- EUR/USD’s upside momentum falters near the 1.0200 mark.

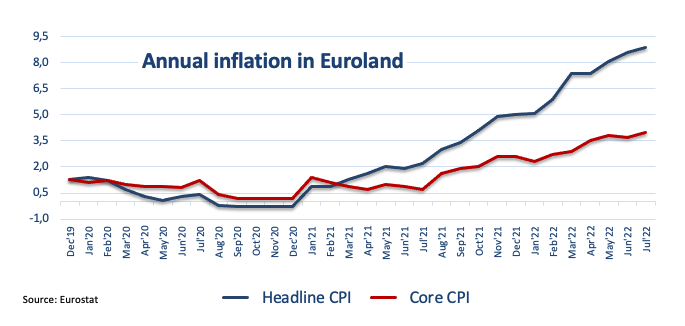

- Final Inflation Rate in the euro area came at 8.9% in July.

- US Initial Claims, Philly Fed Index take centre stage across the pond.

The selling pressure returns to the European currency and forces EUR/USD to give away part of the recent gains and return to the mid-1.0100s.

EUR/USD weaker on USD-buying

EUR/USD fades two consecutive daily advances and comes under pressure amidst shy losses on Thursday, all against the backdrop of some unostentatious rebound in the greenback.

Indeed, not much happening in the FX universe, as market participants refocus on upcoming US data and continue to digest Wednesday’s release of the FOMC Minutes.

The move lower in the pair also comes in tandem with further recovery in the German 10y Bund yields, which so far clinch the third consecutive daily gain near the 1.15% region.

In the euro docket, final inflation figures in the euro area showed the headline CPI rose 8.9% in the year to July and 0.1% vs. the previous month.

In the US calendar, usual weekly Claims and the Philly Fed Manufacturing Index will take centre stage seconded by the CB Leading Index, Existing Home Sales and speeches by FOMC’s George and Kashkari.

What to look for around EUR

EUR/USD now appears somewhat stabilized in the 1.0150 region against the backdrop of a firm recovery in the demand for the US dollar.

Price action around the European currency, in the meantime, is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges and the incipient slowdown in some fundamentals.

Key events in the euro area this week: EMU Final Inflation Rate (Thursday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.14% at 1.0164 and a break below 1.0096 (weekly low July 27) would target 1.0000 (psychological level) en route to 0.9952 (2022 low July 14). On the other hand, the next up barrier comes at 1.0368 (monthly high August 10) seconded by 1.0486 (100-day SMA) and finally 1.0615 (weekly high June 27).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD appreciates to near 1.0400 ahead of Eurozone HICP inflation

EUR/USD continues its winning streak for the third successive session, trading around 1.0400 during the Asian hours on Tuesday. The upside of the EUR/USD pair is attributed to the subdued US Dollar.

GBP/USD rises toward 1.2550 as US Dollar continues to correct downwards

GBP/USD continues to rise for the third consecutive day, trading near 1.2530 during Tuesday's Asian session. The pair's upward momentum is driven by a subdued US Dollar. Later in the day, the US ISM Services Purchasing Managers Index is set to be released.

Gold price sticks to modest gains; lacks bullish conviction amid Fed's hawkish shift

Gold price attracts some haven flows amid worries about Trump’s tariff plans. The Fed’s hawkish shift and elevated US bond yields cap gains for the XAU/USD. Traders seem reluctant ahead of FOMC minutes and US NFP releases later this week.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% the previous week. On-chain data hints for rallying continuation as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Five fundamentals for the week: Nonfarm Payrolls to keep traders on edge in first full week of 2025 Premium

Did the US economy enjoy a strong finish to 2024? That is the question in the first full week of trading in 2025. The all-important NFP stand out, but a look at the Federal Reserve and the Chinese economy is also of interest.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.