EUR/USD stretching its legs, reaching towards 1.0550 for Thursday

- The EUR/USD is extending its lift after reclaiming the 1.050 level.

- ECB officials take turns talking down the possibility of rate hikes moving forward.

- Markets are rolling over to start focusing on another US NFP Friday after Thursday's data beat.

The EUR/USD is reaching higher on Thursday, making a stretch for 1.0550 heading into the end-week populated with US Non-Farm Payroll (NFP) figures. The Euro (EUR) is up a scant 0.3% from Thursday's opening bids of 1.0506 as European Central Bank (ECB) officials continue to talk down the potential for a continuation of the rate hike cycle.

US weekly Initial Jobless Claims rise to 207K vs. 210K expected

The US Dollar (USD) saw a clean beat of market expectations for Thursday, with Initial Jobless Claims printing a slight uptick to 207K from 205K, but still clearing the market forecast 210K.

All that remains for the week is US NFP figures due on Friday. Markets are forecasting a slight decline from 187K to 170K for the headline figure for September.

Read More:

ECB's Villeroy: I don't think an additional rate hike is justified

ECB de Guindos: It's premature to discuss rate cuts

ECB’s Kazimir: Believe that our last rate hike was the last

EUR/USD technical outlook

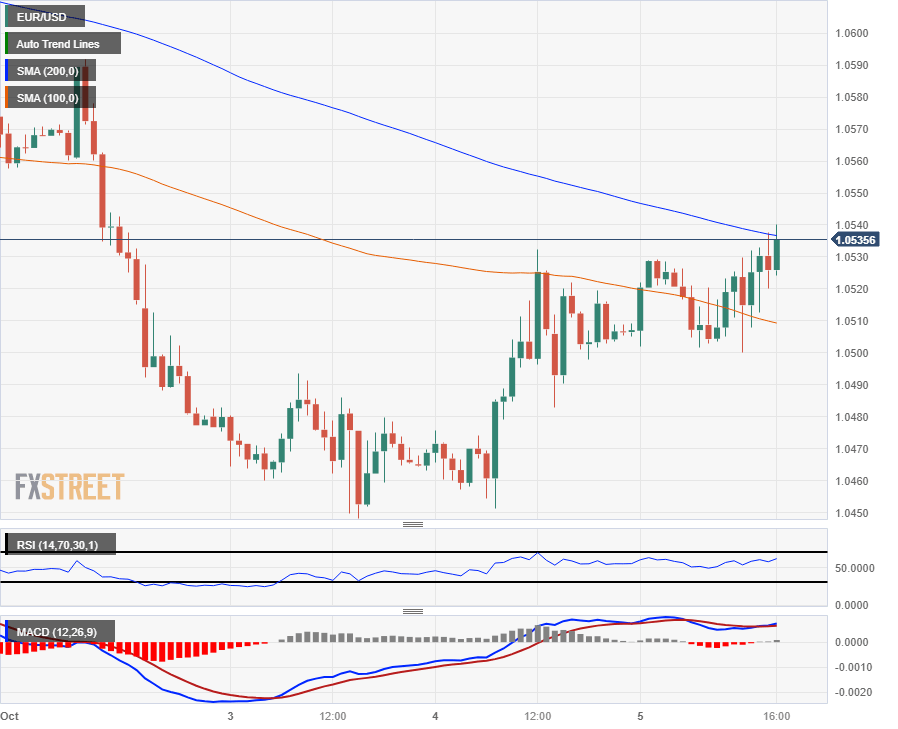

EUR/USD bids are tapping into the 200-hour Simple Moving Average (SMA) near 1.0540 as the Euro looks to extend its recent rebound against the Greenback. A consistent lower-highs pattern leaves bullish momentum firmly underpowered, and Euro bidders will need to first reclaim 1.0600 before staging a longer-term recovery.

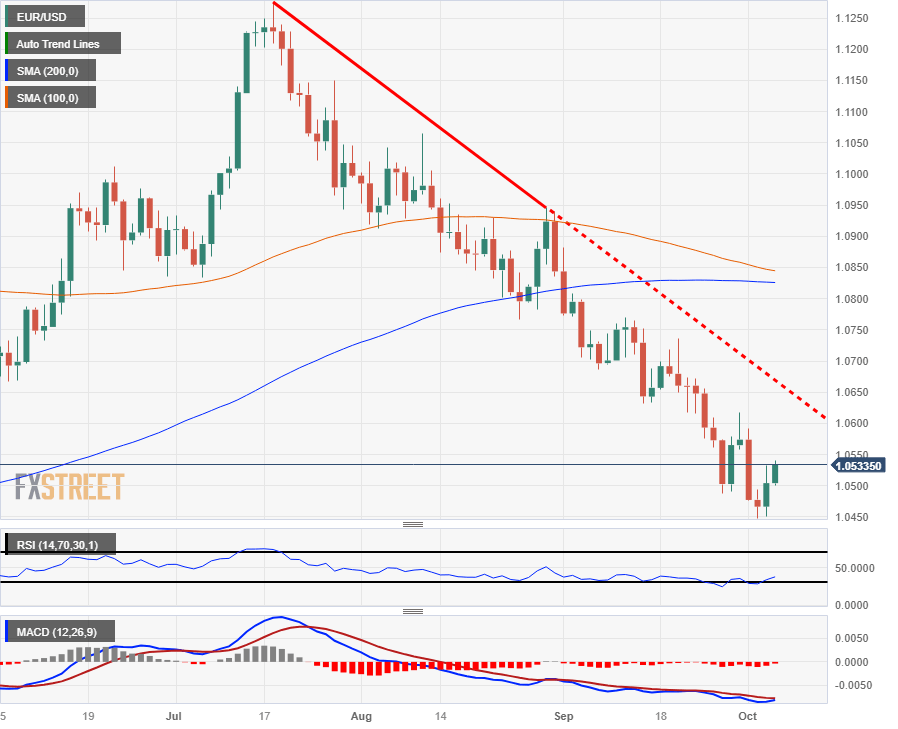

On the daily candlesticks the EUR/USD remains firmly bearish, down over 6.5% from Juily's peaks, and price action remains far below the 200-day SMA near 1.0825. Bidders will need to break and hold above a descending trendline from 1.1275, and a downside slip will see new eleven-month lows below 1.0448.

EUR/USD hourly chart

EUR/USD daily chart

EUR/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.