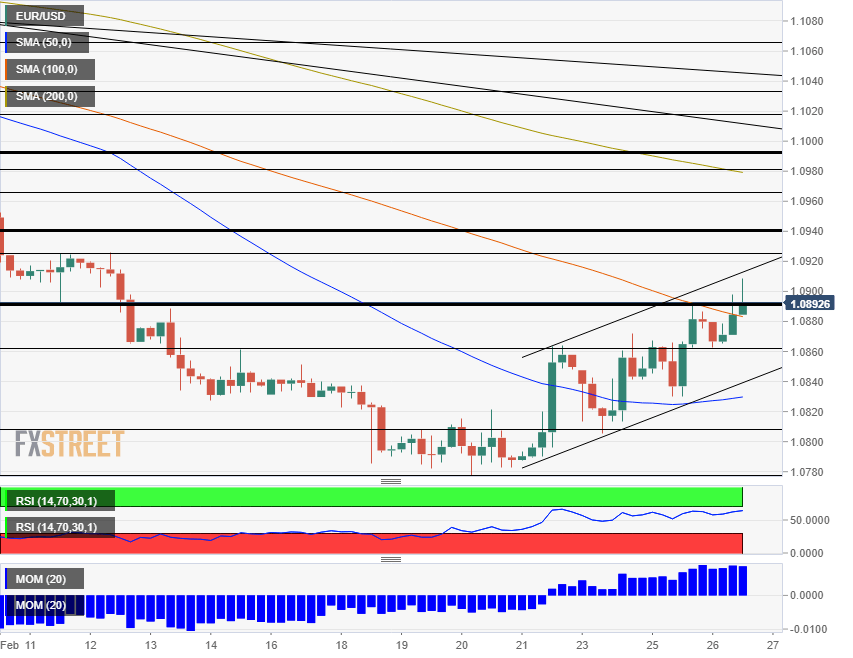

EUR/USD has recaptured the 1.09 level, completing a climb of around 130 from the 2020 low of 1.0777.

The immediate trigger is a report in Die Zeir, a German outlet, saying that authorities are planning to allow local governments to break the debt brake – thus allowing increased spending. The continent's largest economy has been generally reluctant to open its purse strings.

The US dollar is on the back foot amid falling bond yields, a result of safe-haven flows related to the coronavirus outbreak.

The euro is advancing despite the recent fears stemming from the spread of the disease in Europe. Italy has reported a total of 372 cases, France has confirmed the first death related to the illness, and Greece has joined the list of countries where coronavirus has been seen.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1100 ahead of FOMC Minutes

EUR/USD fluctuates in a tight range above 1.1100 after setting a new 2024-high earlier in the day. The mixed action seen in Wall Street helps the US Dollar hold its ground and limits the pair's upside as markets await FOMC Minutes.

GBP/USD climbs to new yearly high above 1.3050

GBP/USD regains its traction and trades at its highest level since July 2023 above 1.3050. The US Dollar struggles to build on earlier recovery gains and helps the pair hold its ground. The Federal Reserve will release the minutes of the July 30-31 policy meeting later in the day.

Gold retreats from record highs, tests $2,500

Gold retreats from the all-time-high it set above $2,530 and tests $2,500 in the American session on Wednesday. Ahead of the FOMC Minutes, the benchmark 10-year US Treasury bond yield holds steady near 3.8%, making it hard for XAU/USD to preserve its bullish momentum.

Top three AI-related tokens yielding highest gains year-to-date: AIOZ, AR, FET

The Artificial Intelligence (AI) sector in the crypto market has a few protocols whose tokens have generated significant yields for users since the beginning of 2024.

Where is the US Dollar heading after the Fed paved the way for a September cut? Premium

Financial markets have been extremely volatile in the last couple of weeks, as all of a sudden, investors realized central bank officials still have the ability to surprise them.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.