- EUR/USD weakened on Monday as European PMIs disappointed.

- Europen Central Bank’s (ECB) President, Mario Draghi, reiterates that the ECB is ready to act.

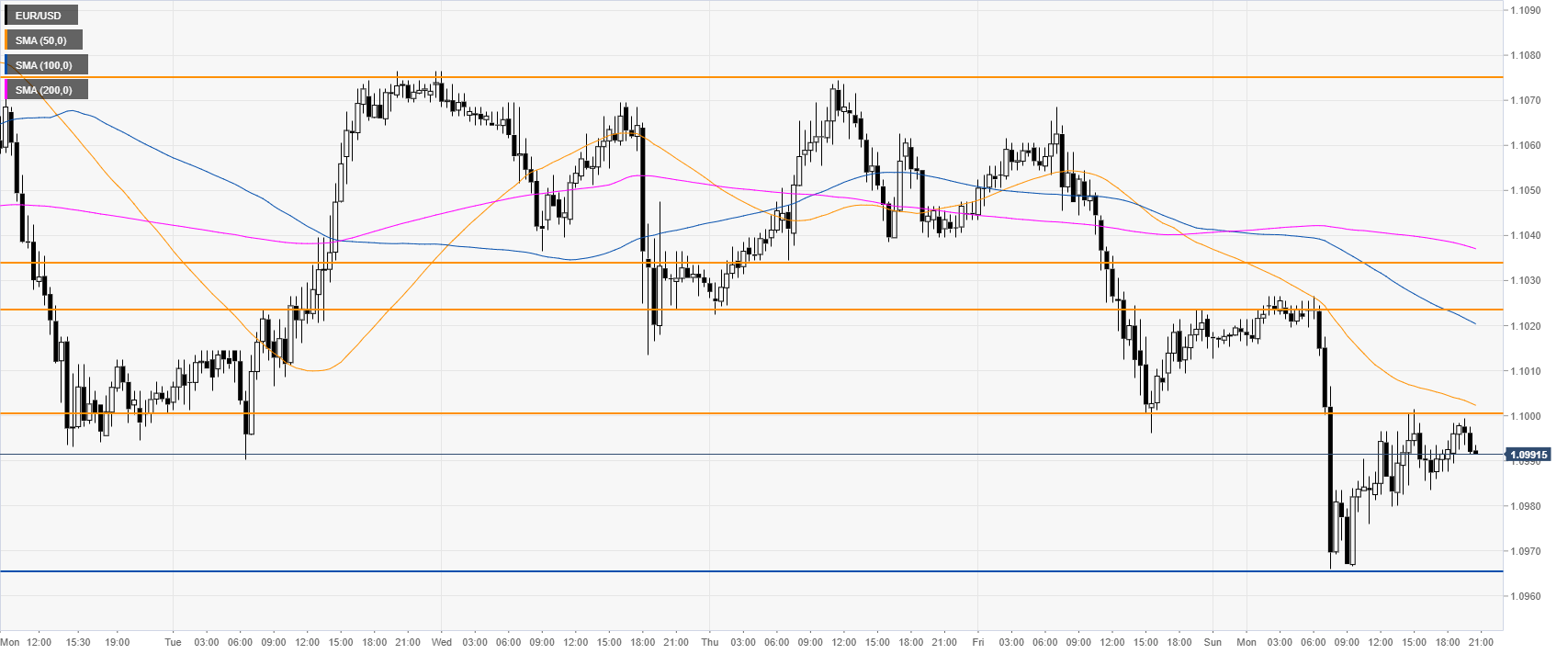

- The level to beat for bears is the 1.0965 support level.

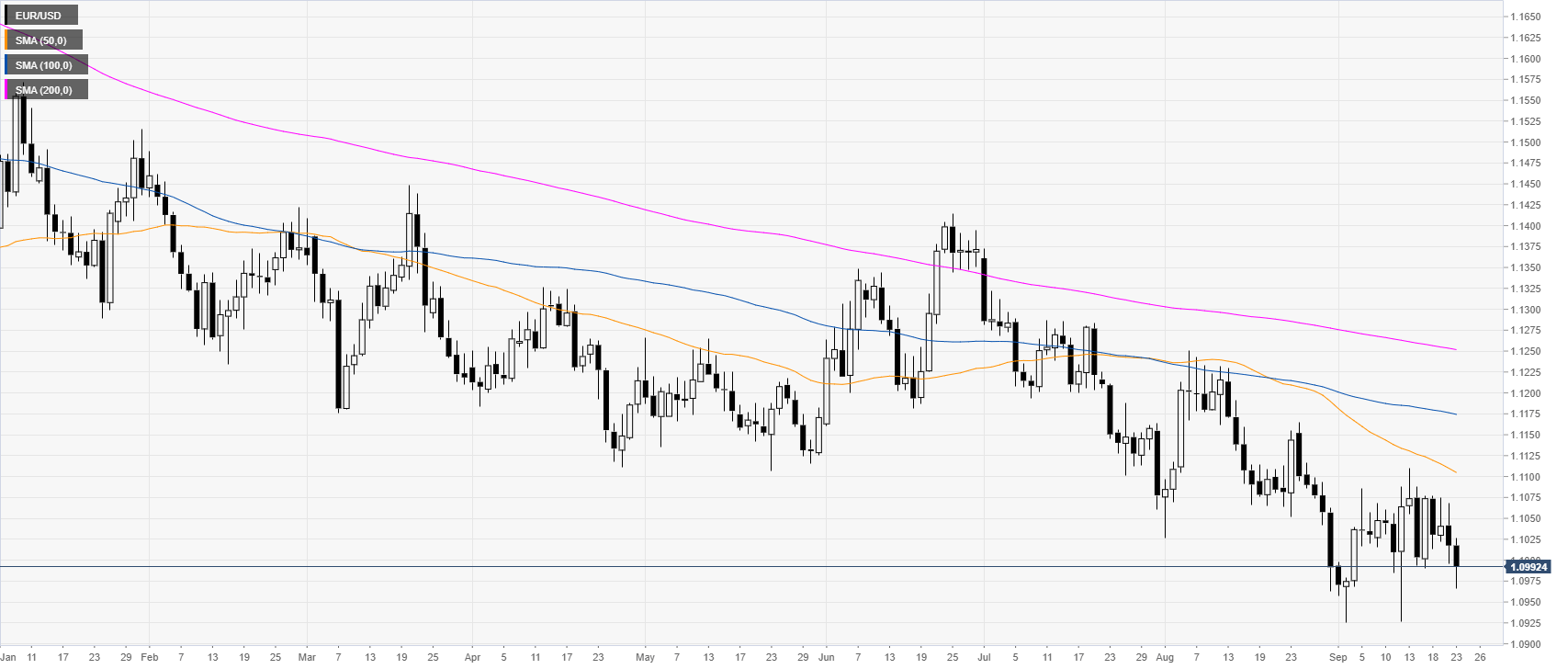

EUR/USD daily chart

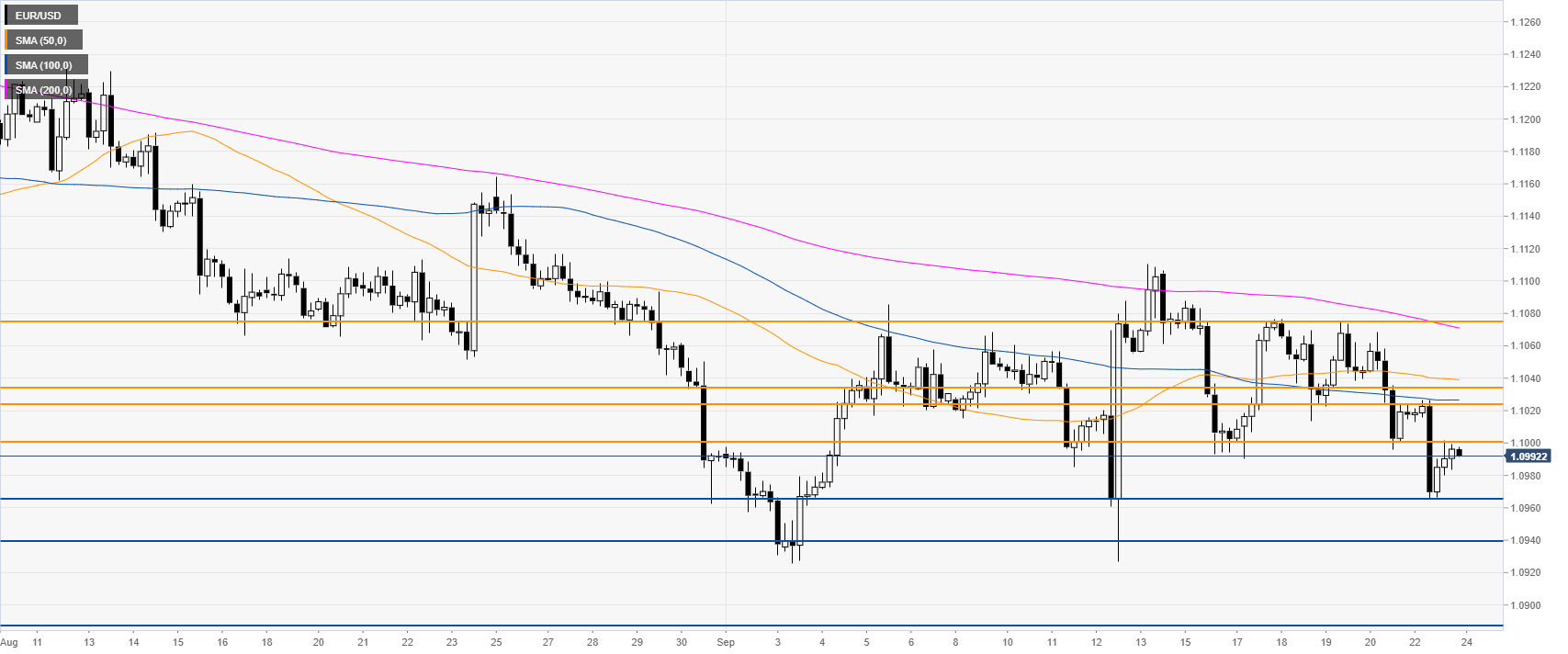

EUR/USD four-hour chart

EUR/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD extends losses to 1.0550 after ECB Negotiated Wages data

EUR/USD holds lower ground near 1.0550 in European trading on Wednesday. The US Dollar resurgence alongside the US Treasury bond yields higher weighs on the pair. Meanwhile, ECB reported Negotiated Wage Rates rose 5.42% in Q3 but this data failed to support the euro.

GBP/USD reverses toward 1.2650, erases UK CPI-led gains

GBP/USD is falling back toward 1.2650 in the European session on Wednesday, having erased UK CPI inflation-data-led gains. The data from the UK showed that the annual inflation, as measured by the change in the CPI, rose to 2.3% in October from 1.7% in September. Fedspeak awaited.

Gold price moves away from one-week top on rising US bond yields, modest USD strength

Gold price retreats after touching a one-and-half-week top earlier this Wednesday and drops to a fresh daily low, below the $2,630 level heading into the European session. A goodish pickup in the US Treasury bond yields, bolstered by bets for a less aggressive policy easing by the Fed, revives the USD demand and undermines demand for the non-yielding yellow metal.

Why is Bitcoin performing better than Ethereum? ETH lags as BTC smashes new all-time high records

Bitcoin has outperformed Ethereum in the past two years, setting new highs while the top altcoin struggles to catch up with speed. Several experts exclusively revealed to FXStreet that Ethereum needs global recognition, a stronger narrative and increased on-chain activity for the tide to shift in its favor.

Sticky UK services inflation to keep BoE cutting gradually

Services inflation is set to bounce around 5% into the winter, while headline CPI could get close to 3% in January. That reduces the chance of a rate cut in December, but in the spring, we think there is still a good chance the Bank of England will accelerate its easing cycle.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.