- The Greenback picked up some steam this Tuesday, helping EUR/USD to decline near two-day lows.

- The Brexit chaos is weighing on the market mood and the Euro.

- The key macroeconomic event of the week is the European Central Bank (ECB) interest rate decision on Thursday.

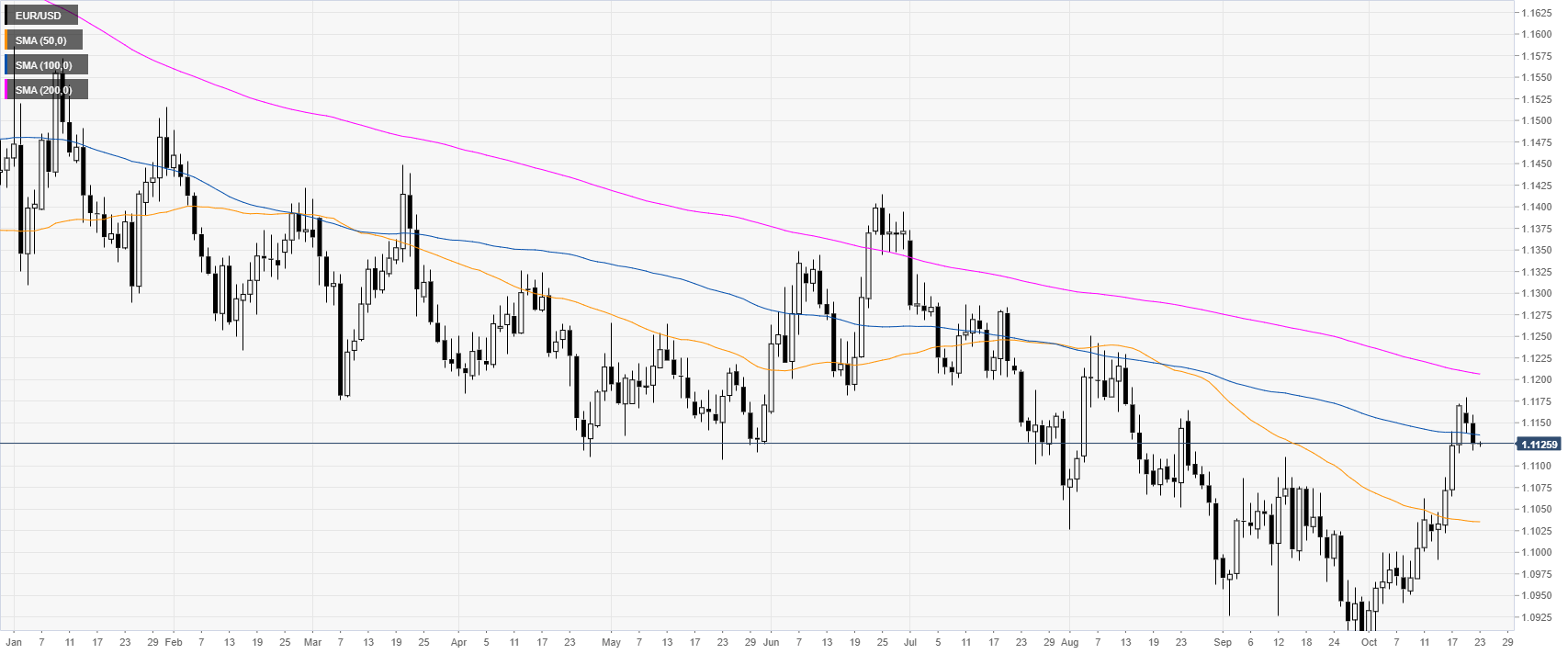

EUR/USD daily chart

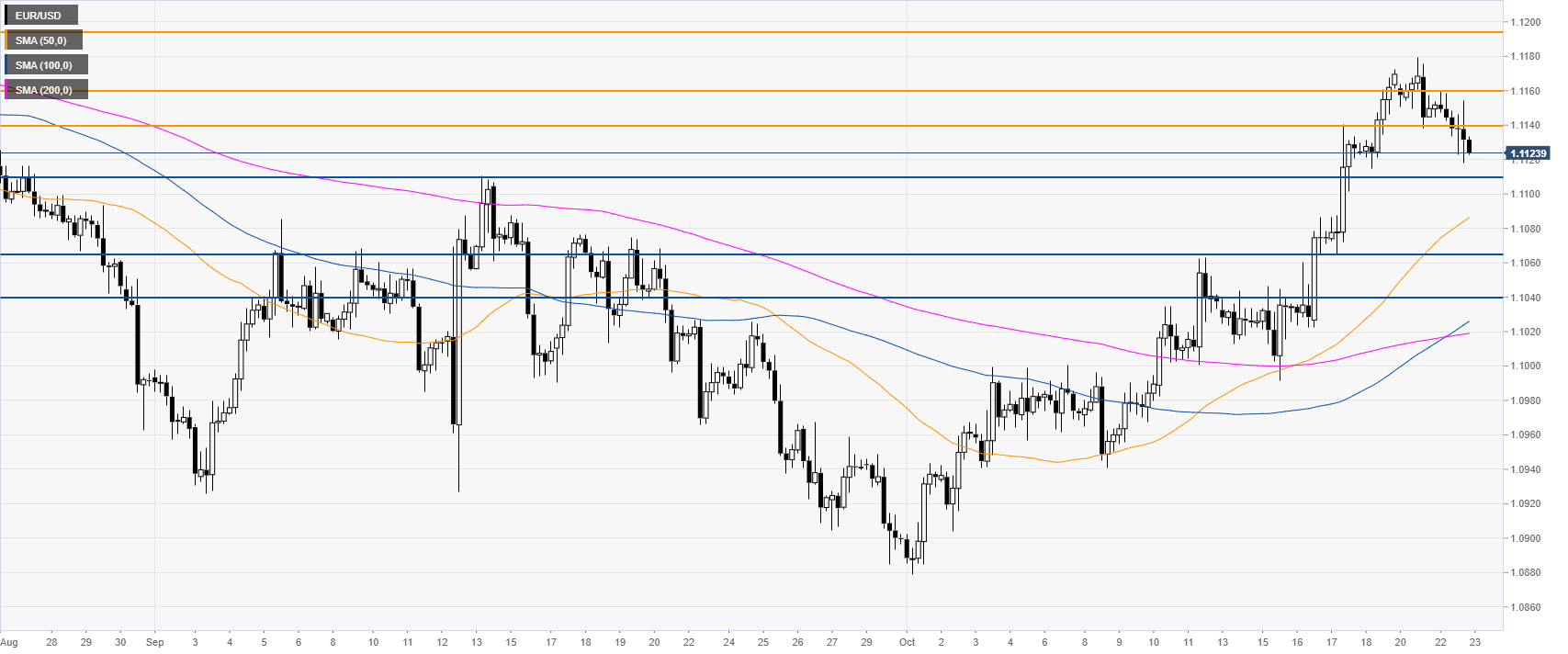

EUR/USD four-hour chart

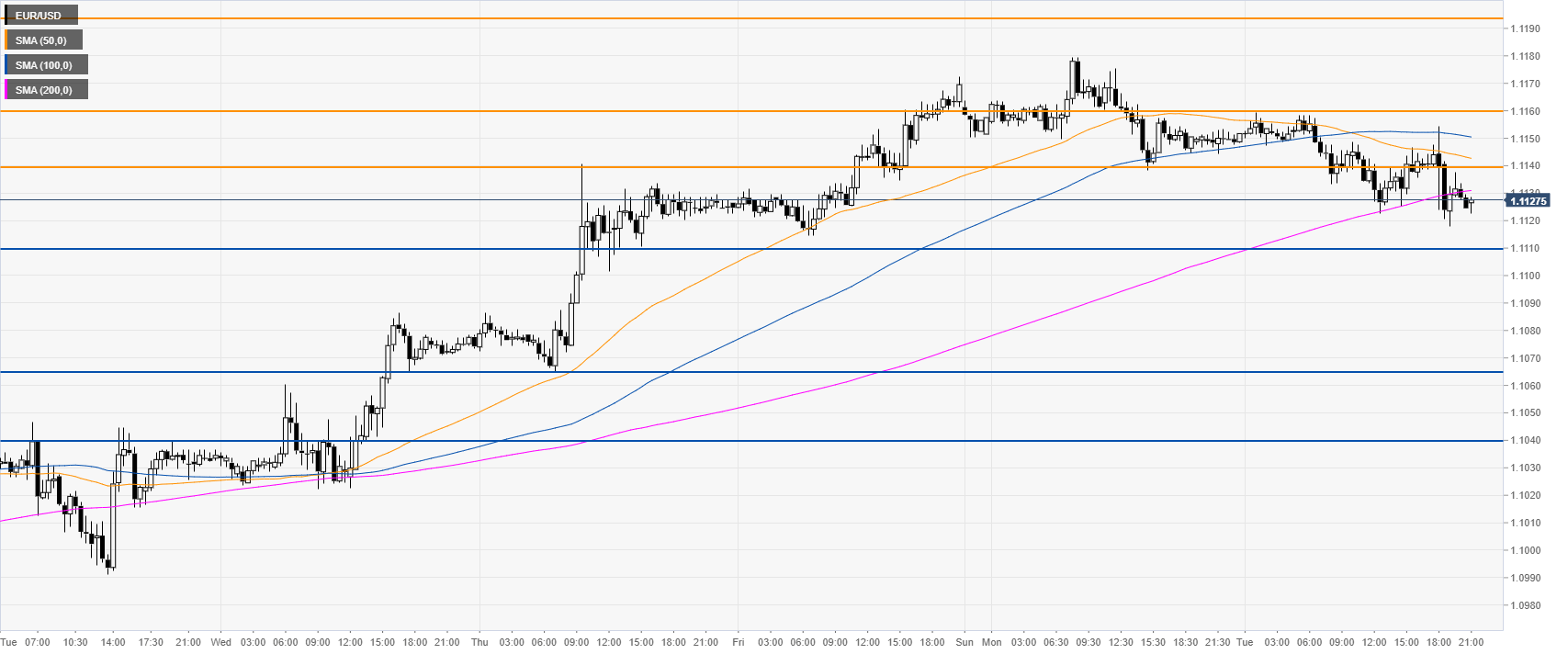

EUR/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD consolidates as traders holder their breath ahead of tariffs

EUR/USD stuck to familiar levels on Tuesday, churning chart paper close to the 1.0800 handle as investors brace for US President Donald Trump’s long-threatened “reciprocal” tariffs package, due to be announced on Wednesday at 1900 GMT.

GBP/USD flat lines above 1.2900 mark as traders await Trump’s tariffs announcement

The GBP/USD pair struggles to capitalize on the overnight bounce from the vicinity of the 1.2870 support zone, or a multi-week low touched last Thursday, and oscillates in a narrow band during the Asian session on Wednesday.

Gold price remains close to record high amid concerns over Trump’s reciprocal tariffs

Gold price regains positive traction amid concerns about Trump’s aggressive trade policies. Fed rate cut bets keep the USD bulls on the defensive and further benefiting the XAU/USD pair. A broadly stable risk sentiment might cap gains ahead of Trump’s tariffs announcement.

Bitcoin, Ethereum and Ripple brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Is the US economy headed for a recession?

Leading economists say a recession is more likely than originally expected. With new tariffs set to be launched on April 2, investors and economists are growing more concerned about an economic slowdown or recession.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.