EUR/USD retreats as ECB officials shift focus to revive economic growth

- EUR/USD faces pressure near 1.0600 as ECB policymakers seem more worried about the economic outlook than about controlling inflation.

- ECB’s Panetta emphasized an expansionary monetary policy stance to prevent inflation from remaining well below the bank’s target.

- Deutsche Bank sees the Fed cutting interest rates in December but expects it to be a close call.

EUR/USD faces pressure near 1.0600 and falls to near 1.0550 in Wednesday’s North American session. The major currency pair weakens as the US Dollar (USD) bounces back strongly on expectations of fewer interest rate cuts from the Federal Reserve (Fed) in its currency policy-easing cycle.

Fed’s data-dependent approach is expected to refrain from cutting interest rates aggressively as market experts project a rebound in the United States (US) inflation and see economic growth accelerating, given that President-elected Donald Trump’s victory in both houses will allow him to implement his economic agenda smoothly.

Trump vowed to raise import tariffs universally by 10% and lower taxes, a move that would not allow the Fed to go for deeper rate cuts. For the December meeting, the Fed will likely cut its borrowing rates by 25 basis points (bps) to the 4.25%-4.50% range, but the decision remains a “close call,” according to analysts at Deutsche Bank.

At the time of writing, the US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, bounces to near 106.30 from the immediate support of 106.10. The USD Index exhibited sheer volatility on Tuesday due to fresh escalation in the Russia-Ukraine war.

The Greenback gained in the European session on Tuesday as Russian President Vladimir Putin’s clearance to nuclear doctrine revision against Ukraine’s launch of long-range missiles, permitted and provided by the US on President Joe Biden’s approval, strengthened its safe-haven appeal. However, the safe-haven demand lost steam after Russian Foreign Minister Sergei Lavrov said the country would "do everything possible" to avoid the onset of nuclear war, Reuters reported.

Daily digest market movers: EUR/USD weakens despite Eurozone Q3 Negotiated Wages Rate rises sharply

- The recovery move in the EUR/USD pair has stalled due to negative sentiment towards the Eurozone due to lingering geopolitical tensions, weak economic outlook, and German political uncertainty.

- European Central Bank (ECB) officials are more concerned about preserving growth than taming price pressures, as Trump’s tariffs are expected to impact the overall output. ECB policymaker and the Governor of the Bank of Italy Fabio Panetta said in a speech at Milan's Bocconi University on Tuesday, "With inflation close to target and domestic demand stagnant, restrictive monetary conditions are no longer necessary.” Panetta added that price pressures could remain well below the bank’s target if the economy doesn’t recover.

- When asked about his outlook on interest rates, Panetta said that the central bank needs to "focus on the sluggishness of the real economy" and push key borrowing rates into "neutral, or even expansionary, territory", Reuters reported.

- Meanwhile, the ECB also warned in its semi-annual Financial Stability Review report that "economic growth remains fragile."

- In this year's last monetary policy meeting on December 12, the ECB is expected to cut its Deposit Facility Rate by 25 bps to 3%. This would be the fourth interest rate cut of the year and a third straight in a row.

- On the economic data front, Eurozone Q3 Negotiated Wage Rates data came in higher at 5.42% from 3.54% recorded in the previous quarter, downwardly revised from 3.55%. Negotiated Wage Rates data is a wage growth measure that drives consumer spending.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.42% | 0.09% | 0.70% | 0.14% | 0.45% | 0.56% | 0.25% | |

| EUR | -0.42% | -0.31% | 0.28% | -0.27% | 0.04% | 0.13% | -0.17% | |

| GBP | -0.09% | 0.31% | 0.57% | 0.04% | 0.34% | 0.45% | 0.15% | |

| JPY | -0.70% | -0.28% | -0.57% | -0.54% | -0.24% | -0.15% | -0.44% | |

| CAD | -0.14% | 0.27% | -0.04% | 0.54% | 0.31% | 0.41% | 0.09% | |

| AUD | -0.45% | -0.04% | -0.34% | 0.24% | -0.31% | 0.10% | -0.20% | |

| NZD | -0.56% | -0.13% | -0.45% | 0.15% | -0.41% | -0.10% | -0.30% | |

| CHF | -0.25% | 0.17% | -0.15% | 0.44% | -0.09% | 0.20% | 0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

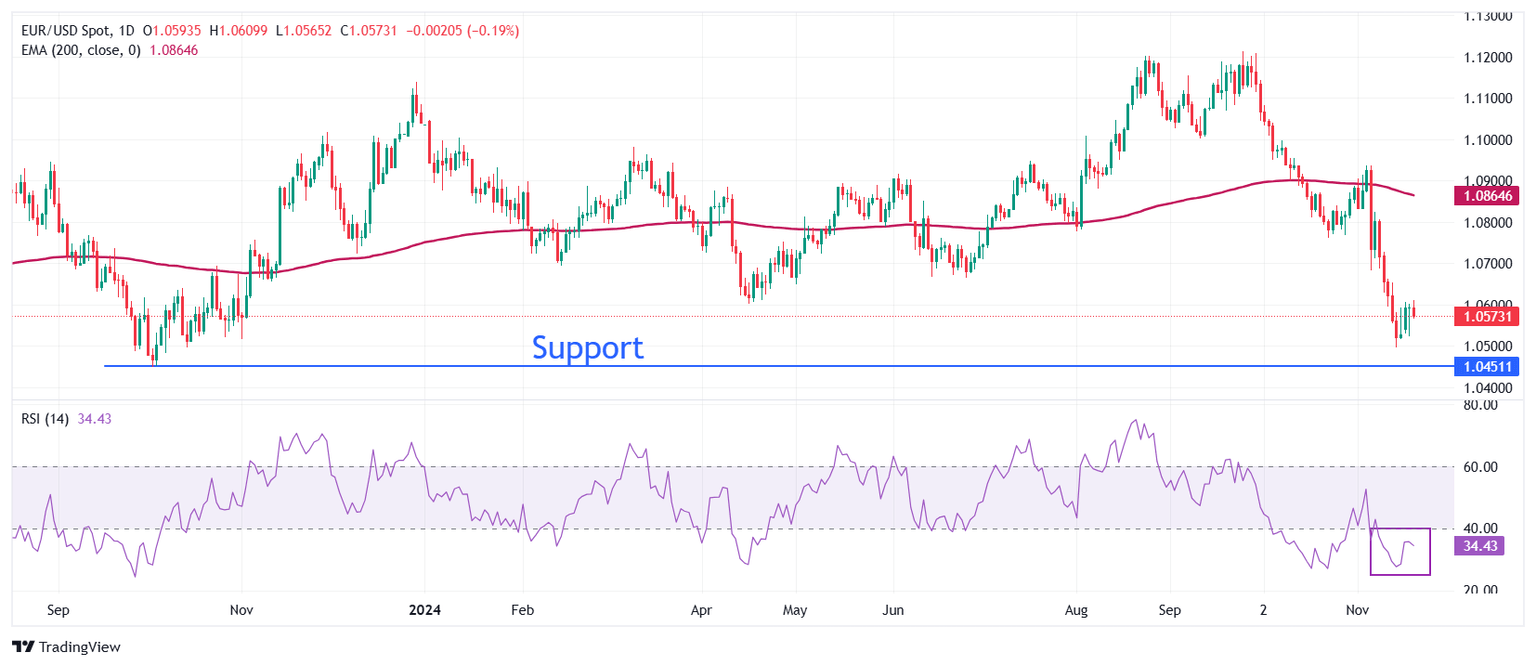

Technical Analysis: EUR/USD slides below 1.0550

EUR/USD holds the key support of 1.0500 but fails to extend recovery above 1.0600. The outlook of the major currency pair remains bearish as all short- to long-term daily Exponential Moving Averages (EMAs) are declining.

The 14-day Relative Strength Index (RSI) oscillates in the bearish range of 20.00-40.00, adding to evidence of more weakness in the near term.

Looking down, the pair is expected to find a cushion near the October 2023 low at around 1.0450. On the flip side, the round-level resistance of 1.0600 will be the key barrier for the Euro bulls.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.