- EUR/USD extends the recovery to 1.0940 on Thursday.

- German Consumer Climate deteriorated markedly in April.

- US Q4 GDP, Trade Balance, Claims next on the calendar.

EUR/USD is extending the weekly recovery to levels well above the 1.0900 mark in the second half of the week.

EUR/USD remains bid on USD-weakness

EUR/USD is prolonging the upside momentum for the fifth consecutive session on Thursday, always against the backdrop of the persistent selling pressure around the greenback. On the latter, it is worth mentioning that the US Dollar Index (DXY) is already shedding around 2.5% from recent tops near the 103.00 mark to the current 100.40 region.

The pair has regained momentum after the US Senate approved (96-0) a historic $2 trillion aid package to fight the fallout of the coronavirus in the US economy. The bill is now moving to the House of Representative to be voted on Friday. This stimulus package adds to Monday’s extra stimulus delivered by the Federal Reserve in the form of open-ended purchases of Treasuries and MBS, among other measures.

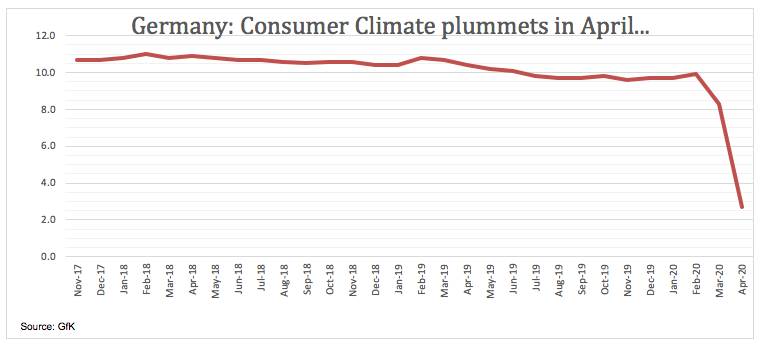

Data wise in Euroland, the German Consumer Climate tracked by GfK deteriorated sharply for the month pf April, falling to 2.7 from March’s 8.3 (revised from 9.8).

Still in the docket and later in the NA session, all the attention will be on the weekly release of Initial Claims, relegating advanced Trade Balance results and another estimate of the Q4 GDP to a secondary role.

What to look for around EUR

EUR/USD keeps the ‘recovery-mode’ well in place in the second half of the week, always following USD-dynamics, developments from the coronavirus and the response from overseas central banks and governments. On the latter, the Fed’s latest round of stimulus plus the US $2 trillion coronavirus aid package have been collaborating further with the rebound in the pair via a weaker dollar. On the macro view, better-than-forecasted PMIs in both Germany and the broader Euroland opened the door to some respite in the prevailing downtrend in fundamentals in the region, although the underlying stance still remains well on the negative side.

EUR/USD levels to watch

At the moment, the pair is gaining 0.52% at 1.0940 and a breakout of 1.0992 (monthly low Jan.29) would target 1.1008 (55-day SMA) en route to 1.1082 (200-day SMA). On the downside, the next support lines up at 1.0814 (78.6% Fibo of the 2017-2018 rally) followed by 1.0635 (2020 low Mar.23) and finally 1.0569 (monthly low Apr.10 2017).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: The hunt for the 0.7000 hurdle

AUD/USD quickly left behind Wednesday’s strong pullback and rose markedly past the 0.6900 barrier on Thursday, boosted by news of fresh stimulus in China as well as renewed weakness in the US Dollar.

EUR/USD refocuses its attention to 1.1200 and above

Rising appetite for the risk-associated assets, the offered stance in the Greenback and Chinese stimulus all contributed to the resurgence of the upside momentum in EUR/USD, which managed to retest the 1.1190 zone on Thursday.

Gold holding at higher ground at around $2,670

Gold breaks to new high of $2,673 on Thursday. Falling interest rates globally, intensifying geopolitical conflicts and heightened Fed easing bets are the main factors.

Bitcoin displays bullish signals amid supportive macroeconomic developments and growing institutional demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

RBA widely expected to keep key interest rate unchanged amid persisting price pressures

The Reserve Bank of Australia is likely to continue bucking the trend adopted by major central banks of the dovish policy pivot, opting to maintain the policy for the seventh consecutive meeting on Tuesday.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.