- NASDAQ: FB has been extending its falls despite broader market gains.

- CEO and Founder Mark Zuckerberg sold around $13.5 million worth of shares.

- President Trump greenlighted the transition, potentially weighing on demand for political ads.

Facebook has been having various transparency issues – and as a public company, openness about critical shareholder action is becoming an issue for all those that recently bought NASDAQ: FB stock.

CEO and Founder Mark Zuckerberg sold 49,750 Facebook shares on November 19, at an average price of $217.98 – above Monday's closing price of $268.73. That exchange followed similar sales in the previous days, a move that coincided with a gradual decline in value. Other senior members of FB's management team such as CFO David M. Wehner, Chief Accounting Office Susan J.s Taylor, and VP and General Counsel Jennifer Newstead reduced their holdings.

That may be one of the reasons for the decline in the social behemoth's value. It is essential to note that Facebook's equity declined while the broad tech index NASDAQ advanced.

Another factor that may weigh on the stock is President Donald Trump's authorization to begin the transition process toward the presidency of Joe Biden. The outgoing Commander-in-Chief has been clinging to power and launching a political and legal campaign, claiming fraud. While he did not concede to President-elect Biden, his greenlight lowers the political pressure in Washington.

Facebook has been a beneficiary of the political advertisement from both parties, which has been rising in Trump's time. A drop in divisiveness in the world's richest economy may decrease spending on political ads moving forward. That may also pressure NASDAQ: FB.

FB Stock Forecast

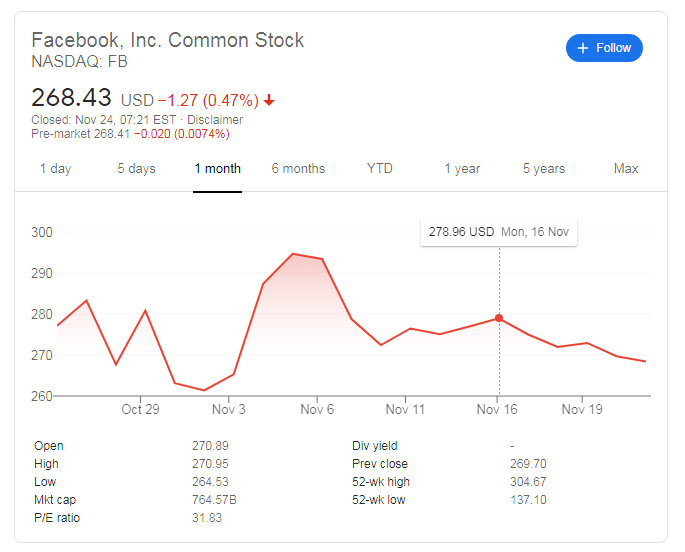

Facebook, Inc. Common Stock (NASDAQ: FB) has been gradually declining since hitting a peak of $294.68 on November 5, shortly after the elections. At current prices, it is nearing the November 2 trough of $261.36.

The broader range consists of the double-bottom at around $250 recorded in late September, while the upside is at the 52-week high of $304.67.

Facebook, which owns Instagram and Whatsapp, has failed to reach a valuation of $1 trillion achieved by some of its tech peers. The sector has been recently struggling with the news of a COVID-19 vaccine, which may depress demand for digital assets.

See Covid Vaccine: Pfizer's success promising for three other efforts, rally may have only just begun

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD hovers around 1.0900 ahead of EU inflation data

EUR/USD is keeping its range at around 1.0900 in Wednesday's European trading. The US Dollar resumes the downside, lending support to the pair. However, traders stay cautious and refrain from placing fresh bets ahead of the Eurozone inflation data release.

GBP/USD stays below 1.3000 after UK CPI data

GBP/USD trades below 1.3000 in the European session on Wednesday. The data from the UK showed that annual CPI inflation held steady at 2% in June. This reading came in line with the market expectation and limited Pound Sterling's upside.

Gold price retreats from all-time high amid profit-taking, potential downside seems limited

Gold price (XAU/USD) trims gains after touching a fresh record peak, around the $2,482-2,483 region during the Asian session on Wednesday and currently trades near the lower end of its daily range.

Bitcoin surpasses $65,000 mark

Bitcoin closes above the daily resistance level of $64,900, with Ethereum and Ripple subsequently breaking through their resistance levels, indicating an emerging bullish trend.

ECB could disappoint expectations for a dovish shift

ECB meets but all eyes remain on the US The ECB is preparing for the last meeting before the summer lull with developments elsewhere making President Lagarde’s job even more challenging.