- EUR/USD is turning bullish above its main daily simple moving averages.

- The level to beat for bulls is the 1.1420 resistance.

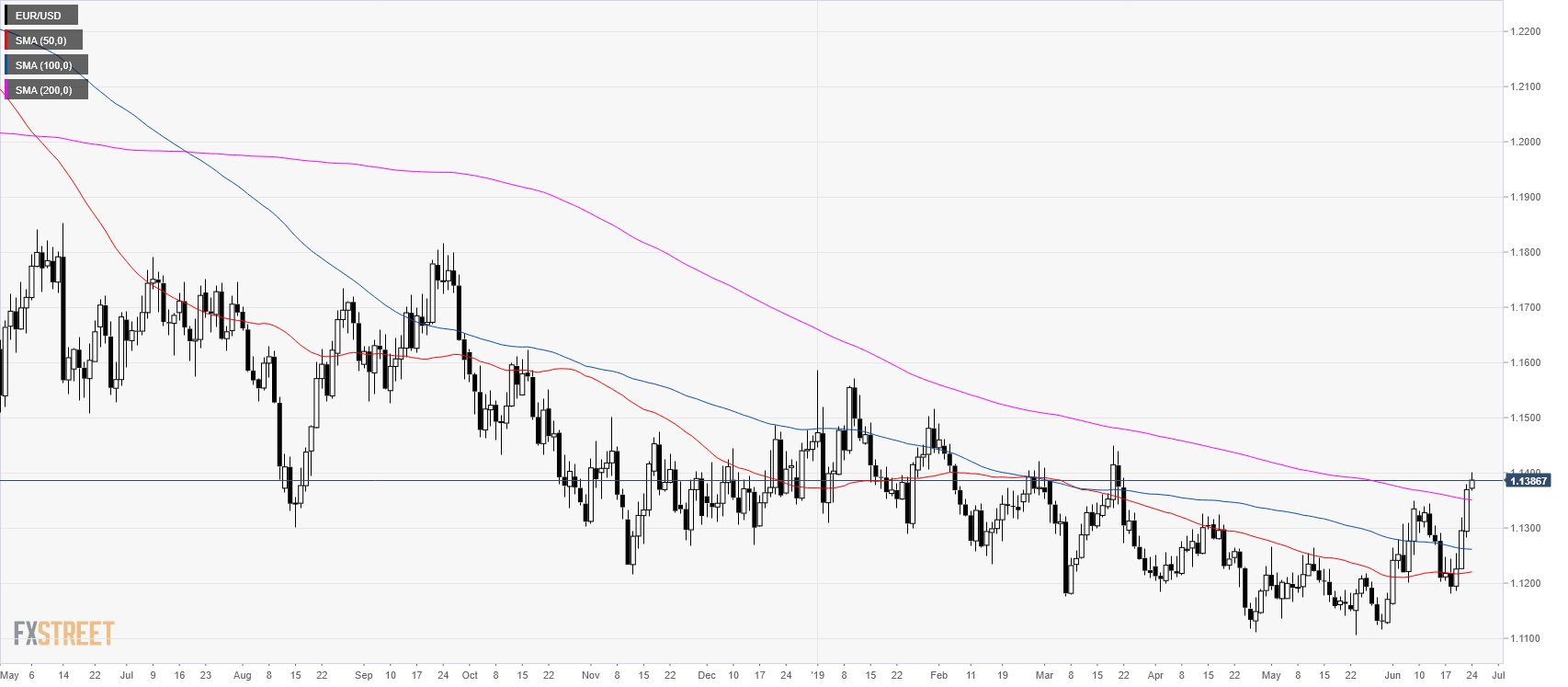

EUR/USD daily chart

EUR/USD is trading above its main daily simple moving averages suggesting that the trend is turning bullish.

EUR/USD 4-hour chart

The market is trading above its main SMAs suggesting bullish momentum. The market is finding some resistance at the 1.1400 level. The correction down can potentially extend to 1.1340 and 1.1310 support, according to the Technical Confluences Indicator.

-636969801538136623.png)

EUR/USD 30-minute chart

EUR/USD is trading above its main SMAs suggesting a bullish bias in the near term. According to the Technical Confluences Indicator, resistances are at 1.1400, 1.1420 and 1.1440 levels.

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD nears 1.1200 after US PCE inflation data

EUR/USD approaches 1.1200 following generally softer-than-anticipated US inflation-related figures. The pair lacks momentum amid tepid European data undermining demand for the Euro. Still, optimism weighs on the USD.

GBP/USD battles the 1.3400 level for a definitive bullish breakout

GBP/USD advances modestly beyond the 1.3400 level after US PCE inflation data showed price pressures continued to recede in August. Sterling Pound aims for fresh yearly highs beyond the 1.3433 peak posted earlier this week.

Gold hovers around $2,670 as US Dollar resumes decline

Gold price retains its bullish bias near fresh record highs, as demand for the US Dollar remains subdued following US PCE inflation figures. The strong momentum around stocks limits demand for the safe-haven metal.

Week ahead – NFP on tap amid bets of another bold Fed rate cut

Investors see decent chance of another 50bps cut in November. Fed speakers, ISM PMIs and NFP to shape rate cut bets. Eurozone CPI data awaited amid bets for more ECB cuts. China PMIs and BoJ Summary of Opinions also on tap.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.

-636969804049550256.png)