Euro rebounds from daily lows and flirts with 1.1000 once again

- Euro stages a marked comeback and approaches 1.1000 vs. the US Dollar.

- Stocks in Europe show a mixed performance as the session draws to a close.

- EUR/USD finds decent support near1.0960 on Fed, risk-off mood.

- The USD Index (DXY) now puts the 102.00 yardstick to the test.

- Industrial Production in Germany contracted 1.5% MoM in June.

- EMU's Investor Confidence improved in August.

The Euro (EUR) manages to regain some balance and trims earlier losses against the US Dollar (USD) on Monday, helping EUR/USD to regain the 1.1000 neighbourhood after bottoming out near 1.0960 below.

The Greenback, on the other hand, gives away a big chunk of those early gains and now confronts the 102.00 zone when tracked by the USD Index (DXY) pari passu with the loss of momentum in US yields across different maturities and amidst further investors' assessment of the recent release of Nonfarm Payrolls data (+187K) from Friday.

Regarding the latter point, it's important to note that even though the US economy generated fewer jobs than initially predicted, the stability of wage growth and an improved jobless rate of 3.5% suggest that the labor market's resilience remains mostly intact.

The initial marked bias towards the risk-averse space was bolstered by statements made by Michelle Bowman of the FOMC. She suggested earlier in the session the possibility of further interest rate hikes (perhaps in the upcoming meeting) if deflationary pressures lose traction.

This stance contradicts the prevailing speculation that the Fed's rate hike in July could have been its final one in the near future. Furthermore, the likelihood of the European Central Bank (ECB) implementing additional tightening measures beyond the summer seems to be losing its strength.

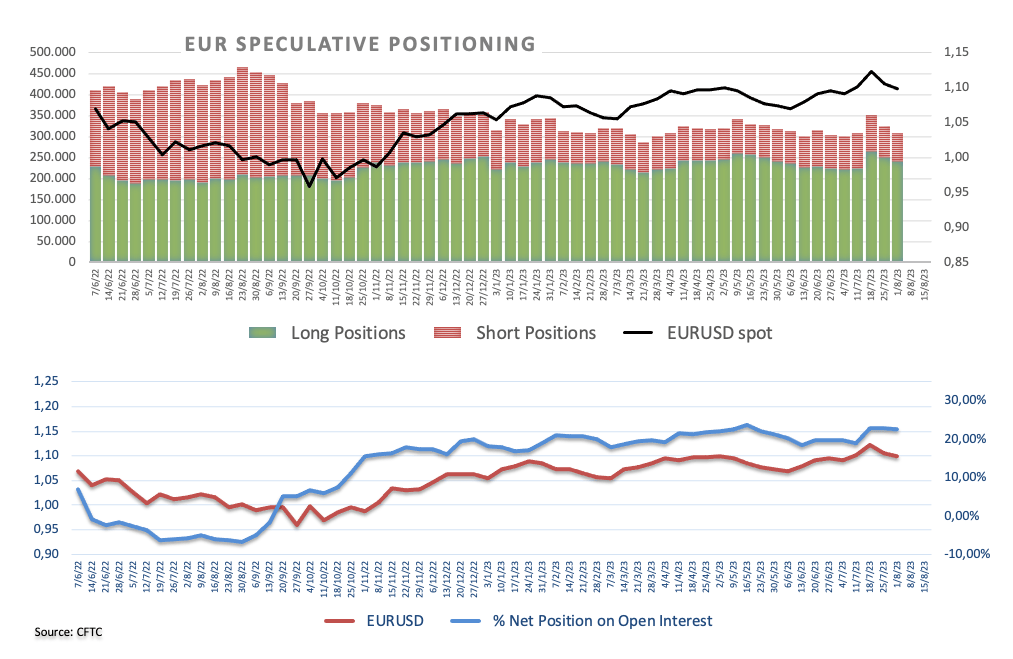

From the speculative community, EUR net longs receded a tad to three-week lows just above 172K contracts in the week to August 1 according to CFTC's report. Under that period, spot saw its decline accelerate in the wake of the FOMC and ECB interest rate decisions on July 26 and July 27, respectively.

In the euro docket, Industrial Production in Germany contracted 1.5% MoM in June and 1.8% over the last 12 months. In addition, Investor Confidence tracked by the Sentix index improved to -18.9 for the month of August.

In the US, Consumer Credit Change will be the sole release along with short-term bill auctions.

Daily digest market movers: Euro shifts its attention to the 1.1000 mark

- The EUR meets initial support near 1.0960 vs. the USD on Monday.

- The USD Index (DXY) loses traction after faltering ahead of 1.1040.

- Risk aversion continues to fade away at the beginning of the new week.

- Fed’s Bowman did not rule out extra tightening in the near term.

- CME Group’s FedWatch Tool sees no rate hikes by the Fed in H2 2023.

- Speculation that the Fed might have ended its hiking cycle remains steady.

- Fed's Williams suggested rates could be reduced in early 2024.

- Investors’ focus is expected to shift to US inflation figures (August 11).

Technical Analysis: Euro now looks to 1.1150

EUR/USD comes under renewed downside pressure and breaches the key psychological support at 1.1000.

The loss of the 1.0920 region, where the provisional 55-day and 100-day SMAs converge, leaves EUR/USD vulnerable to a probable drop to the July low of 1.0833 (July 6) ahead of the key 200-day SMA at 1.0748 and the May low of 1.0635 (May 31). South from here emerges the March low of 1.0516 (March 15) before the 2023 low of 1.0481 (January 6).

On the other hand, occasional bullish attempts could motivate the pair to initially dispute the weekly top at 1.1149 (July 27). Above this level, the downside pressure could mitigate somewhat and could encourage the pair to test the 2023 high at 1.1275 (July 18). Once this level is cleared, there are no resistance levels of significance until the 2022 peak of 1.1495 (February 10), which is closely followed by the round level of 1.1500.

Furthermore, the constructive view of EUR/USD appears unchanged as long as the pair trades above the key 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.