EUR/USD soars above 1.0900 after poor US NFP report

- EUR/USD jumps to near 1.0900 as the US Dollar plunges after a weak US NFP report for July.

- US labor demand appears to have slowed significantly, with slower wage growth.

- The Euro fails to capitalize on increased doubts over market expectations for two more ECB rate cuts this year.

EUR/USD climbs to near the round-level resistance of 1.0900 in Friday's North American trading hours. The major currency pair rallies as the United States (US) Nonfarm Payrolls (NFP ) report for July showed signs of significant cracks in resilient labor market conditions. The report showed that US employers hired 114K new workers in July, lower than expectations of 175K and the former addition of 179K, downwardly revised from 206K.

The Unemployment Rate rose sharply to 4.3% from the estimates and the prior release of 4.1%. Also, slower Average Hourly Earnings growth, a key measure of wage growth that fuels consumer spending and eventually influences price pressures, has eased fears of price pressures remaining persistent. Annually, the wage growth measure decelerated to 3.6% from expectations of 3.7% and the prior reading of 3.8%, downwardly revised from 3.9%.

Weak US labor demand has weighed heavily on the US Dollar (USD) as it prompts expectations that the Federal Reserve (Fed) will begin reducing interest rates in September.. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, plummets to near 103.30. The outlook of the US Dollar was already downbeat due to a string of weak US economic data/

On Thursday, the US ISM Manufacturing Purchasing Managers Index (PMI) report for July showed that factory activities unexpectedly contracted at a faster pace to 46.8. Economists estimated the Manufacturing PMI to contract at a slower pace to 48.8 from June’s reading of 48.5. Also, Initial Jobless Claims for the week ending July 26 came out highest in 11 months. Individuals claiming jobless benefits for the first time were higher at 249K than estimates of 236K and the former release of 235K.

Daily digest market movers: EUR/USD strengthens as US Dollar plunges

- EUR/USD jumps to near the round-level figure of 1.0900 in Friday’s New York session. The shared currency pair strengthens after downbeat US NFP data, which boosts rate-cut expectations. Meanwhile, the Fed was already leaning towards pivoting to policy normalization in September.

- On Wednesday, the Fed kept interest rates unchanged in the range of 5.25%-5.50% but delivered a dovish guidance, as expected. Fed Chair Jerome Powell said, "If we were to see inflation moving down more or less in line with expectations, growth remains reasonably strong, and the labor market remains consistent with current conditions, then I think a rate cut could be on the table at the September meeting”, Reuters reported.

- On the other side of the Atlantic, the Euro struggles to recover despite the hotter-than-expected Eurozone preliminary Harmonized Index of Consumer Prices (HICP) in July. The headline HICP unexpectedly rose to 2.6%, while economists expected the inflation figure to decelerate to 2.4% from June’s reading of 2.5%. The core HICP, which strips off volatile items such as food, energy, alcohol, and tobacco, grew steadily 2.9% against expectations of 2.8%.

- Also, the old continent’s preliminary Gross Domestic Product (GDP) growth in the second quarter was higher than expected. The Eurozone economy expanded steadily by 0.3%, while investors anticipated a slower growth rate of 0.2%.

- A scenario of stubborn inflation and steady growth is unfavorable for market expectations for interest rate cuts. Financial markets currently expect the European Central Bank (ECB) to cut its key borrowing rates two times more this year. A few ECB policymakers are comfortable with market expectations, while others refrain from committing to a specific rate-cut path.

Euro Price Today:

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| EUR | USD | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| EUR | 0.95% | 0.33% | 0.03% | 0.72% | 0.37% | 0.46% | 0.14% | |

| USD | -0.95% | -0.63% | -0.95% | -0.23% | -0.59% | -0.49% | -0.82% | |

| GBP | -0.33% | 0.63% | -0.32% | 0.40% | 0.02% | 0.14% | -0.17% | |

| JPY | -0.03% | 0.95% | 0.32% | 0.68% | 0.30% | 0.39% | 0.09% | |

| CAD | -0.72% | 0.23% | -0.40% | -0.68% | -0.36% | -0.27% | -0.57% | |

| AUD | -0.37% | 0.59% | -0.02% | -0.30% | 0.36% | 0.12% | -0.23% | |

| NZD | -0.46% | 0.49% | -0.14% | -0.39% | 0.27% | -0.12% | -0.30% | |

| CHF | -0.14% | 0.82% | 0.17% | -0.09% | 0.57% | 0.23% | 0.30% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

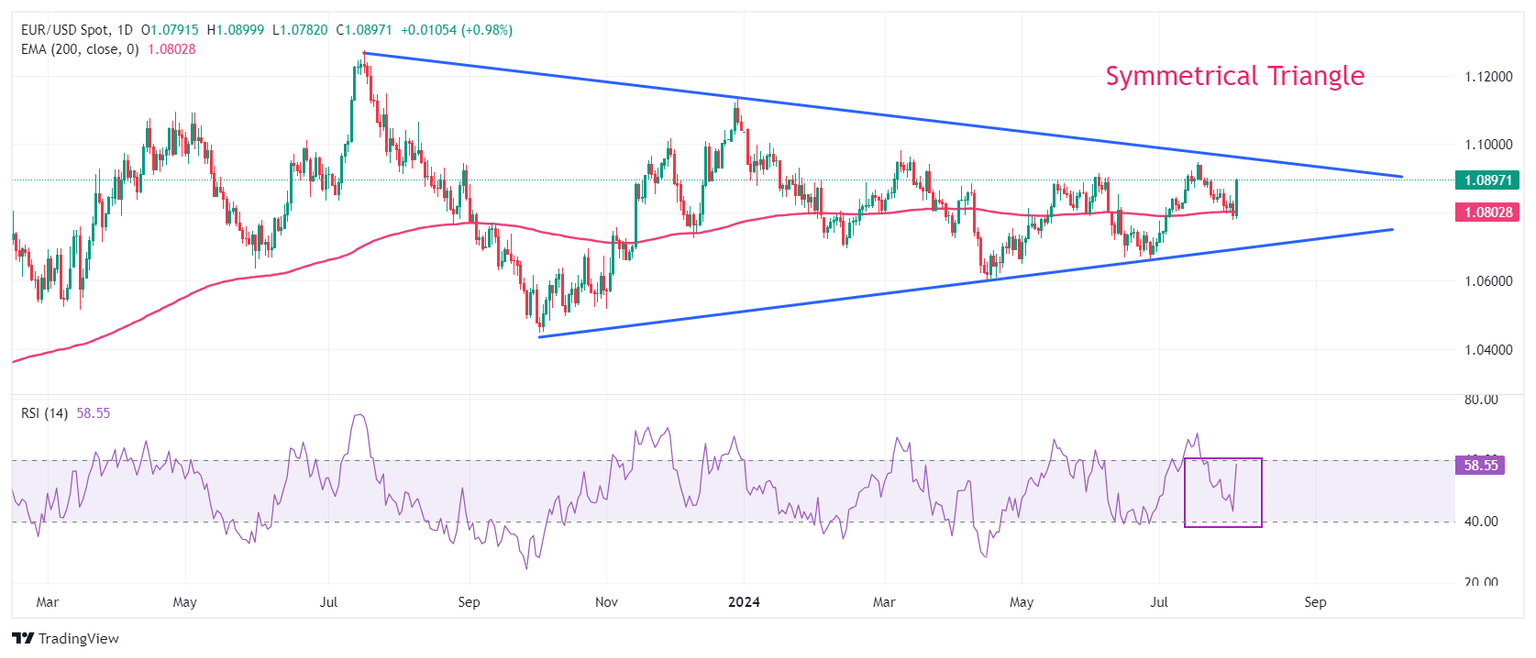

Technical Analysis: EUR/USD approaches upper boundary of Symmetrical Triangle

EUR/USD recovers sharply after discovering strong buying interest near the 200-day Exponential Moving Average (EMA), which trades around 1.0835. This has improved the near-term outlook of the shared currency pair. The major still trades inside a Symmetrical Triangle formation on a daily timeframe, exhibiting a sideways trend. The aforementioned chart pattern signifies a sharp volatility contraction, which is expected to remain for a while amid the absence of clear signals of a breakout or a breakdown.

The 14-day Relative Strength Index (RSI) recovers to near 60.00. If the RSI breaks above 60.00, a bullish momentum would trigger.

Economic Indicator

Nonfarm Payrolls

The Nonfarm Payrolls release presents the number of new jobs created in the US during the previous month in all non-agricultural businesses; it is released by the US Bureau of Labor Statistics (BLS). The monthly changes in payrolls can be extremely volatile. The number is also subject to strong reviews, which can also trigger volatility in the Forex board. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish, although previous months' reviews and the Unemployment Rate are as relevant as the headline figure. The market's reaction, therefore, depends on how the market assesses all the data contained in the BLS report as a whole.

Read more.Last release: Fri Aug 02, 2024 12:30

Frequency: Monthly

Actual: 114K

Consensus: 175K

Previous: 206K

Source: US Bureau of Labor Statistics

America’s monthly jobs report is considered the most important economic indicator for forex traders. Released on the first Friday following the reported month, the change in the number of positions is closely correlated with the overall performance of the economy and is monitored by policymakers. Full employment is one of the Federal Reserve’s mandates and it considers developments in the labor market when setting its policies, thus impacting currencies. Despite several leading indicators shaping estimates, Nonfarm Payrolls tend to surprise markets and trigger substantial volatility. Actual figures beating the consensus tend to be USD bullish.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.