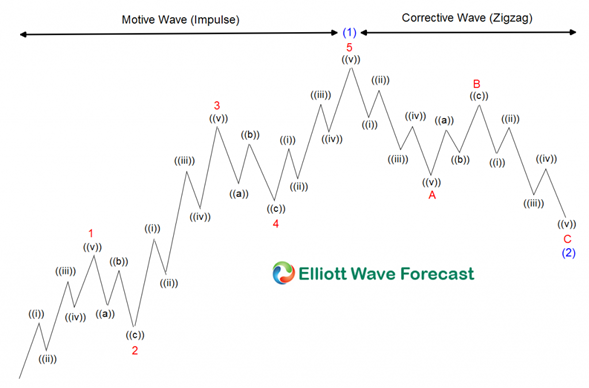

The Market has been in a correction since the peak at 02.14.2022. Many Market participants have turned bearish and forgot about the trend. As we always do at EWF, we locate the trend, and always relate the instrument among different time frames and cycles. The Elliott Wave Theory comes with degrees and cycles like Grand Super Cycle, and Super Cycle. Expedia stock has done a nice pull-back and we provided the target area in the past. We provided the reason in the following seminar “Are World Indices Entering into Crash Territory?”. We expected the stock to rally from the Blue Box buying area. Now, the stock is pulling back again and trading within another Blue Box area. The Elliott Wave Theory basic pattern comes with an advance in five waves and a pullback in three waves. The following chart illustrates the idea:

The chart above shows how each subdivision is in five waves. The degrees and sequences with the trend is in 5-9-13 swing. Also, after the cycle ended, the market corrects and traps the sellers because of the wrong impression that something bigger will happen. The correction always comes with a sequence of 3-7-11 swing. The most popular correction is a simple ABC, which structure is 5-3-5.

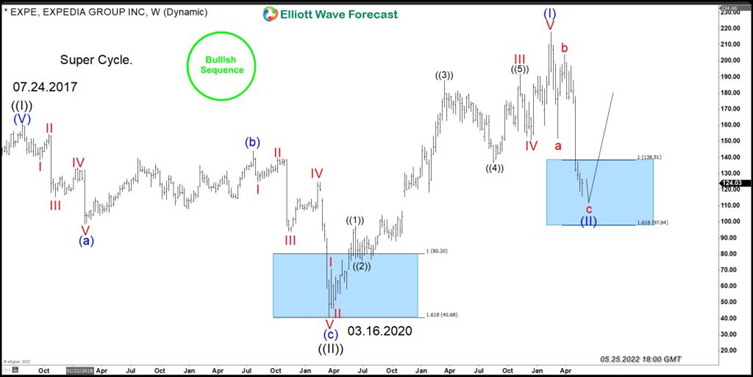

Expedia since the lows at ((II)) has rallied in clear five waves within the (I) degree, and now is correcting the cycle in a simple ABC. The following chart below illustrates the move

EXPE weekly Elliott Wave chart

The stock shows the structure and representation of the Super Cycle degree since the lows at ((II)). We can see how since the lows the stock went from I-II-III-IV-V degree with the lesser degree ((1))((2))((3))((4))((5)). It has a perfect sequence of 5-9-13-17 which is an impulse.

The stock is now in the process of ending the abc lower against the main trend and should turn higher as far as it stays above the $97.84 area. As an alternate, if the stock trades below the $97.84 area, it will make the move from the peak in (I) as a five waves decline. Consequently, a bounce in three waves should happen before another leg lower. Even in the alternate scenario, another move higher is still going to happen as far as wave ((II)) low at 3.16.2020 holds. The Super Cycle move higher should remain in place because the stock already traded above the peak at 07.24.2017, which represents a bullish sequence in our system.

In conclusion: The stock shows a bullish sequence within the Grand Super Cycle. Buyers should remain in control against the lows at 03.16.2020. We recommend buying the dips in three, seven, and eleven, and at this moment we are within the first three waves of pullback which should offer an opportunity that can not be missed.

FURTHER DISCLOSURES AND DISCLAIMER CONCERNING RISK, RESPONSIBILITY AND LIABILITY Trading in the Foreign Exchange market is a challenging opportunity where above average returns are available for educated and experienced investors who are willing to take above average risk. However, before deciding to participate in Foreign Exchange (FX) trading, you should carefully consider your investment objectives, level of xperience and risk appetite. Do not invest or trade capital you cannot afford to lose. EME PROCESSING AND CONSULTING, LLC, THEIR REPRESENTATIVES, AND ANYONE WORKING FOR OR WITHIN WWW.ELLIOTTWAVE- FORECAST.COM is not responsible for any loss from any form of distributed advice, signal, analysis, or content. Again, we fully DISCLOSE to the Subscriber base that the Service as a whole, the individual Parties, Representatives, or owners shall not be liable to any and all Subscribers for any losses or damages as a result of any action taken by the Subscriber from any trade idea or signal posted on the website(s) distributed through any form of social-media, email, the website, and/or any other electronic, written, verbal, or future form of communication . All analysis, trading signals, trading recommendations, all charts, communicated interpretations of the wave counts, and all content from any media form produced by www.Elliottwave-forecast.com and/or the Representatives are solely the opinions and best efforts of the respective author(s). In general Forex instruments are highly leveraged, and traders can lose some or all of their initial margin funds. All content provided by www.Elliottwave-forecast.com is expressed in good faith and is intended to help Subscribers succeed in the marketplace, but it is never guaranteed. There is no “holy grail” to trading or forecasting the market and we are wrong sometimes like everyone else. Please understand and accept the risk involved when making any trading and/or investment decision. UNDERSTAND that all the content we provide is protected through copyright of EME PROCESSING AND CONSULTING, LLC. It is illegal to disseminate in any form of communication any part or all of our proprietary information without specific authorization. UNDERSTAND that you also agree to not allow persons that are not PAID SUBSCRIBERS to view any of the content not released publicly. IF YOU ARE FOUND TO BE IN VIOLATION OF THESE RESTRICTIONS you or your firm (as the Subscriber) will be charged fully with no discount for one year subscription to our Premium Plus Plan at $1,799.88 for EACH person or firm who received any of our content illegally through the respected intermediary’s (Subscriber in violation of terms) channel(s) of communication.

Recommended content

Editors’ Picks

EUR/USD holds near 1.1100, looks to post small weekly gains

EUR/USD trades near 1.1100 in the American session on Friday. Although the risk-averse market atmosphere caps the pair's upside, dovish comments from Fed officials and the disappointing US jobs report help it hold its ground.

GBP/USD retreats to 1.3150 area after post-NFP spike

GBP/USD turns south and declines to 1.3150 area after spiking to 1.3240 in the early American session. The negative shift seen in risk mood following the US labor market data for August helps the US Dollar stay resilient against its peers and weighs on the pair.

Gold pulls away from near record highs, holds above $2,500

Gold came within a touching distance of a new all-time high near $2,530 as US Treasury bond yields turned south on disappointing US jobs data. The US Dollar's resilience amid a souring risk mood, however, caused XAU/USD to erase its daily gains.

Crypto today: Bitcoin, Ethereum, XRP tests key support, TRON network non-stablecoin activity hits new highs

Bitcoin, Ethereum, and XRP hover around key support levels after registering a steep correction earlier this week. TRON network’s stablecoin activity hit new highs following the release of SunPump.

Nonfarm Payrolls expected to show modest hiring rebound in August after July’s tepid report

The Nonfarm Payrolls report is forecast to show that the US economy added 160,000 jobs in August, after creating 114,000 in July. The Unemployment Rate is likely to dip to 4.2% in the same period from July’s 4.3% reading.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.