EUR/USD rises as US Dollar falls back ahead of Eurozone/US heavy-data week

- EUR/USD moves higher as investors focus on a slew of economic data from both the US and the Eurozone.

- The German economy is expected to have contracted by 0.3% in the third quarter on an annual basis, while the Eurozone as a whole is seen growing by 0.8% YoY.

- Risk-aversion could stay afloat amid uncertainty over the US presidential election.

EUR/USD rises slightly above 1.0800 in North American trading hours on Monday. The major currency pair broadly remains sideways ahead of a data-packed week in which traders will get economic growth and inflation data for both the United States (US) and the Eurozone, two key metrics that usually determine the path of interest rates, a crucial driver for currencies.

In the Eurozone, investors are likely to pay closer attention to the economic growth data because inflation is expected to remain near the European Central Bank’s (ECB) target of 2%. Economists expect the Eurozone economy to have grown by 0.8% on year, higher than the 0.6% expansion seen in the second quarter. When compared with 2Q 2024, economists expect the Eurozone to have grown by 0.2% in Q3, the same pace as the previous quarter.

A major contribution to the Eurozone economy is expected to have come from Spain and other economies as the economy of its largest nation, Germany, is forecasted to have declined by 0.3% in Q3 compared with the same quarter a year earlier.

At the sidelines of the International Monetary Fund (IMF) meeting last week, ECB policymaker and President of the Deutsche Bundesbank Joachim Nagel emphasized the need to implement the growth package, which has already been announced by the German government, to prevent the economy from getting worse.

"This would make an important contribution to strengthening the forces of growth. But anything that could go beyond that in 2025 would certainly be welcome from the central bank point of view," Nagel said, Reuters reported.

On the interest rate outlook, Nagel said: “We shouldn’t be too hasty,” adding that the decision in December will be based on a slew of indicators such as the US presidential election outcome and inflation data. His comments came after a few ECB officials had supported a larger-than-usual 50-basis points (bps) interest rate cut in December.

Daily digest market movers: EUR/USD gains as US Dollar retreats

- EUR/USD gains in Monday’s North American session as the US Dollar retreats after revisiting an almost three-month high. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, falls back from 104.60. However, the outlook of the US Dollar remains firm as investors are expected to stay risk-averse with the United States (US) presidential election just a week away.

- Central bankers, in various discussion panels at the sidelines of the IMF meeting last week, discussed possible consequences of former US President Donald Trump winning against current Vice President Kamala Harris. Traders seem to be taking this scenario as a positive for the US Dollar as Trump vowed to hike tariffs by 10% on all economies, except for China, which would face even higher tariffs of 60%.

- Apart from the uncertainty over the US election, the US Dollar will also be guided by a string of US data to be published this week. Market participants will mainly focus on the JOLTS Job Openings and the Nonfarm Payrolls (NFP) data to get cues about job demand, and the Q3 GDP data for the current status of economic health.

US Dollar PRICE Today

The table below shows the percentage change of the US Dollar (USD) against listed major currencies today. The US Dollar was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.24% | -0.19% | -0.15% | 0.03% | 0.06% | -0.12% | -0.31% | |

| EUR | 0.24% | 0.17% | 0.00% | 0.27% | 0.38% | 0.11% | -0.04% | |

| GBP | 0.19% | -0.17% | 0.68% | 0.22% | 0.27% | 0.00% | 0.03% | |

| JPY | 0.15% | 0.00% | -0.68% | 0.27% | -0.40% | -0.71% | -0.62% | |

| CAD | -0.03% | -0.27% | -0.22% | -0.27% | -0.01% | -0.23% | -0.31% | |

| AUD | -0.06% | -0.38% | -0.27% | 0.40% | 0.01% | -0.30% | -0.43% | |

| NZD | 0.12% | -0.11% | -0.01% | 0.71% | 0.23% | 0.30% | -0.19% | |

| CHF | 0.31% | 0.04% | -0.03% | 0.62% | 0.31% | 0.43% | 0.19% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

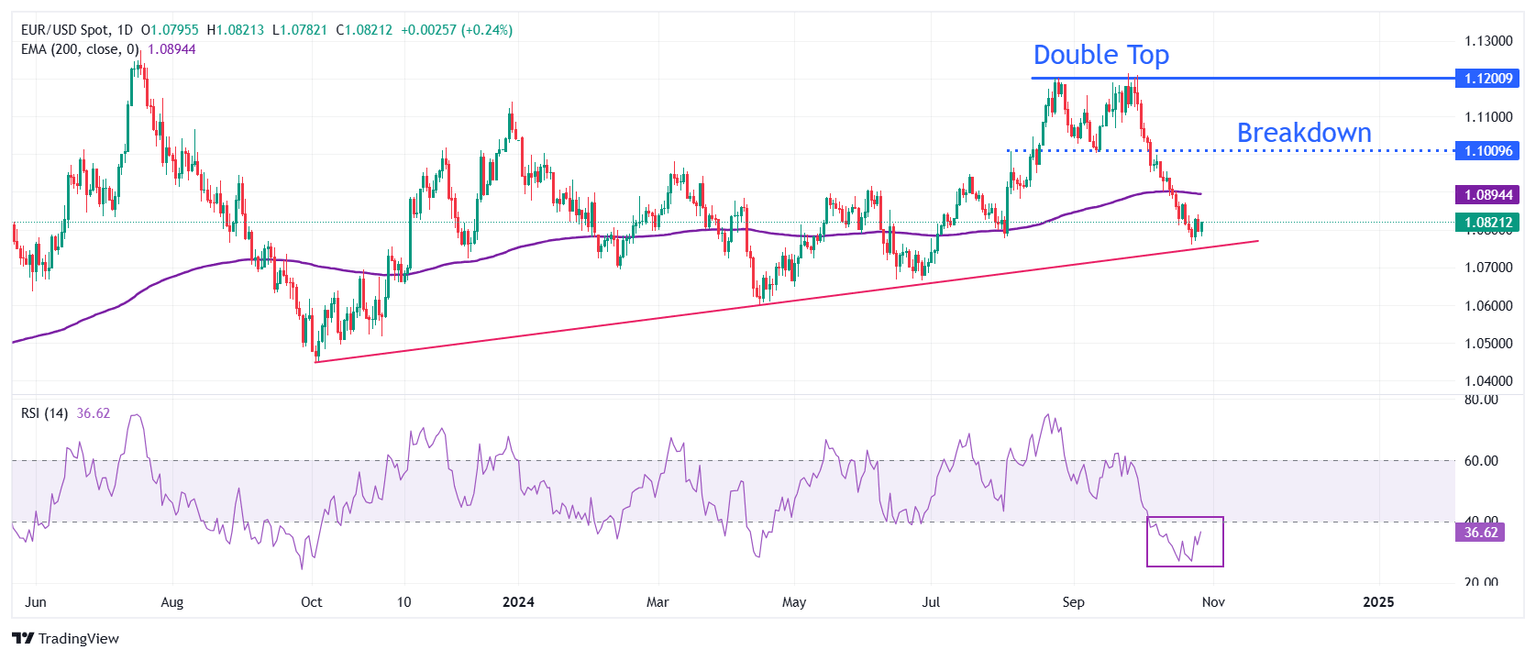

Technical Analysis: EUR/USD strives to sustain above 1.0800

EUR/USD continues to hold above the upward-sloping trendline near 1.0750, which is plotted from the October 3, 2023, low at around 1.0450 on the daily time frame. However, the outlook of the major currency pair remains downbeat as it stays below the 200-day Exponential Moving Average (EMA), which trades around 1.0900.

The downside move in the shared currency pair started after a breakdown of a Double Top formation on the daily time frame near the September 11 low at around 1.1000, which resulted in a bearish reversal.

The 14-day Relative Strength Index (RSI) remains in the 20.00-40.00 range, indicating a strong bearish momentum.

On the downside, the major pair could see more weakness towards the round-level support of 1.0700 if it slips below 1.0750. Meanwhile, the 200-day EMA near 1.0900, and the psychological figure of 1.1000 emerge as key resistances.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 30, 2024 12:30 (Prel)

Frequency: Quarterly

Consensus: 3%

Previous: 3%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.