EUR/USD soars as US CPI comes in below expectations

- EUR/USD soars on the back of the sentiment for a Fed pivot following soft US Consumer Price Index (CPI).

- US CPI came in below expectations and sent risk assets higher, US Dollar lower.

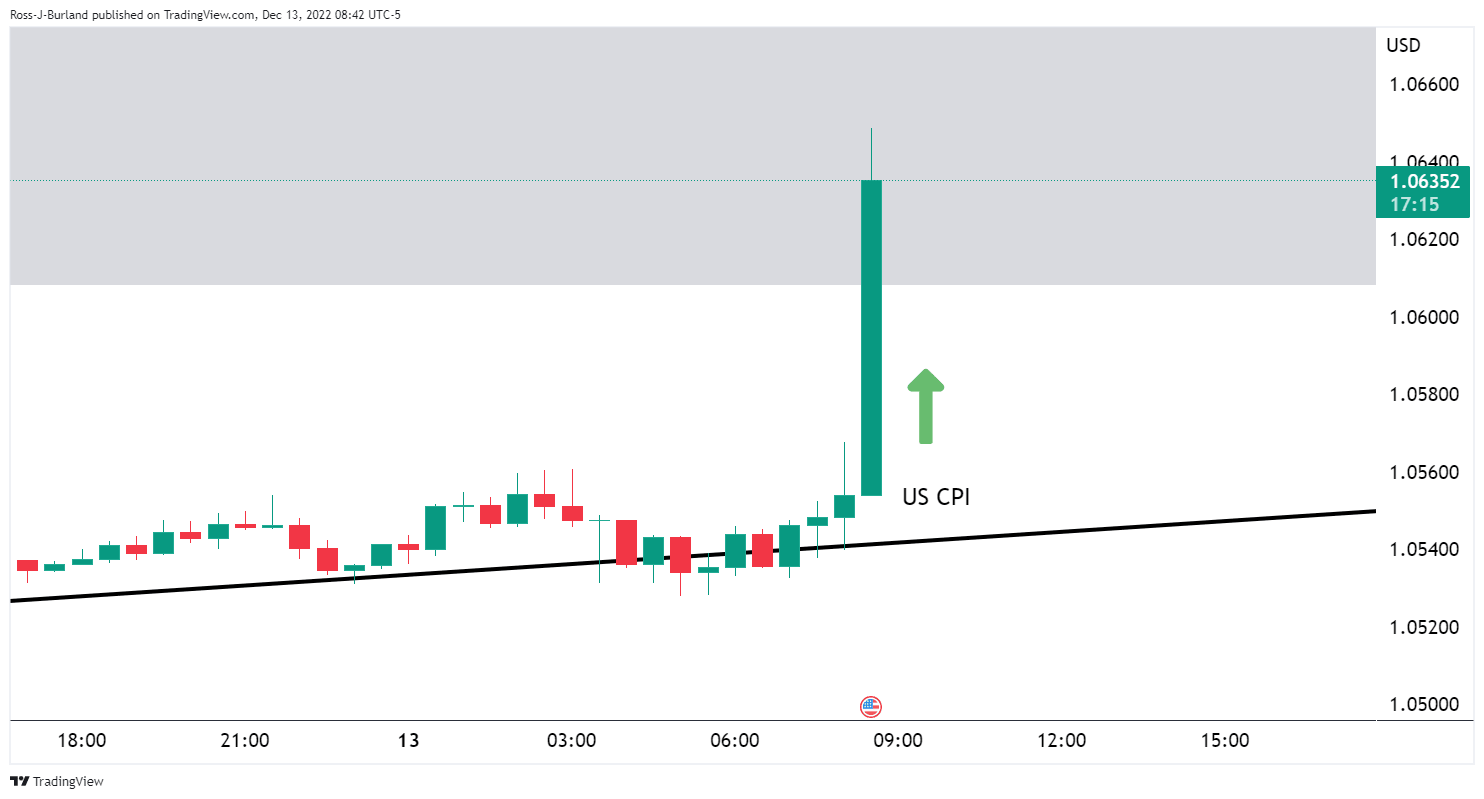

EUR/USD has rallied heavily as the US Consumer Price Index has come in below expectations, leaving the door wide open for a pivot from the Federal Reserve that meets this week to decide on its monetary policy path. At the time of writing, EUR/USD is up on the day by over 1%, with the bulk of its gains coming in a knee-jerk reaction to the US inflation data as illustrated below.

The Euro reached a high of 1.0648 from 1.0555 off the bat vs. the US Dollar when US CPI printed as follows:

- US CPI MoM Nov: 0.1% (est 0.3%, prev 0.4%).

- US CPI Ex Food And Energy M/M Nov: 0.2% (est 0.3%, prev 0.3%).

- US CPI YoY Nov: 7.1% (est 7.3%, prev 7.7%).

- US CPI Ex Food And Energy Y/Y Nov: 6.0% (est 6.1%, prev 6.3%).

As a consequence of the data, the terminal Fed rate is now down to 4.86% vs 4.98% prior to the report which is weighing heavily on the US Dollar and US Treasury yields. DXY, an index that measures the US dollar vs. a basket of currencies fell to a low of 103.923 having been as high as 105.095 on the day as investors give a sigh of relief with the US benchmarks rallying - The Nasdaq jumped over 500 points.

EUR/USD technical analysis

(EUR/USD 30 min chart, above)

In the above daily chart, the market is on the front side of the bullish trend and there is every possibility that the price will continue higher into the in-the-money shorts towards 1.0800/50 in the days or weeks ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.