Evergrande updates helping risk sentiment, RBA Debelle addresses risks

Risk sentiment has improved with China's Evergrande main unit Hengda Real Estate group announcing that it will make a coupon payment for onshore bond due September 23, according to Reuters.

In the same theme, we have the Reserve Bank of Australia's deputy speaking who has stated that the central bank is addressing the issue.

Guy Debblle said that he expects Chinese authorities could allow Evergrande to default.

Additionally, ADB has trimmed developing Asia's 2021 growth forecast to 7.1% (prev 7.2%) and keeps 2022 growth forecast at 5.4%. It says that the Evergrande debt problem ‘warrants careful monitoring’.

Earlier in the day, ''the International Monetary Fund on Tuesday said it is closely following developments surrounding China Evergrande Group (3333.HK), but believes Beijing has the tools to prevent the situation from turning into a systemic crisis,'' Reuters reported.

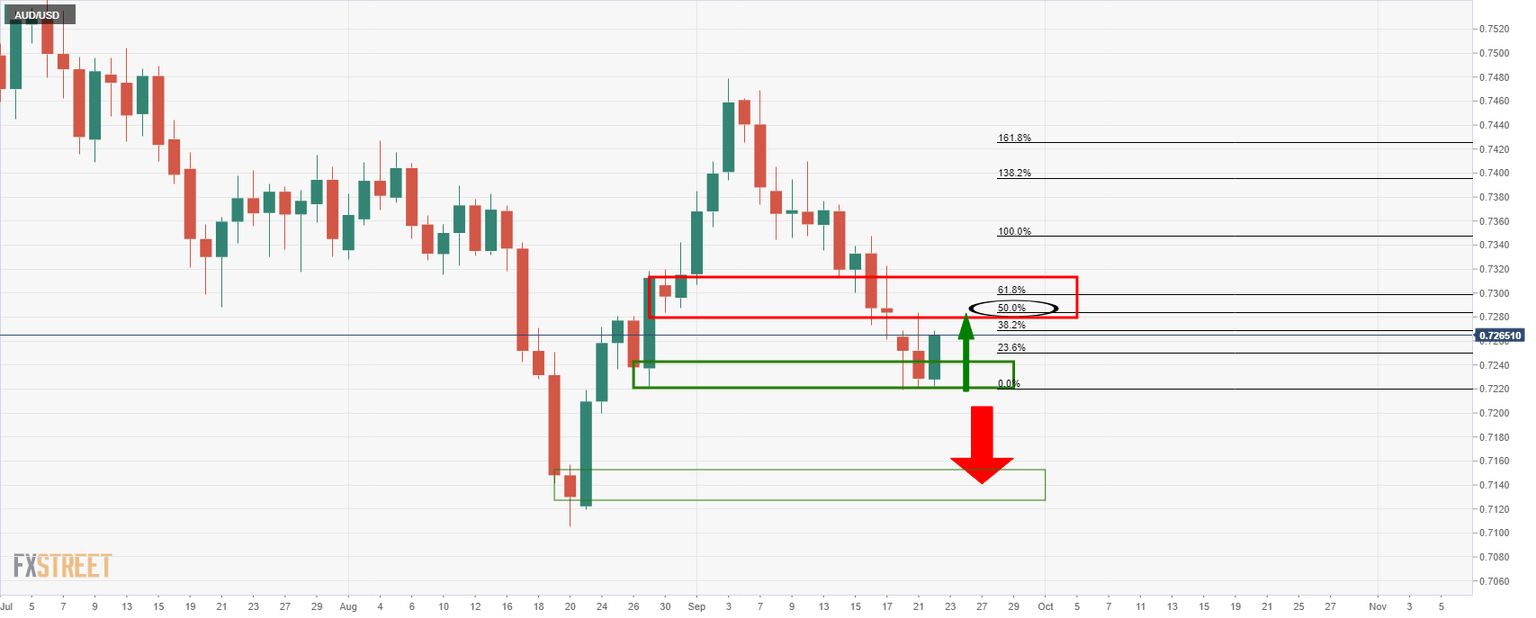

Meanwhile, AUD/USD bulls are stepping and the price would be expected to continue higher in a bullish correction as illustrated in the following prior analysis, AUD/USD bulls eye a bull correction as Evergrande risks start to abate:

''The daily wick as illustrated in the prior daily chart was filled into the target and now the bulls could well see value here. A run back to a 50% mean reversion that meets old structure could be targetted near 0.7280. However, failures below 0.7220 open risk of a retest of the mid-Aug lows and 071 the figure.''

AUD/USD live market

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.