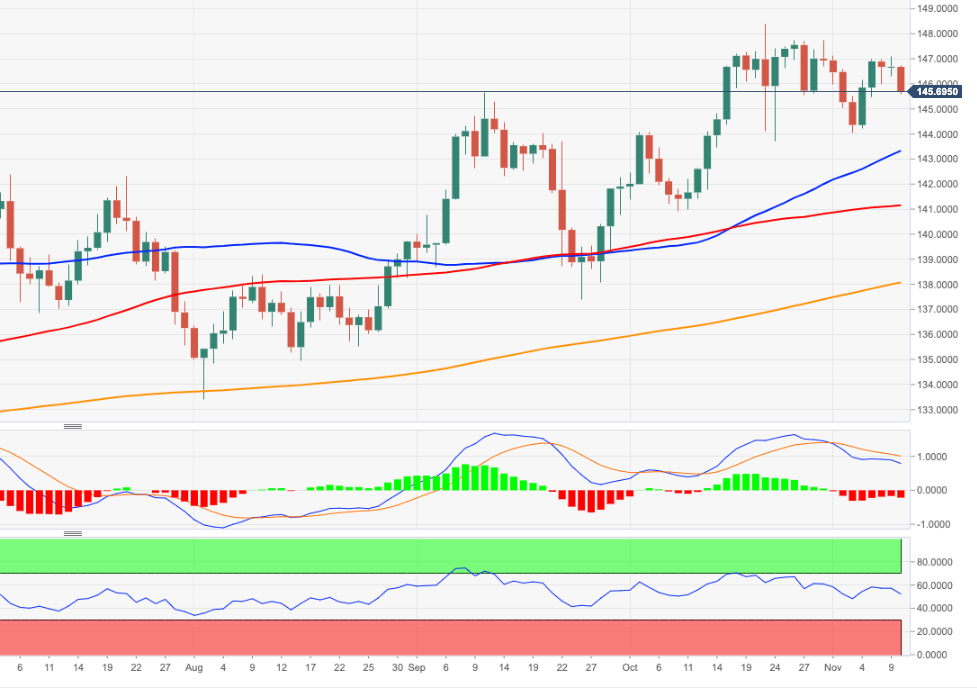

EURJPY Price Analysis: Corrective decline could extend to 144.00

- EURJPY extends the weekly leg lower for the third session in a row.

- Immediately to the downside now comes the 144.00 region.

EURJPY clinches the third straight day with losses and breaks below the key 146.00 support on Thursday.

The cross seems to have embarked on a corrective phase and the continuation of this stance could challenge the so far November low at 144.03 (November 3) in the short term. Further south awaits the 55-day SMA, today at 143.28.

In the short term the upside momentum is expected to persist while above the October lows near 141.00.

In the longer run, while above the key 200-day SMA at 138.03, the constructive outlook is expected to remain unchanged.

EURJPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.