Euro on its way to close another week of losses near 1.0600

- The Euro keeps the offered bias intact against the US Dollar.

- Stocks in Europe trade mostly on the defensive so far on Friday.

- EUR/USD deflates to multi-month lows on poor PMIs.

- The USD Index (DXY) resumes the uptrend and retargets 105.70.

- Advanced PMIs will also be in the limelight in the US calendar.

- ECB Vice-President Luis De Guindos speaks later in the session.

The Euro (EUR) remains firmly in a selling mode against the US Dollar (USD), resulting in EUR/USD reaching new six-month lows around the 1.0600 level early on Friday.

In contrast, the Greenback manages to shrug off the knee-jerk reaction seen on Thursday and resumes its upward trajectory around the 105.60 area, as indicated by the USD Index (DXY). The relentless ascent of the Dollar has gained renewed strength following the hawkish stance adopted by the Federal Reserve (Fed) during Wednesday's meeting. Additionally, the robust rally in US yields across the intermediate and long-term maturity spectrum further supports the strength of the Dollar.

Board members at the European Central Bank (ECB) showed some common ground after leaning to a potential pause in the next meeting despite seeing inflation still running well above the bank’s target.

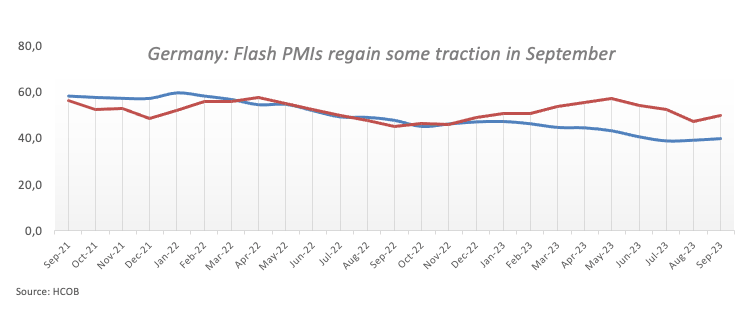

In the European docket, flash Manufacturing and Services PMIs in Germany surprised to the upside at 39.8 and 49.8, respectively, in September, although they remain well into contraction territory. In the broader eurozone, the advanced Manufacturing PMI came in at 43.4, lower than expected, while the Services PMI stood at a higher-than-anticipated 48.4.

Friday is also PMI-day across the pond. In addition, FOMC Governor Lisa Cook will speak later in the American session.

Daily digest market movers: Euro remains depressed amidst Dollar strength

- The EUR loses further ground against the USD.

- US and German yields trade without clear direction on Friday.

- Investors see the Federal Reserve hiking rates by 25 bps before end of 2023.

- The BoJ keeps its policy rate unchanged, as expected.

- BoJ Governor Kazuo Ueda sees inflation picking up pace (at some point far far away).

- Market chatter see potential interest rate cuts by the Fed in Q3 2024.

- Talks of a pause by the ECB continue to pick up pace.

- Intervention fears surround the price action around USD/JPY.

Technical Analysis: Euro's outlook stays negative below the 200-day SMA

EUR/USD recedes to new lows, although the 1.0600 region appears to be quite a tough nut to crack for Euro bears.

If the EUR/USD breaches its low of 1.0614, there is a chance it could revisit the March 15 low of 1.0516 before reaching the 2023 bottom of 1.0481 seen on January 6.

On the positive side, there is a minor resistance level at the September 12 high of 1.0767, followed by the more significant 200-day Simple Moving Average (SMA) at 1.0828. If the pair manages to break above this level, it could pave the way for a continued recovery towards the temporary 55-day SMA at 1.0905, with the possibility of reaching the August 30 top of 1.0945. Surpassing the latter could bring the psychological level of 1.1000 into focus, followed by the August 10 peak of 1.1064. Beyond that, the pair might retest the July 27 high at 1.1149 and potentially reach the 2023 top at 1.1275 from July 18.

As long as the EUR/USD remains below the 200-day SMA, there is a chance that the pair will continue to face downward pressure.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.