- EUR/USD extends the move further north of 1.0900.

- The better tone in the risk complex helps the upside in spot.

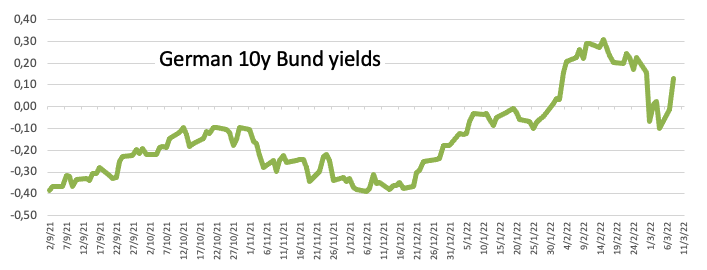

- Yields in the German 10y Bund trade close to monthly peaks.

The upbeat mood in the risk-associated space motivates EUR/USD to push further north of the 1.0900 barrier on Wednesday.

EUR/USD keeps the attention on the Russia-Ukraine dispute

EUR/USD adds to Tuesday’s gains and looks to consolidate the recent breakout of 1.0900 the figure amidst the continuation of the offered bias in the dollar and the somewhat diminishing demand for safe havens.

The upside in the pair also remains propped up by the moderate rebound in yields of the German 10y Bund to new monthly highs near the 0.15% area, all against the backdrop of the generalized bounce in yields in the global cash markets.

In the meantime, market participants continue to closely follow the geopolitical landscape and the upcoming meeting between Russian and Ukraine officials, expected anytime soon.

Absent data releases in the euro area and minor publications in the NA session should leave all the attention to the upcoming ECB event and US inflation figures, both due on Thursday.

What to look for around EUR

EUR/USD managed well to regain upside momentum and reclaim the area above the 1.0900 barrier. The European currency is expected to remain under heavy pressure for as long as the Russia-Ukraine conflict lasts along with the persistent risk aversion, altogether bolstering the “flight-to-safety” environment. In the longer run, occasional strength in the pair should remain underpinned by speculation of a potential interest rate hike by the ECB probably sooner than many anticipate, higher German yields, persevering elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region.

Key events in the euro area this week: ECB interest rate decision (Thursday) – Germany Final CPI.

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Presidential elections in France in April. Geopolitical concerns from the Russia-Ukraine conflict.

EUR/USD levels to watch

So far, spot is gaining 0.27% at 1.0925 and faces the next up barrier at 1.1058 (10-day SMA) followed by 1.1286 (55-day SMA) and finally 1.1395 (weekly high Feb.16). On the other hand, a drop below 1.0805 (2022 low Mar.7) would target 1.0766 (monthly low May 7 2020) en route to 1.0727 (monthly low Apr. 24 2020).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY remains below 158.00 after Japanese data

Soft US Dollar demand helps the Japanese Yen to trim part of its recent losses, with USD/JPY changing hands around 157.70. Higher than anticipated Tokyo inflation passed unnoticed.

AUD/USD weakens to near 0.6200 amid thin trading

The AUD/USD pair remains on the defensive around 0.6215 during the early Asian session on Friday. The incoming Donald Trump administration is expected to boost growth and lift inflation, supporting the US Dollar (USD). The markets are likely to be quiet ahead of next week’s New Year holiday.

Gold hovers around $2,630 in thin trading

The US Dollar returns from the Christmas holidays with a soft tone, although market action seems contained. The positive tone of Asian shares weighs on the Greenback.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

2025 outlook: What is next for developed economies and currencies?

As the door closes in 2024, and while the year feels like it has passed in the blink of an eye, a lot has happened. If I had to summarise it all in four words, it would be: ‘a year of surprises’.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.