EUR/USD gains after ECB's interest rate cut decision, moderate US Q4 GDP growth

- EUR/USD recovers losses and turns positive after the ECB’s interest rate cut decision.

- The ECB cut interest rates by 25 bps, as expected.

- The Fed kept interest rates steady in the range of 4.25%-4.50% on Wednesday.

EUR/USD bounces back to near 1.0435 after sliding slightly below 1.0400 in Thursday’s North American session. The major currency pair gains after the European Central Bank (ECB) cut its Deposit Facility Rate by 25 basis points (bps) to 2.75%, with the Main Refinancing Operations Rate sliding to 2.9%, as expected. Traders had already priced in a 25-bps interest rate reduction on the assumption that inflationary pressures in the Eurozone are sustainably on track to return to the central bank’s target of 2%. Investors are also worried that potential tariffs by United States (US) President Donald Trump could falter the Eurozone economic outlook, which is already going through a rough phase.

In the European session, flash Eurozone Gross Domestic Product (GDP) data for the fourth quarter of 2024 showed that the economy was flat after expanding 0.4% in the third quarter. Economists expect the shared bloc to have expanded by 0.1%. The shrinking German economy remained the weak link to the Eurozone's flat GDP growth. Flash German GDP data shows that the economy contracted by 0.2% in the last quarter of 2024 on YoY, slower than the 0.3% decline in the third quarter. Compared to the same quarter of 2023, the Eurozone economy rose steadily by 0.9%, softer than estimates of 1% growth.

In the press conference, ECB President Christine Lagarde reiterated that she will not commit to a pre-defined rate cut path and that the central bank will remain data-dependent.

Meanwhile, traders have priced in three more interest rate cuts this year and see them coming by the summer, which would push the key Deposit Facility Rate to 2%. A string of ECB officials had been comfortable with dovish bets but not with the timeframe before the policy announcement, and they see the 2% rate coming by year-end. ECB officials have also anticipated 2% as a neutral rate, which neither stimulates nor weighs on economic growth.

Daily digest market movers: EUR/USD gains at US Dollar's expense

- The recovery move in the EUR/USD pair could also be attributed to a decline in the US Dollar (USD) that came after the release of the weak US Q4 GDP data. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, slides to near 107.80.

- The GDP report showed that the pace at which the economy expanded in the last quarter of 2024 was slower than projected. Year-on-year GDP growth came in at 2.3%, slower than expectations of 2.6% and the 3.1% growth seen in the July-September period.

- Meanwhile, Initial Jobless Claims for the week ending January 24 remained lower than estimated. Individuals claiming jobless benefits for the first time were 207K, fewer than estimates of 220K and the former release of 223K.

- The US Dollar was trading sideways, earlier the day, in the aftermath of the Federal Reserve’s (Fed) monetary policy on Wednesday, in which the central bank left interest rates unchanged in the range of 4.25%-4.50%.

- The Fed was already expected to announce a pause in the policy-easing spell as market participants were worried about stalling progress in the disinflation trend towards the central bank’s target of 2%. In the press conference, Fed Chair Jerome Powell adopted a cautious stance on interest rates and said that the central bank would resume the rate-cut cycle only after seeing "real progress on inflation or at least some weakness in the labor market”.

- In December, the core Consumer Price Index (CPI), which excludes volatile food and energy prices, decelerated to 3.2% year-over-year but remained well above the Fed’s desired rate of 2%. For more cues on the current status of inflation, investors will focus on the US Personal Consumption Expenditure Price Index (PCE) data for December, which will be released on Friday.

- When asked about whether the Fed will follow President Trump’s call for immediate rate cuts, Powell said, “The committee is very much in the mode of waiting to see what policies are enacted.”

- In Thursday’s session, investors will focus on the preliminary, which will be published at 13:30 GMT. The US economy is expected to have grown by 2.6% compared to the same quarter of 2023 but slower than the 3.1% growth in the previous quarter.

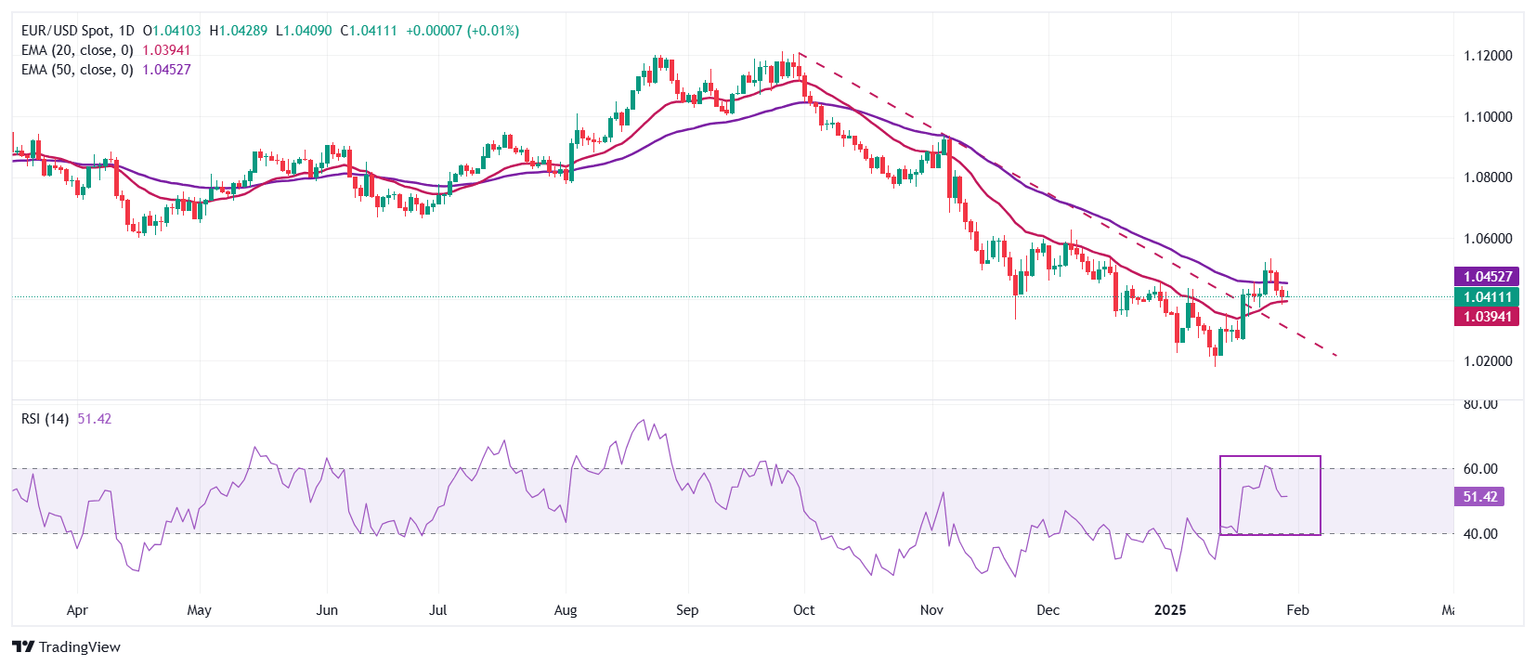

Technical Analysis: EUR/USD stays above 20-day EMA

EUR/USD fell to near the 20-day Exponential Moving Average (EMA), which trades around 1.0395, on Wednesday in a corrective move from Monday's high of 1.0530. The major currency pair weakens after failing to sustain above the 50-day EMA, which trades around 1.0450.

The 14-day Relative Strength Index (RSI) failed to climb above the 60.00 hurdle after recovering from below the 40.00 level, suggesting that the trend would be sideways.

Looking down, the downward-sloping trendline from the September 30, 2024, high of 1.1209 will act as major support for the pair near the round level of 1.0300, followed by the January 20 low of 1.0266. Conversely, the December 6 high of 1.0630 will be the key barrier for the Euro bulls.

Economic Indicator

ECB Rate On Deposit Facility

One of the European Central Bank's three key interest rates, the rate on the deposit facility, is the rate at which banks earn interest when they deposit funds with the ECB. It is announced by the European Central Bank at each of its eight scheduled annual meetings.

Read more.Last release: Thu Jan 30, 2025 13:15

Frequency: Irregular

Actual: 2.75%

Consensus: 2.75%

Previous: 3%

Source: European Central Bank

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.