EUR/USD recovery stalls as ECB sees three rate cuts this year

- EUR/USD consolidates around 1.0770 after correcting from 1.0800 as investors expect the ECB to reduce interest rates from June.

- ECB Stournaras’s projection of three rate cuts this year is aligned with market expectations.

- The speculation for the Fed lowering interest rates from September has strengthened.

EUR/USD rebounds to 1.0770 in Tuesday’s early New York session. The shared currency pair is broadly sideways amid indecisiveness among investors due to the absence of high-tier data in the United States (US) and the Eurozone.

The upside in the major currency pair stalled near 1.0800 as the US Dollar (USD) steadied after investors priced in weak US Nonfarm Payrolls (NFP) and ISM Services Purchasing Managers Index (PMI) data for April, which strengthened speculation for the Federal Reserve (Fed) reducing interest rates from the September meeting. The CME FedWatch tool shows that traders see a 67% chance for rates being lower than current levels in September, which has increased significantly from the 46% chance recorded a week ago.

Despite declining confidence in the US economic outlook, Fed policymakers support keeping interest rates restrictive for a longer period due to the stubborn inflation outlook. On Monday, Richmond Fed Bank President Thomas Barkin said that risks to inflation are still on the upside, and demand must be hit to finish the battle against inflation.

Recently, the Institute for Supply Management (ISM) reported significantly higher Price Paid Indexes for both Manufacturing and Services PMI. This suggests that businesses' prices paid for inputs rose significantly, which exhibits a stubborn outlook on price pressures.

In the American session, Minneapolis Federal Reserve President Neel Kashkari also commented, "Inflation progress seen in the latter half of 2023 appears to have stalled; the question is whether disinflation is still underway or just taking longer."

Daily digest market movers: EUR/USD trades sideways after correcting from 1.0800

- EUR/USD is stuck in a tight range around 1.0770 amid the absence of tier-1 Eurozone economic data this week. Investors are expected to predict the next move in the Euro based on speculation about the European Central Bank’s (ECB) interest rate outlook.

- Financial markets anticipate that the ECB will extend its rate-cut campaign, which is expected to start at the June meeting. ECB policymakers have projected three rate cuts this year, which are aligned with market expectations.

- ECB policymaker and Bank of Greece Governor Yannis Stournaras said in an interview with a Greek media outlet that he sees three rate cuts this year. He sees a rate cut in July too as possible and added that the Eurozone’s economic rebound in the first quarter of the year made three cuts more likely than four.

- ECB’s confidence in beginning to reduce interest rates from June has been deepened due to consistently easing price pressures. Eurozone’s core Consumer Price Index (CPI), which is the ECB’s preferred inflation measure, has been declining consistently since July 2023. The annual core CPI has come down to 2.7% in April, suggesting that inflation is on course to return to the desired rate of 2%.

- Also, a sharp decline in Eurozone service inflation has also boosted the confidence of the ECB for cutting interest rates from the June meeting. The annual Eurozone service inflation softened to 3.7% in April after remaining steady at 4% for five months. About that, ECB policymaker Philip Lane said that April inflation data finally showed progress on services prices. However, he warned that the ECB would continue to focus on services to make sure it did not derail disinflation later on.

- Meanwhile, Eurostat reported strong Retail Sales data for March. Monthly Retail Sales rose strongly by 0.8% from the estimates of 0.6% after contracting by 0.3% in February. Annually, Retail Sales increased by 0.7% after declining 0.5% (revised from -0.7%) in February.

Technical Analysis: EUR/USD consolidates around 1.0770

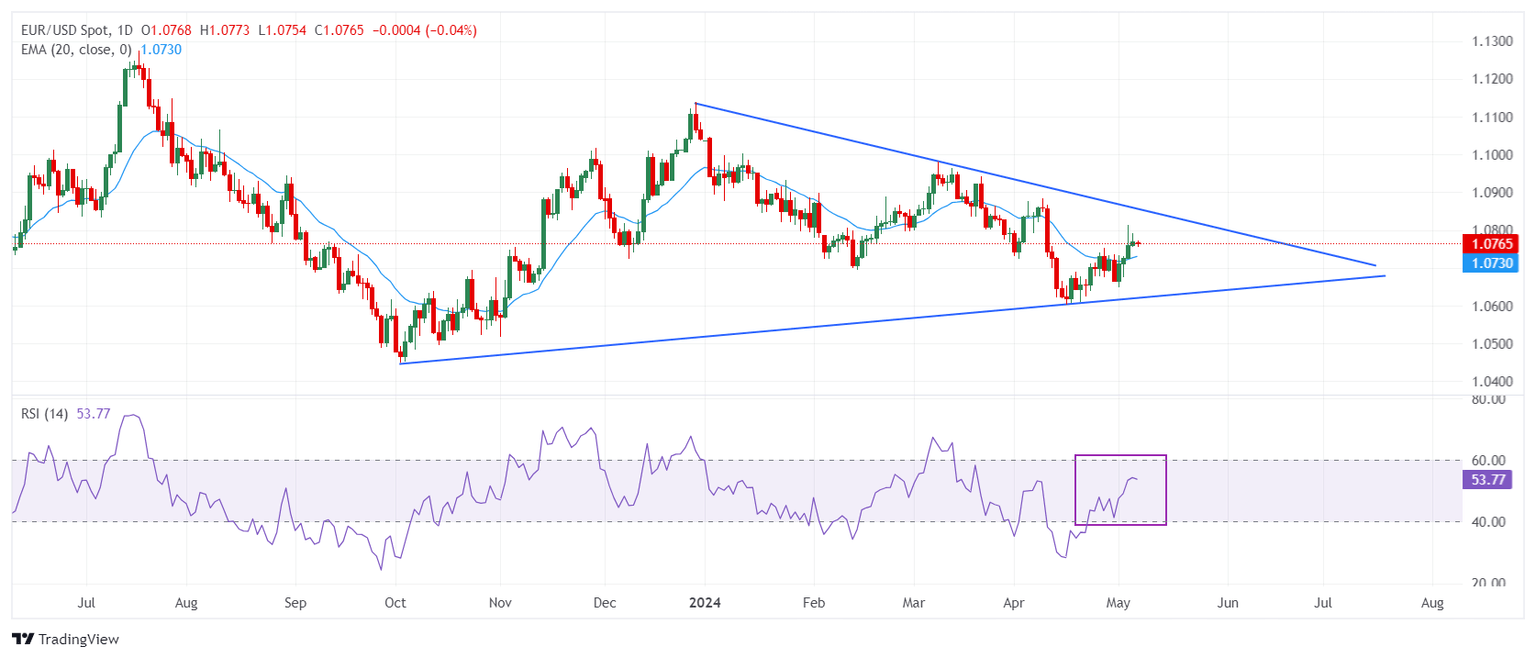

EUR/USD trades in a narrow range around 1.0770. The major currency pair struggles for a direction amid an absence of top-tier economic events. The overall trend in the major is also sideways due to a Symmetrical Triangle formation on a daily timeframe.

EUR/USD exhibits a sharp volatility contraction due to a Symmetrical Triangle formation on a daily timeframe. The upward-sloping border of the triangle pattern is plotted from October 3 low at 1.0448 and the downward-sloping border is placed from December 28 high around 1.1140.

The 14-period Relative Strength Index (RSI) shifts into the 40.00-60.00 range, suggesting indecisiveness among market participants.

The asset trades above the 20-day Exponential Moving Average (EMA) near 1.0723, suggesting that the near-term outlook is bullish.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.