- The Euro gathers extra pace vs. the US Dollar.

- Stocks in Europe close Friday's session with decent gains.

- EUR/USD reaches four-day highs near 1.0620.

- The DXY USD Index extends the decline to 105.70.

- Germany reported a firm labour market report.

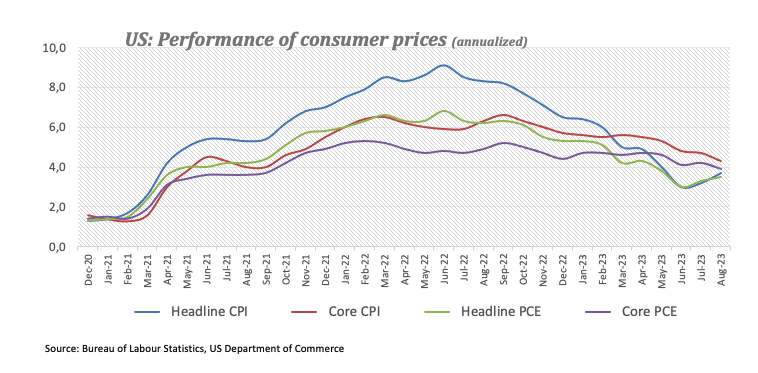

- US headline PCE inflation rose to 3.5% YoY in August.

On Friday, the Euro (EUR) gained significant momentum against the US Dollar (USD), allowing EUR/USD to surpass the important resistance level of 1.0600 and clinch multi-day highs at the same time.

Meanwhile, the Greenback is experiencing a correction from its recent yearly highs around 106.80. It has convincingly breached the support level of 106.00, as indicated by the USD Index (DXY) in response to an improvement in risk sentiment and growing concerns about a potential government shutdown in the United States over the weekend.

The recovery in the pair also comes amidst some loss of momentum in US and German yields after hitting multi-year tops earlier in the week.

The monetary policy outlook remains unchanged, with investors still factoring in a 25 bps interest rate hike by the Federal Reserve (Fed) before the year concludes. Meanwhile, discussions in the market persist regarding a potential impasse in policy adjustments at the European Central Bank (ECB), despite inflation levels that exceed the bank's target and mounting concerns about a potential recession.

In the euro calendar, Retail Sales in Germany contracted 2.3% YoY in August, while the Unemployment Change increased by 10K individuals in September and the Unemployment Rate held steady at 5.7% in the same period. In the broader euro area, flash Inflation Rate for the month of September saw the headline CPI rise at an annualized 4.3% and 4.5% when it comes to the Core CPI (excluding food and energy costs).

Across the pond, inflation gauged by the headline PCE rose 3.5% in the year to August and the Core PCE went up 3.9% over the last twelve months. In addition, Personal Income expanded 0.4% MoM also in August, Personal Spending rose 0.4% from a month earlier and the flash Goods Trade Balance showed a $84.27B deficit in the same month. Later in the NA session, the final print of the Michigan Consumer Sentiment will close the weekly docket.

Daily digest market movers: Euro appears propped up by risk appetite

- The EUR bounces off eight-month lows against the USD.

- US and German yields extend the corrective decline on Friday.

- Investors keep pricing in another rate raise by the Fed before year-end.

- Markets expect a pause at the ECB’s hiking cycle.

- EMU advanced inflation figures extend the downward trend.

- UK Q2 GDP figures surprise to the upside.

- Intervention concerns persist as USD/JPY targets the 150.00 barrier.

- US headline PCE rose marginally in August.

Technical Analysis: Euro faces decent support in the 1.0490/80 band

EUR/USD extends the recovery to the area beyond 1.0600 on Friday, managing to bounce off the oversold zone.

In case the recovery in EUR/USD becomes more serious, the pair should meet the next up-barrier at the September 12 high of 1.0767, prior to the key 200-day Simple Moving Average (SMA) at 1.0828. Should the pair surpass this level, it may pave the way for a test of the transitory 55-day SMA at 1.0855 ahead of the August 30 top at 1.0945 and the psychological hurdle of 1.1000. If the pair clears the latter, it could then challenge the August 10 peak of 1.1064 before the July 27 peak at 1.1149 and the 2023 high of 1.1275 seen on July 18.

On the downside, there is immediate contention at Thursday's low of 1.0491 seconded by the 2023 low of 1.0481 from January 6.

As long as the EUR/USD remains below the 200-day SMA, the potential for downward pressure persists.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD extends recovery beyond 1.0400 amid Wall Street's turnaround

EUR/USD extends its recovery beyond 1.0400, helped by the better performance of Wall Street and softer-than-anticipated United States PCE inflation. Profit-taking ahead of the winter holidays also takes its toll.

GBP/USD nears 1.2600 on renewed USD weakness

GBP/USD extends its rebound from multi-month lows and approaches 1.2600. The US Dollar stays on the back foot after softer-than-expected PCE inflation data, helping the pair edge higher. Nevertheless, GBP/USD remains on track to end the week in negative territory.

Gold rises above $2,620 as US yields edge lower

Gold extends its daily rebound and trades above $2,620 on Friday. The benchmark 10-year US Treasury bond yield declines toward 4.5% following the PCE inflation data for November, helping XAU/USD stretch higher in the American session.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Bank of England stays on hold, but a dovish front is building

Bank of England rates were maintained at 4.75% today, in line with expectations. However, the 6-3 vote split sent a moderately dovish signal to markets, prompting some dovish repricing and a weaker pound. We remain more dovish than market pricing for 2025.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.