- Interest rate futures signal ECB likely to delay tightening.

- Bond yield spreads favor USD.

- A hawkish Fed could push EUR/USD below 1.20.

The EUR/USD remains trapped in 1.2250-1.2450 range even though the top European Central Bank (ECB) officials stressed this week that stimulus will end only after inflation starts moving towards the 2 percent target.

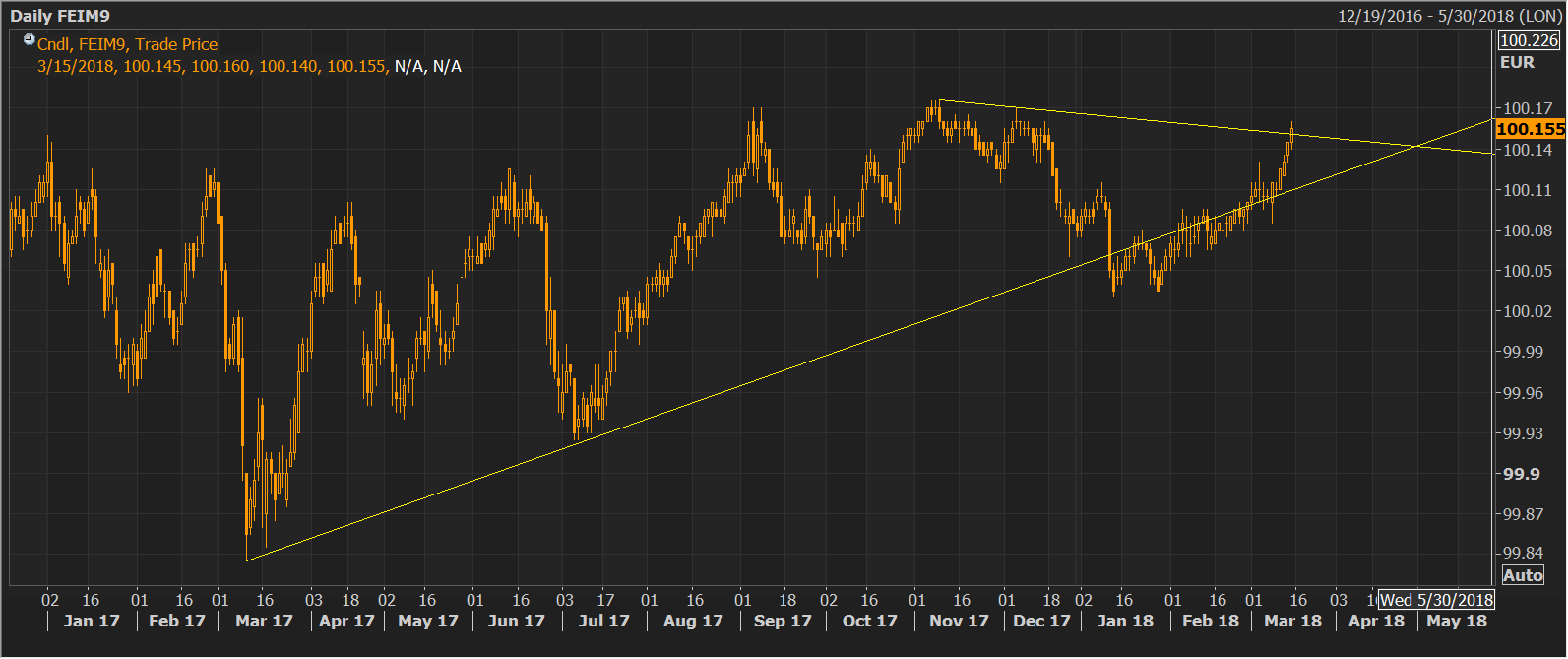

However, the Eurozone interest rate futures have started pricing-in a delay in the ECB tightening. For instance, the European Interbank Offered Rate (EURIBOR) three-month futures daily chart shows a bullish breakout, meaning the yields will likely fall (investors are digesting the dovish ECB).

FEIMR (Euro 3 month Euribor future)

Yield spreads continue to rise in the USD-positive manner

Further, the two-year US-German bond yield spread stands at 285.67 basis points - the highest level since 1997. Meanwhile, the 10-year yield spread has risen to 225 basis points, its highest level since December 2016.

So, the current levels in the EUR/USD are unjustified and the common currency is on the defensive ahead of the Fed. The pair may drop below 1.20 if the Fed revises its dot plot forecast to four (or five) rate hikes this year from the December forecast of three rate hikes.

EUR/USD Technical Levels

The pair clocked a low of 1.2295 in Asia and was last seen trading at 1.2309. The pullback from 1.2413 (March 14 high) has established another lower high on the daily chart and suggests the erratic rise from 1.2273 (March 9 low) has ended. That said, only a clear break below 1.2273 would signal resumption of the sell-off from 1.2446 (March 8 high) and open doors for 1.2206 (Feb. 9 low) and 1.2154 (March 1 low).

On the higher side, a close above 1.2413 would allow a stronger rally to 1.25 (psychological level + multiple daily highs) and 1.2538 (Jan. 25 high).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD under pressure near 1.0350 after mixed sentiment data

EUR/USD remains in the negative territory near 1.0350 in the European session on Tuesday, erasing a portion of Monday's gains. The pair is undermined by risk aversion and the US Dollar demand, fuelled by US President Trump's tariff threats, and mixed sentiment data.

GBP/USD drops to 1.2250 area on broad USD strength

GBP/USD stays under bearish pressure and trades deep in the red near 1.2250 on Tuesday as the USD gathers strength following US President Trump's tariff threats. The data from the UK showed that the ILO Unemployment Rate edged higher to 4.4% in the three months to November.

Gold price eases from over two-month top on stronger USD, positive risk tone

Gold price (XAU/USD) retreats slightly after touching its highest level since November 6 during the early European session on Tuesday and currently trades just below the $2,725 area, still up over 0.50% for the day.

Bitcoin fails to sustain the $109K mark after Trump’s inauguration

Bitcoin’s price steadies above the $102,000 mark on Tuesday after reaching a new all-time high of $109,588 the previous day. Santiment’s data shows that BTC prices quickly corrected, as social media showed major greed and FOMO among the traders in Bitcoin after President Donald Trump’s inauguration.

Five keys to trading Trump 2.0 with Gold, Stocks and the US Dollar Premium

"I have the best words" – one of Donald Trump's famous quotes represents one of the most significant shifts to trading during his time. Words from the president may have a more significant impact than economic data.

Trusted Broker Reviews for Smarter Trading

VERIFIED Discover in-depth reviews of reliable brokers. Compare features like spreads, leverage, and platforms. Find the perfect fit for your trading style, from CFDs to Forex pairs like EUR/USD and Gold.