Euro collapses below 1.1000 following Lagarde, ECB

- Euro makes a sharp U-turn and drop below 1.1000 against the US Dollar.

- Stocks in Europe on their way to close with decent gains.

- EUR/USD drops to fresh lows in the sub-1.1000 region.

- Germany’s Consumer Confidence improved marginally in August.

- The ECB hiked rates by 25 bps, as widely expected.

- The ECB's Lagarde reiterated the meeting-by-meeting stance.

- US Flash Q2 GDP surprises to the upside.

The Euro (EUR) could not sustain the earlier bull run to the 1.1150 region against the US Dollar (USD) and forces EUR/USD to come all the way down to the area below the psychological 1.1000 mark, or 2-week lows, following the ECB event on Thursday.

The earlier strong advance in the pair comes on the back of extra weakness in the Greenback, which was particularly magnified after the FOMC event on Wednesday. On this, the Federal Reserve unanimously hiked rates by 25 bps as widely expected, taking the Fed Funds Target Range (FFTR) to 5.25%-5.50%.

In addition, at his press conference, Chair Jerome Powell confirmed live meetings for policy statements, citing little change from May and June iterations, while the current level of interest rates support slower tightening if needed.

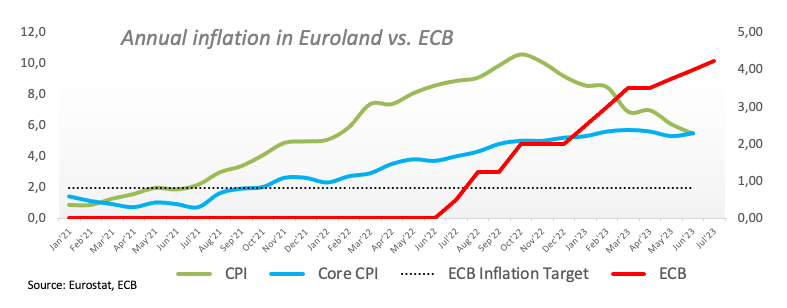

The pair saw its early uptick trimmed after the European Central Bank (ECB) raised its policy rates by 25 bps. From the bank's statement, interest rate decisions will be based on inflation outlook, economic and financial data, underlying inflation dynamics, and monetary policy transmission. In addition, the Coucil will set restrictive interest rates to achieve a 2% medium-term target, ensuring a timely return of inflation to the target. The data-dependent approach will continue to guide future decisions.

At her press conference, President Christine Lagarde stated that they were maintaining an open-minded stance regarding September and the coming months. She also mentioned that the Council were not engaging in forward guidance and that they had the option of either increasing or maintaining interest rates. Furthermore, they had not yet deliberated on implementing any balance sheet reductions. Lagarde expressed that they were beginning to observe a robust transmission of policies into the economy and that there would be no compromise between interest rates and quantitative tightening.

In the domestic data space, Germany’s Consumer Confidence gauged by GfK rose to -24.4 for the month of August, while the Unemployment Rate in Spain dropped to 11.6% and Consumer Confidence in Italy eased to 106.7 in July.

Across the pond, advanced Q2 GDP figures saw the economy expand 2.4% YoY. Additionally, usual Initial Claims rose by 221K in the week to July 22, Durable Goods Orders rose sharply by 4.7% MoM in June, Pending Home Sales contracted 15.6% in the year to June, and preliminary Goods Trade Balance figures now expect a $87.84B deficit in June.

Daily digest market movers: Euro revisits the area below 1.1000

- The EUR reverses Wednesday's gain and breaks below 1.1000 against the USD.

- The USD Index gathers some composure and reclaims levels above 101.00.

- The ECB fails to shed light on the bank's plans for the next months.

- US yields advance modestly vs. a daily pullback in German yields.

Technical Analysis: Euro could now slip back to 1.0900

The next hurdle for EUR/USD appears at the 2023 high at 1.1275, reached on July 18. Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 recorded on February 10.

In case sellers regain the initiative, EUR/USD should meet immediate contention at the weekly low of 0991 (July 27) seconded by provisional support at the 55-day and 100-day SMAs at 1.0903 and 1.0899, respectively. The loss of this region could open the door to a potential visit to the July 6 low of 1.0833 ahead of the key 200-day SMA at 1.0713 and the May 31 low of 1.0635. South from here emerges the March 15 low of 1.0516 before the 2023 low of 1.0481 on January 6.

The constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.