EUR/USD treads water in familiar chart territory ahead of thin Wednesday

- EUR/USD churns near 1.0720 as market flows buckle down for the wait to key data.

- Wednesday has a limited data docket on the offer.

- Investors look ahead to Friday’s packed data docket.

EUR/USD traded within familiar levels on Wednesday, keeping the Fiber trapped in near-term consolidation just north of 1.0700 as Euro traders hunker down for the wait to meaningful data releases. Momentum is set to remain thin as markets await fresh data to drive market flows beginning on Thursday.

Forex Today: The FX universe remains in waiting mode

Wednesday’s economic calendar is notably thin, though traders will note that the latest German GfK Consumer Confidence Survey for July is expected to improve slightly from the previous print of -20.9 to -18.9. European Central Bank (ECB) Chief Economist Philip Lane is also expected to deliver some talking points during the European market session. Still, the ECB Executive Board member is not expected to rock the boat or otherwise deviate from recent talking points shared by other ECB board members.

The US will also release the latest Bank Stress Test results, but performance is not expected to wildly deviate from previous runs through the Federal Reserve’s stress test of the US banking system. The current “severely adverse” stress test asks banks to examine the soundness of their balance sheets under a hypothetical scenario where the US Unemployment Rate reaches 10% within a two-year period, alongside an increase in market volatility, a 36% decline in housing prices, and a 40% drop in commercial real estate values.

Thursday will kick off the week’s data releases in earnest, with final pan-EU Consumer Confidence figures for June as well as a revision print for Q1’s US Gross Domestic Product (GDP) print which is expected to hold steady at 1.3% QoQ.

Friday will blow the doors off the week’s otherwise sedate economic release schedule with German Retail Sales figures for May and the latest print of US Personal Consumption Expenditure Price Index (PCE) inflation, also for the monthly period of May. One of the Federal Reserve's (Fed) preferred inflation metrics, investors will be closely monitoring a continued decrease in crucial US inflation figures to ensure the Fed stays on track to implement an initial rate cut when the Federal Open Market Committee (FOMC) convenes on September 18.

EUR/USD technical outlook

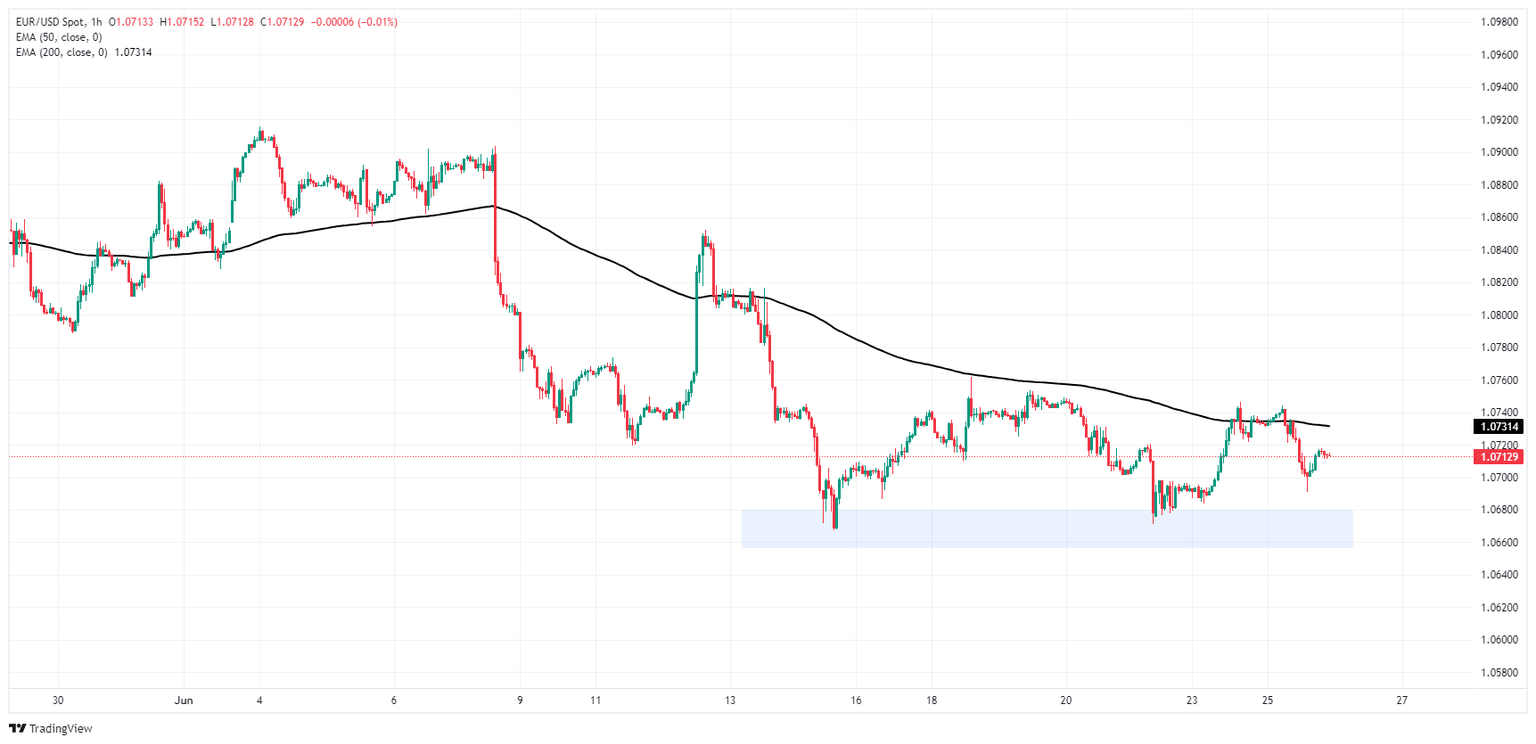

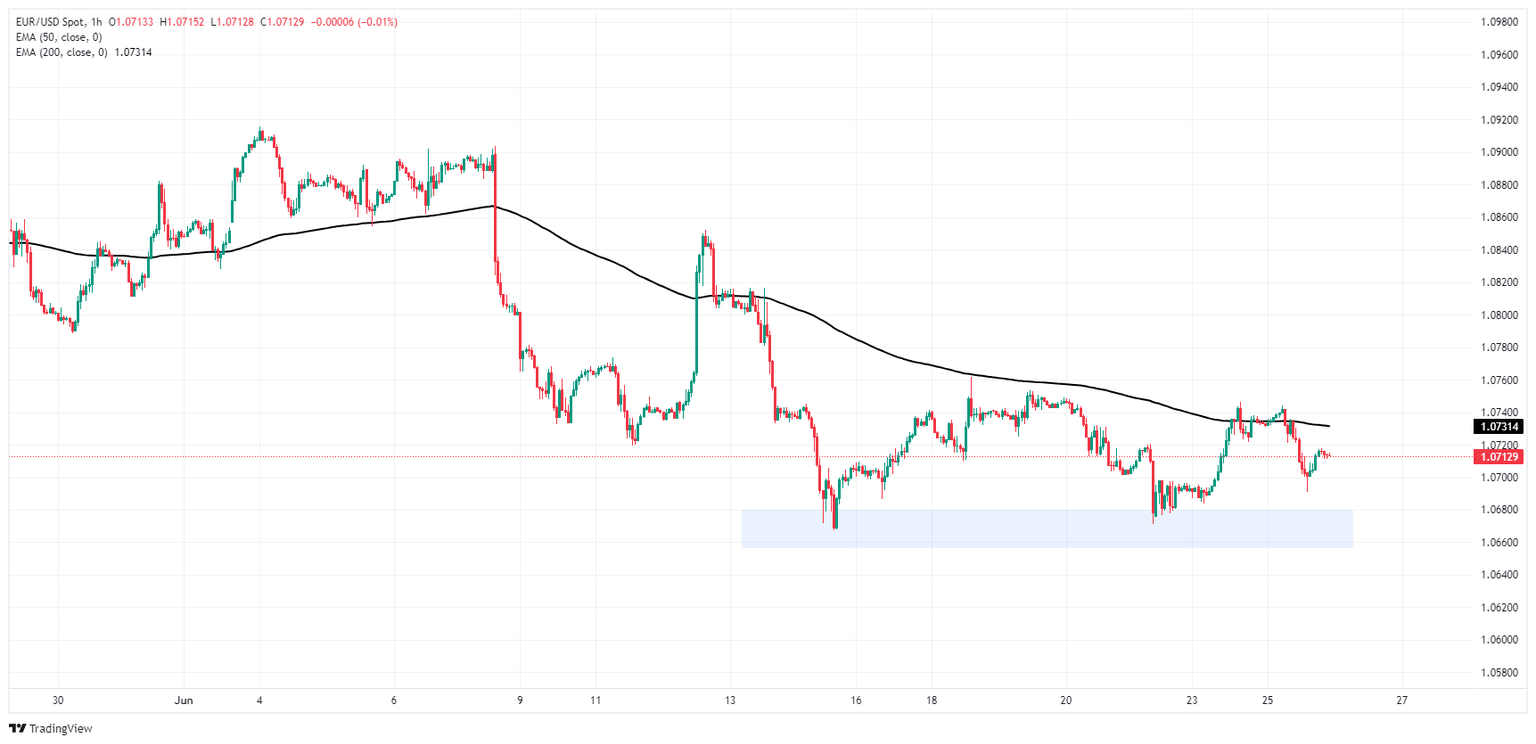

EUR/USD continues to get squeezed into near-term consolidation as the 200-hour Exponential Moving Average (EMA) weighs on intraday price action from 1.071, but a demand zone below 1.0680 is proving technical support and keeping bids bolstered.

Daily candlesticks are mired in technical congestion, but the Fiber remains poised for an extended slide as high and lows continue to chalk in lower peaks and valleys. The pair is drifting on the south side of the 200-day EMA at 1.0798, and failure to spark a firm bullish push back into the high end of recent lower highs could see the Fiber contesting the last major swing low into the 1.0600 handle.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.