EUR/USD falls further as ECB looks set to cut interest rates

- EUR/USD remains below 1.1050 as investors turn cautious ahead of the US inflation for August and the ECB policy announcement.

- The ECB is expected to cut its key borrowing rates by 25 basis points (bps).

- US inflation data will influence market speculation for the Fed’s potential interest rate cut size.

EUR/USD struggles to gain ground near its weekly low of 1.1030 in Tuesday’s New York session. The major currency pair remains under pressure as investors turn cautious ahead of the United States (US) Consumer Price Index (CPI) data for August, which will be published on Wednesday.

Investors will keenly focus on the US consumer inflation data as it is just a week before the Federal Reserve’s (Fed) monetary policy meeting. The inflation data will provide fresh cues about whether the Fed will start its policy-easing process gradually or aggressively. The importance of the inflation data in getting more insights about the magnitude of the Fed interest rate cut has increased significantly as the US Nonfarm Payrolls (NFP) data for August failed to make a clear case for the Fed’s likely interest rate cut size.

Earlier, market participants remained worried that the Fed could opt for a large interest rate cut in September due to a sharp slowdown in the US job growth, indicated by the US NFP report for July, which prompted fears for the economy entering a recession. However, Friday’s NFP report showed that the labor market health is not as bad as it appeared last month.

Economists expect the annual headline CPI to have grown at a slower pace of 2.6%, the lowest since March 2021, from July’s reading of 2.9%. The core inflation – which excludes volatile food and energy prices – is expected to have risen steadily by 3.2%. Both monthly headline and core inflation are projected to have increased by 0.2%.

Later this week, investors will focus on the US Producer Price Index (PPI) data for August, which will be published on Thursday.

Daily digest market movers: EUR/USD declines as US Dollar extends upside

- EUR/USD trades cautiously as the Euro (EUR) exhibits a subdued performance on Tuesday, with investors focusing on the European Central Bank’s interest rate policy, which will be announced on Thursday. The ECB is widely anticipated to cut interest rates by 25 basis points (bps) on Thursday. This will be the second interest rate cut decision by the ECB in its current policy-easing cycle, which the bank started in June but left borrowing rates unchanged in July.

- Though investors seem confident about the ECB resuming its policy-easing process, market participants will majorly focus on the monetary policy statement and ECB President Christine Lagarde’s press conference to get cues about the likely policy action for the remainder of the year.

- Lagarde is expected to deliver a dovish interest rate guidance as the annual Harmonized Index of Consumer Prices (HICP) of the Eurozone’s largest nation, Germany, has returned to the bank’s target of 2% in August. Also, German economic growth is vulnerable due to the poor demand environment. The scenario of declining inflation and worsening economic conditions paves the way for an expansionary monetary policy stance.

- Currently, financial market participants expect that the ECB will cut interest rates one more time in the last quarter of this year.

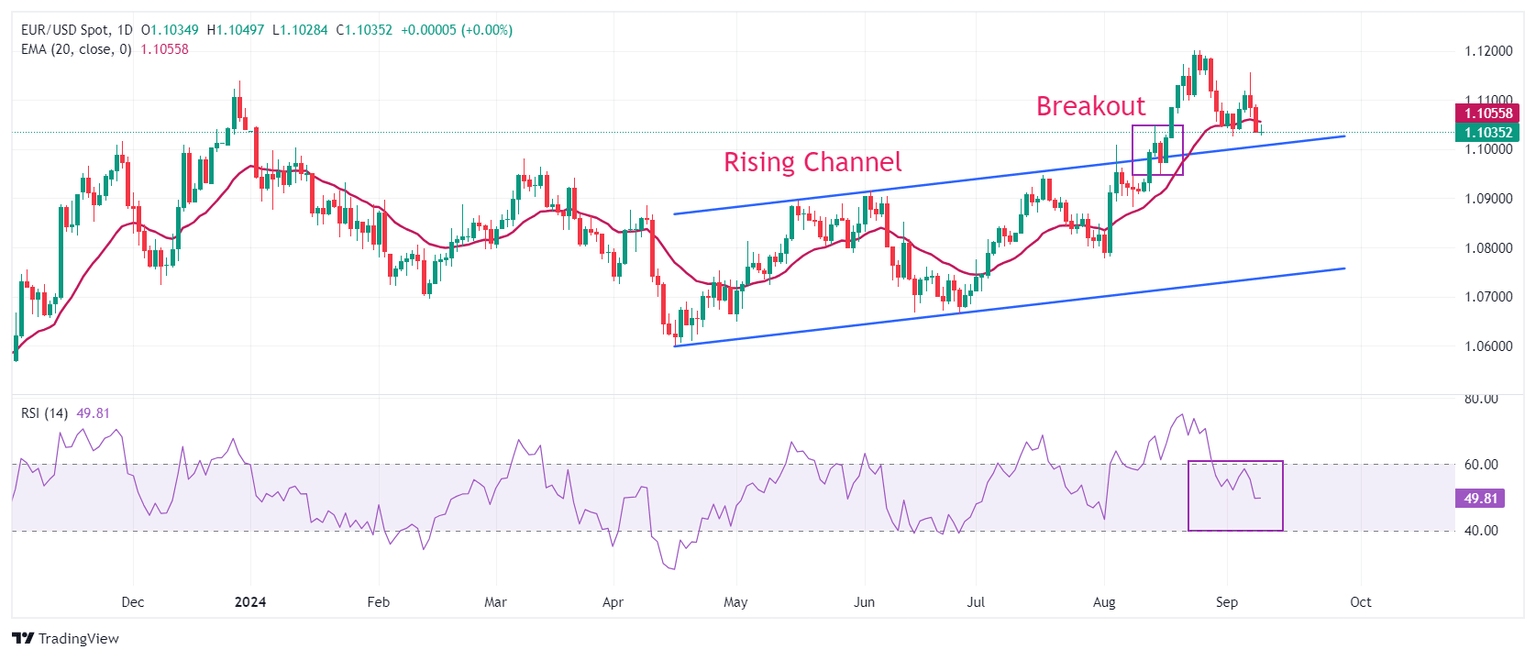

Technical Analysis: EUR/USD sees temporary cushion near 1.1000

EUR/USD stays below 1.1050 in Tuesday’s North American trading hours. The major currency pair has come under pressure after failing to sustain above the crucial resistance of 1.1100. The near-term outlook of the shared currency pair is uncertain as it continues to trade below the 20-day Exponential Moving Average (EMA), which trades around 1.1060.

The 14-day Relative Strength Index (RSI) falls further to 50.00, suggesting a lack of momentum and a sideways trend.

The pair is expected to find support near the psychological level of 1.1000. On the upside, last week’s high of 1.1155 and the round-level resistance of 1.1200 will act as major barricades for the Euro bulls.

Economic Indicator

Consumer Price Index ex Food & Energy (YoY)

Inflationary or deflationary tendencies are measured by periodically summing the prices of a basket of representative goods and services and presenting the data as the Consumer Price Index (CPI). CPI data is compiled on a monthly basis and released by the US Department of Labor Statistics. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The CPI Ex Food & Energy excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures. Generally speaking, a high reading is bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Sep 11, 2024 12:30

Frequency: Monthly

Consensus: 3.2%

Previous: 3.2%

Source: US Bureau of Labor Statistics

The US Federal Reserve has a dual mandate of maintaining price stability and maximum employment. According to such mandate, inflation should be at around 2% YoY and has become the weakest pillar of the central bank’s directive ever since the world suffered a pandemic, which extends to these days. Price pressures keep rising amid supply-chain issues and bottlenecks, with the Consumer Price Index (CPI) hanging at multi-decade highs. The Fed has already taken measures to tame inflation and is expected to maintain an aggressive stance in the foreseeable future.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.