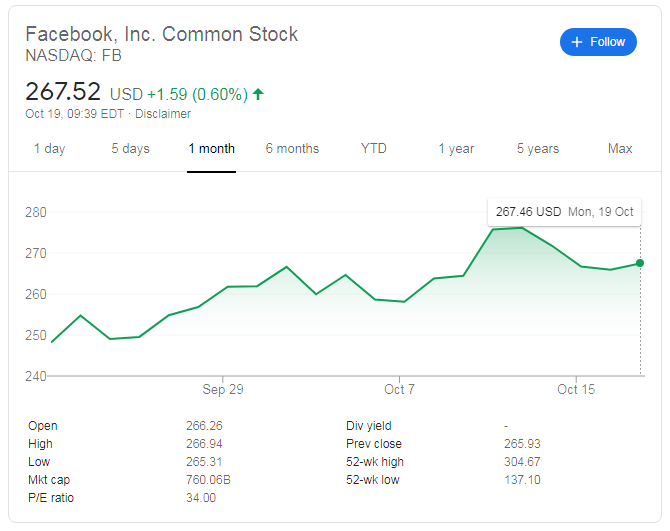

- NASDAQ: FB is rising amid hopes for a fiscal stimulus package that may come before or after the elections.

- Ad spending on Facebook is set to increase in the long "election month."

- Rising coronavirus cases could drive more shopping online, benefiting the social network.

Facebook Inc. (NASDAQ: FB) is on the rise – and that is unlikely a surprise when all tech shares are on the rise. Mark Zuckerberg's firm is edging higher as investors anticipate Congress to strike a deal on a new fiscal stimulus package. President Donald Trump said that he would offer more than Democrats.

It remains unclear if Senate Republicans would back their standard-bearer as they prefer only a minor support package – and as Trump is trailing rival Joe Biden in the polls. However, the social media behemoth has other reasons to advance.

FB Stock Forecast

1) Economic relief is coming after the elections: Democrats and Republicans are set to posture ahead of the vote and fail to strike a deal. However, they may reach one after the vote, boosting the American economy and indirectly affecting Facebook.

If Dems win the Senate – and they have a good chance of doing so – a more generous package is likely. The party has criticized FB for serving as a platform for fake news supporting Trump. However, Kamala Harris, the Vice-President candidate, has been friendly to tech firms in her home state of California. At least initially, a Biden administration is likely to only "slap tech on the wrist" rather than try to break it up.

2) Election spending unlikely to end: Facebook depends on ad spending, including political propaganda. With record mail-in and early votes, the elections are unlikely to end on the night of November 3, but more likely to extend for several weeks. Apart from a potential battle in courts, both parties will fight for public opinion – and that could extend spending throughout November – perhaps bridging the gap between election day and Black Friday shopping.

3) More online shopping: The world is watching the US elections and rising COVID-19 cases in Europe – but infections are also surging in the US and elsewhere. With more people staying at home once again, online consumption may reach new highs – and that means more spending as well.

Moreover, Zuckerberg and co. are expanding their e-commerce abilities, right in time for the peak of the second wave of the virus.

Overall, there are reasons for Facebook to rise.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD holds the bounce toward 0.6250 after China's Caixin Services PMI

AUD/USD sustains the rebound toward 0.6250 in the Asian session on Monday after China's Caixin Services PMI beat estimates with 52.2 in December. China's stimulus optimism and a subdued US Dollar offset increased bets for early RBA rate cuts, reviving the demand for the Aussie.

USD/JPY: Upside remains capped below 158.00 amid cautious mood

USD/JPY is consolidating the upside below 158.00 in Asian trading on Monday. The pair feels the heat from a cautious risk tone and a broadly subdued US Dollar but the divergent Fed-BoJ policy expectatations help keep it afloat in the Nonfarm Payrolls week.

Gold buyers stay hopeful whilst above 21-day SMA support

Gold price finds support and looks at $2,650 as the US Nonfarm Payrolls week begins. The US Dollar corrects further despite firm US Treasury bond yields and a cautious mood. Technically, daily indicators continue to paint a bullish picture for Gold price.

Bitcoin, Ethereum and Ripple show signs of bullish momentum

Bitcoin’s price is approaching its key psychological level of $100,000; a firm close above would signal the continuation of the ongoing rally. Ethereum price closes above its upper consolidation level of $3,522, suggesting bullish momentum. While Ripple price trades within a symmetrical triangle on Monday.

Week ahead – US NFP to test the markets, Eurozone CPI data also in focus

King Dollar flexes its muscles ahead of Friday’s NFP. Eurozone flash CPI numbers awaited as euro bleeds. Canada’s jobs data to impact bets of a January BoC cut. Australia’s CPI and Japan’s wages also on tap.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.