- EUR/USD falls to 2-year lows as the Greenback strengthens across the board.

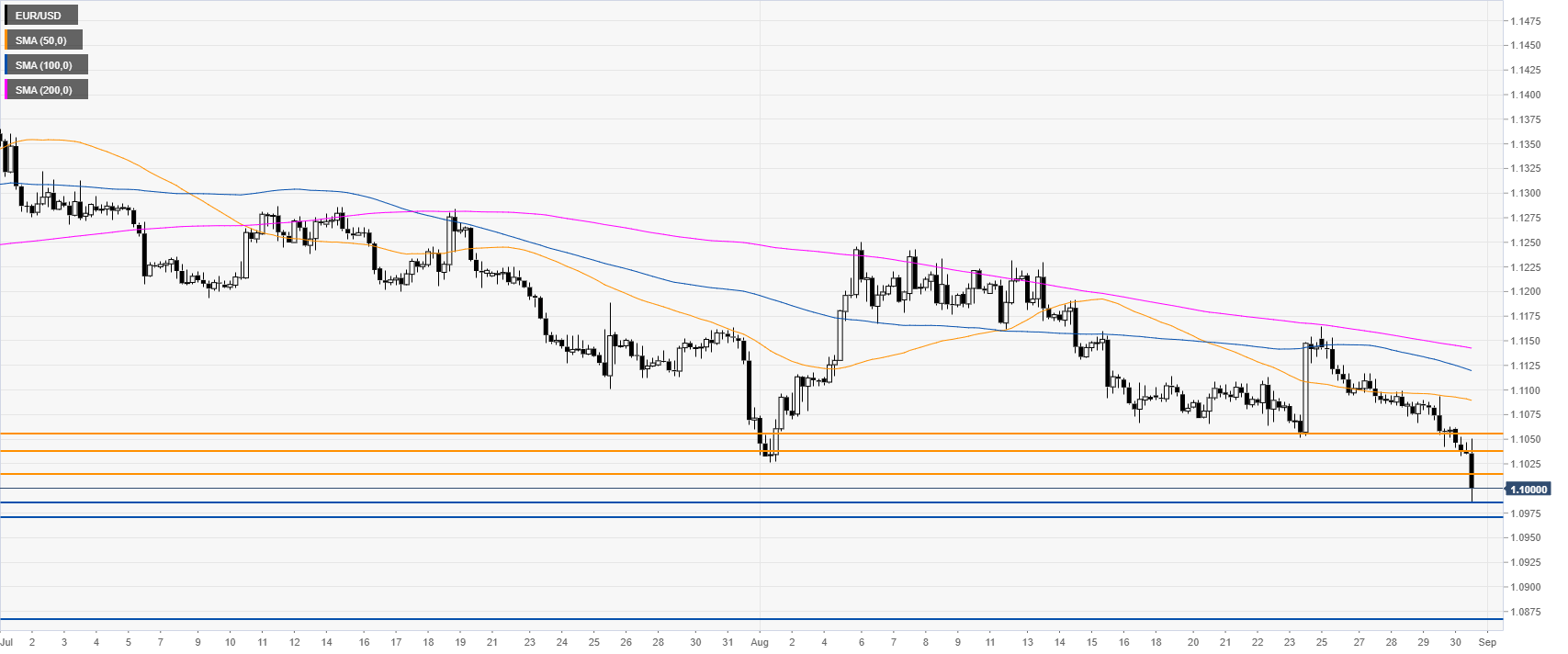

- The level to beat for bears is the 1.1016 support followed by the 1.1039 level.

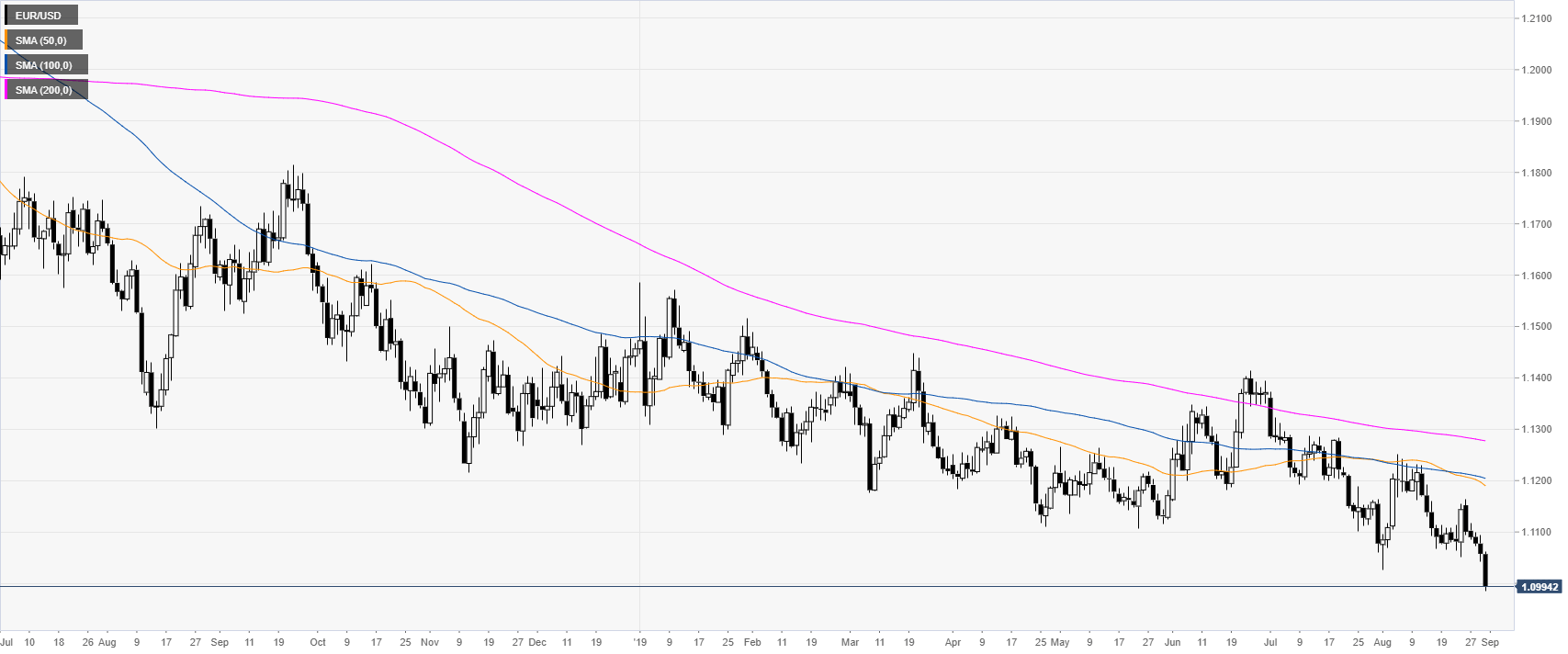

EUR/USD daily chart

EUR/USD 4-hour chart

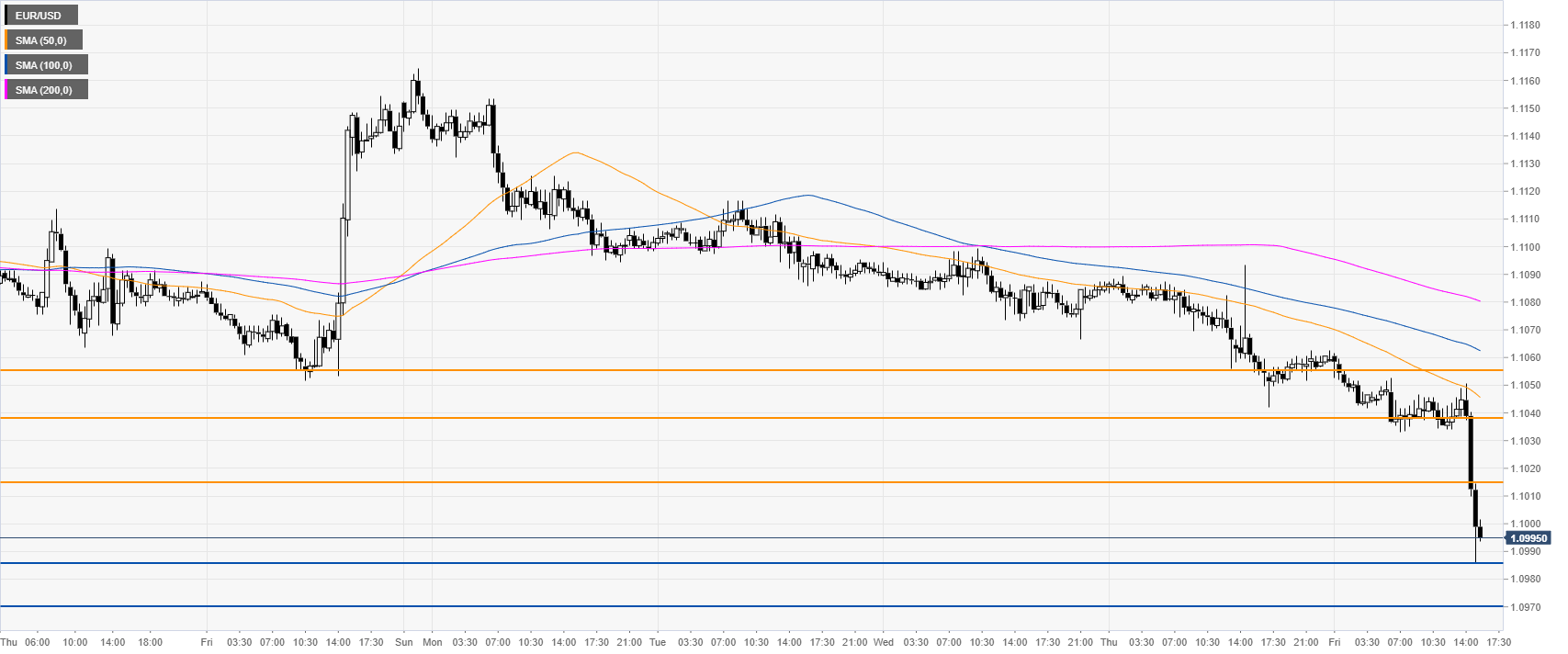

EUR/USD 30-minute chart

Additional key levels

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD rose to fresh highs around 1.1240

EUR/USD maintained its bullish momentum on Thursday, climbing to the 1.1240 region as the US Dollar accelerated its decline amid growing concerns about the economic fallout from Trump's tariffs.

GBP/USD picks up pace, challenges 1.3000

GBP/USD made significant gains, edging just pips shy of the psychological 1.3000 barrier. The advance came amid trade war jitters and a sharp sell-off in the Greenback following the announcement of 145% US tariffs on China.

Gold flirts with record peaks near $3,175, Dollar tumbles

Gold continued its record-setting rally on fresh tariff-related headlines, surging past the $3,170 mark per troy ounce after the White House confirmed new tariffs, sparking another round of US Dollar selling.

Cardano stabilizes near $0.62 after Trump’s 90-day tariff pause-led surge

Cardano stabilizes around $0.62 on Thursday after a sharp recovery the previous day, triggered by US Donald Trump’s decision to pause tariffs for 90 days except for China and other countries that had retaliated against the reciprocal tariffs announced on April 2.

Trump’s tariff pause sparks rally – What comes next?

Markets staged a dramatic reversal Wednesday, led by a 12% surge in the Nasdaq and strong gains across major indices, following President Trump’s unexpected decision to pause tariff escalation for non-retaliating trade partners.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.