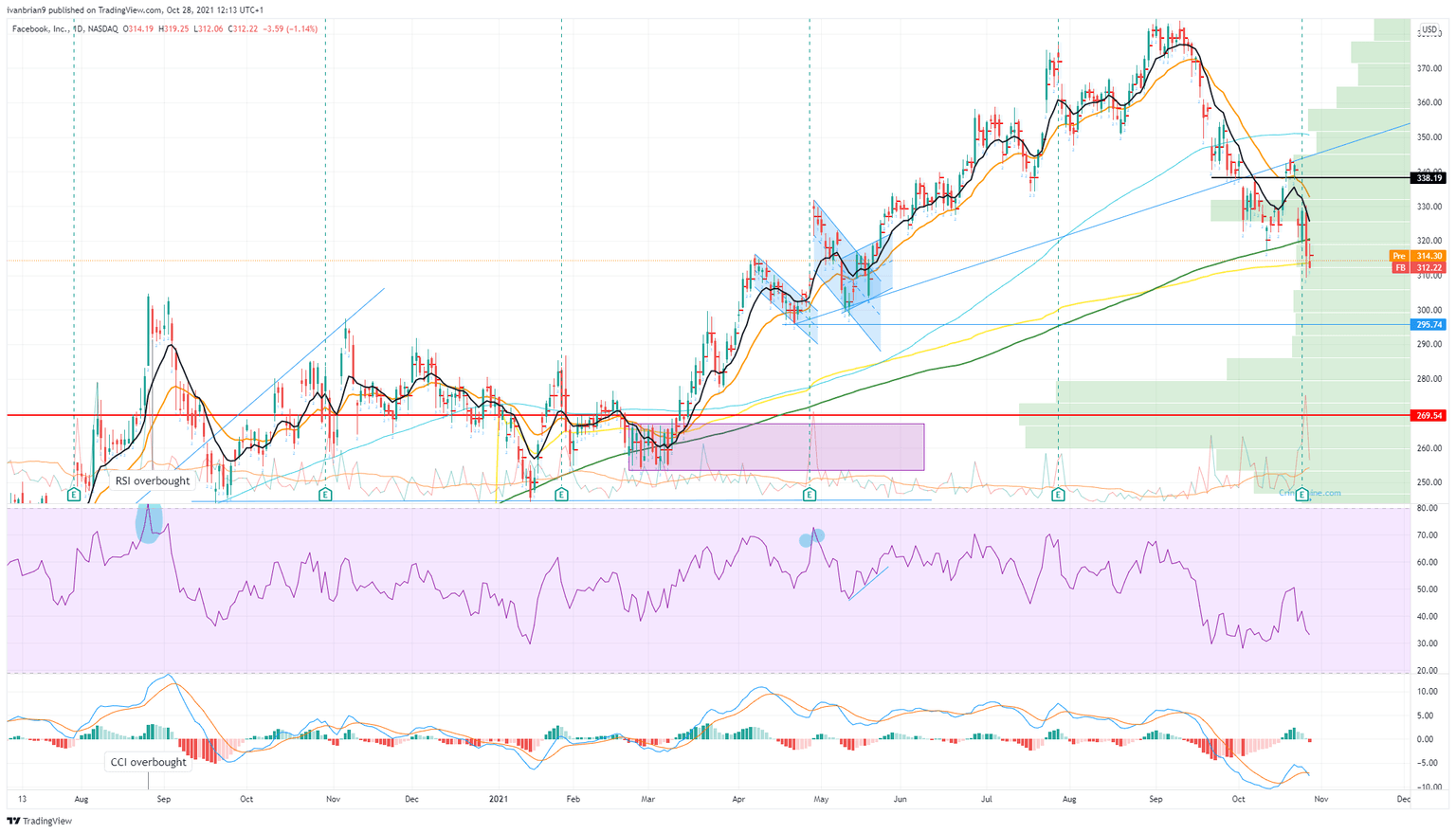

FB shares have now retreated to the yearly Volume Weighted Average Price (VWAP) and 200-day moving average, so this may provide some support. However, the Moving Average Convergence Divergence (MACD) has just crossed and given a bearish signal. Previous lows at $298 and $295 provide some support, but $280 to $260 is the real strong support in volume terms.

FB 1-day chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.