- EUR/USD climbed into a five-week peak amid broad-market Greenback selling.

- US PPI inflation rose faster than expected in June, but investors pin hopes on rate cuts.

- ECB rate cut looms ahead next week, US Retail Sales due next Tuesday.

Broad-market hopes for an accelerated pace of rate cuts from the US Federal Reserve (Fed) reached a fever pitch on Friday despite a notable upswing in US Producer Price Index (PPI) wholesale inflation. The Fiber extended into a third straight week of gains as investor risk appetite gets pinned to the ceiling.

Forecasting the Coming Week: Fed rate cut bets and the ECB should rule the sentiment

June’s core Producer Price Index (PPI) for wholesale inflation in the US rose to 3.0% YoY, surpassing the expected 2.5%. The previous period's figure was adjusted upward to 2.6% from the initial 2.3%. Despite the notable increase in producer-level inflation, market focus has shifted to the earlier decrease in Consumer Price Index (CPI) inflation, raising expectations for a rate cut.

The CME's FedWatch tool indicates a significant likelihood of a quarter-point rate cut at the Federal Open Market Committee's (FOMC) meeting on September 18. Rate traders are currently factoring in at least three rate cuts by 2024, more than the one or two cuts projected by the Fed by December.

Economic Indicator

Producer Price Index ex Food & Energy (YoY)

The Producer Price Index ex Food & energy released by the Bureau of Labor statistics, Department of Labor measures the average changes in prices in primary markets of the US by producers of commodities in all states of processing. Those volatile products such as food and energy are excluded in order to capture an accurate calculation. Generally speaking, a high reading is seen as positive (or bullish) for the USD, whereas a low reading is seen as negative (or bearish).

Read more.Last release: Fri Jul 12, 2024 12:30

Frequency: Monthly

Actual: 3%

Consensus: 2.5%

Previous: 2.3%

Source: US Bureau of Labor Statistics

In other US economic data released on Friday, the University of Michigan's Consumer Sentiment Index survey dropped to a seven-month low of 66.0, falling short of the expected increase to 68.5. This reflects increasing discouragement among US consumers about the economic outlook. Additionally, the University of Michigan's 5-year Consumer Inflation Expectations decreased slightly in July to 2.9% from the previous 3.0%. Long-term consumer inflation expectations remain significantly higher than the Fed's target annual inflation rate of 2.0%

US Retail Sales figures are on the docket for next Tuesday, and Euro traders will be buckling down for the wait to next week’s latest rate call from the European Central Bank (ECB), slated for early next Thursday. The ECB recently delivered a quarter-point rate trim in early June, but odds of a follow-up cut are looking unlikely, and markets are broadly forecasting a cautious hold in July.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.62% | -1.35% | -1.74% | -0.07% | -0.50% | 0.31% | -0.19% | |

| EUR | 0.62% | -0.53% | -0.81% | 0.89% | 0.28% | 1.30% | 0.77% | |

| GBP | 1.35% | 0.53% | -0.33% | 1.44% | 0.81% | 1.79% | 1.30% | |

| JPY | 1.74% | 0.81% | 0.33% | 1.71% | 1.29% | 2.26% | 1.64% | |

| CAD | 0.07% | -0.89% | -1.44% | -1.71% | -0.46% | 0.37% | -0.08% | |

| AUD | 0.50% | -0.28% | -0.81% | -1.29% | 0.46% | 0.98% | 0.49% | |

| NZD | -0.31% | -1.30% | -1.79% | -2.26% | -0.37% | -0.98% | -0.48% | |

| CHF | 0.19% | -0.77% | -1.30% | -1.64% | 0.08% | -0.49% | 0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

EUR/USD technical outlook

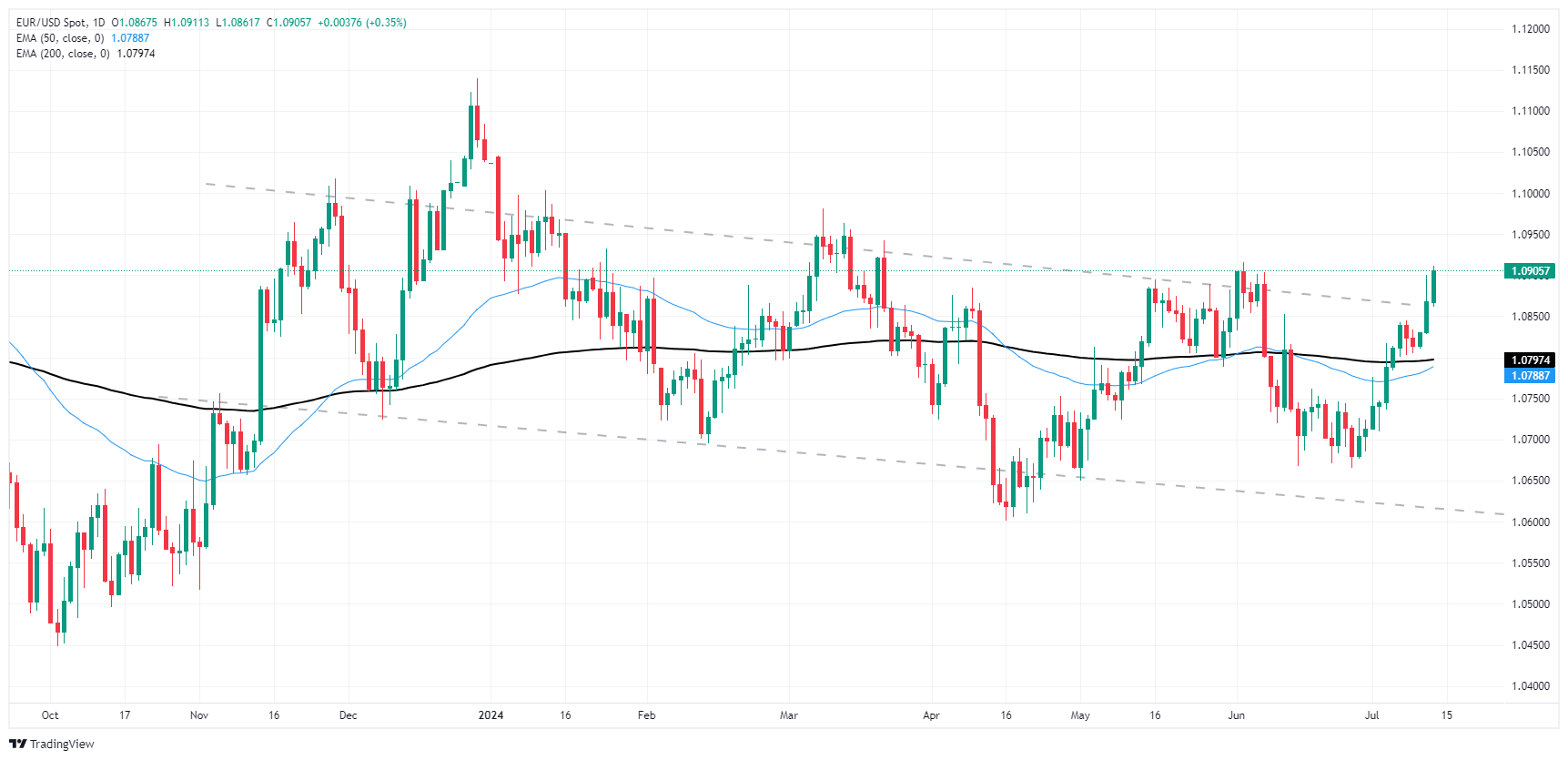

EUR/USD has chalked in a third straight week of gains, closing Friday a hair above the 1.0900 handle. The pair has risen 2.3% from late June’s swing low into 1.0666, and intraday price action is poised for a clash with technical resistance from June’s early peaks near 1.0920.

Fiber broken out of the topside of a rough descending channel on daily candlesticks. Despite closing in the green for all but two of the last twelve consecutive trading days, bullish momentum is poised to run out of gas and could see a bearish pullback to the 200-day Exponential Moving Average (EMA) at 1.0797.

EUR/USD hourly chart

EUR/USD daily chart

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD pares gains to near 1.0450 ahead of Germany's IFO survey

EUR/USD pares gains to trade near 1.0450 in European trading on Monday, moving back toward two-year lows of 1.0332. The renewed weakness is due to a modest recovery n the US Dollar and the US Treasury bond yields. The focus shifts to German data and ECB-speak.

GBP/USD pulls back toward 1.2550 as US Dollar sell-off pauses

GBP/USD is falling back toward 1.2550 in the European session on Monday after opening with a bullish gap at the start of a new week. A pause in the US Dollar decline alongside the US Treasury bond yields weighs down on the pair. Speeches from BoE policymakers are eyed.

Gold price sticks to heavy intraday losses amid risk-on mood, holds above $2,650 level

Gold price witnessed an intraday turnaround after touching a nearly three-week high, around the $2,721-2,722 area and snapped a five-day winning streak at the start of a new week. Bets for slower Fed rate cuts also drive flows away from the non-yielding yellow metal.

Bitcoin consolidates after a new all-time high of $99,500

Bitcoin remains strong above $97,700 after reaching a record high of $99,588. At the same time, Ethereum edges closer to breaking its weekly resistance, signaling potential gains. Ripple holds steady at a critical support level, hinting at continued upward momentum.

Eurozone PMI sounds the alarm about growth once more

The composite PMI dropped from 50 to 48.1, once more stressing growth concerns for the eurozone. Hard data has actually come in better than expected recently – so ahead of the December meeting, the ECB has to figure out whether this is the PMI crying wolf or whether it should take this signal seriously. We think it’s the latter.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.