EUR/USD breaks lower after NFP beats estimates

- EUR/USD breaks lower after the release of Nonfarm Payrolls data shows 303,000 new jobs added.

- Economists had expected only 200,000 extra jobs – US Dollar surges on the news.

- Middle East tensions are pushing up Oil prices, with implications for global inflation.

- Fed officials vacillate on timing of first interest-rate cut, German factory data weighs.

EUR/USD breaks lower, touching 1.0800 on Friday, after the release of US Nonfarm Payrolls (NFP) data beat expectations. The data showed that the US economy added 303,000 new jobs in March compared to the 200,000 predicted by economists. February's 275,000 result, meanwhile, was revised down to 270,000.

Seperately-released data from the household survey showed a fall in the US Unemployment Rate to 3.8% from 3.9% previously. Economists had expected no-change.

The better-than-expected data indicates the US economy is still in good shape. It means inflation is likely to remain stubbornly high and reduces the chances the Federal Reserve (Fed) will see fit to cut interest rates in June as previously expected.

Another key component of the report, Average Hourly Earnings data stayed unchanged, showing a 4.1% rise YoY and 0.3% MoM, according to data from the Bureau of Labor Statistics on Friday.

EUR/USD: Pulls back on inflationary risks

EUR/USD was already trading down a tenth of a percent prior to the NFP release after German Industrial Orders data on Friday observed a steep decline at an annual rate of 10.6% in February, compared with a decline of 6.2% in January.

German Factory Order data showed orders rising 0.2% over the same period, missing economists estimates of 0.8%, but recovering from an 11.4% slump reported in January.

Rising Middle East tensions are pushing up the price of Oil, with Brent Crude now trading above $90 per barrel. This is likely to pass through into broader inflation, adding fuel to the thesis of those policymakers who push to keep interest rates elevated.

Commentary from Minneapolis Federal Reserve (Fed) Bank President Neel Kashkari raised the prospect the Fed might not cut interest rates at all in 2024 if inflation remained at current levels.

“If inflation continues to move sideways, it makes me wonder if we should cut rates at all this year,” Kashkari said, despite admitting to previously penciling in two rate cuts this year.

The maintenance of higher interest rates is positive for the US Dollar as it increases foreign capital inflows.

There appears to be more of a consensus amongst rate-setters in the Eurozone about going ahead with a proposed interest-rate cut in June, a factor weighing on the Euro (EUR).

The decision is likely to be dependent on whether wage data released prior to the June meeting shows a decline in wage inflation.

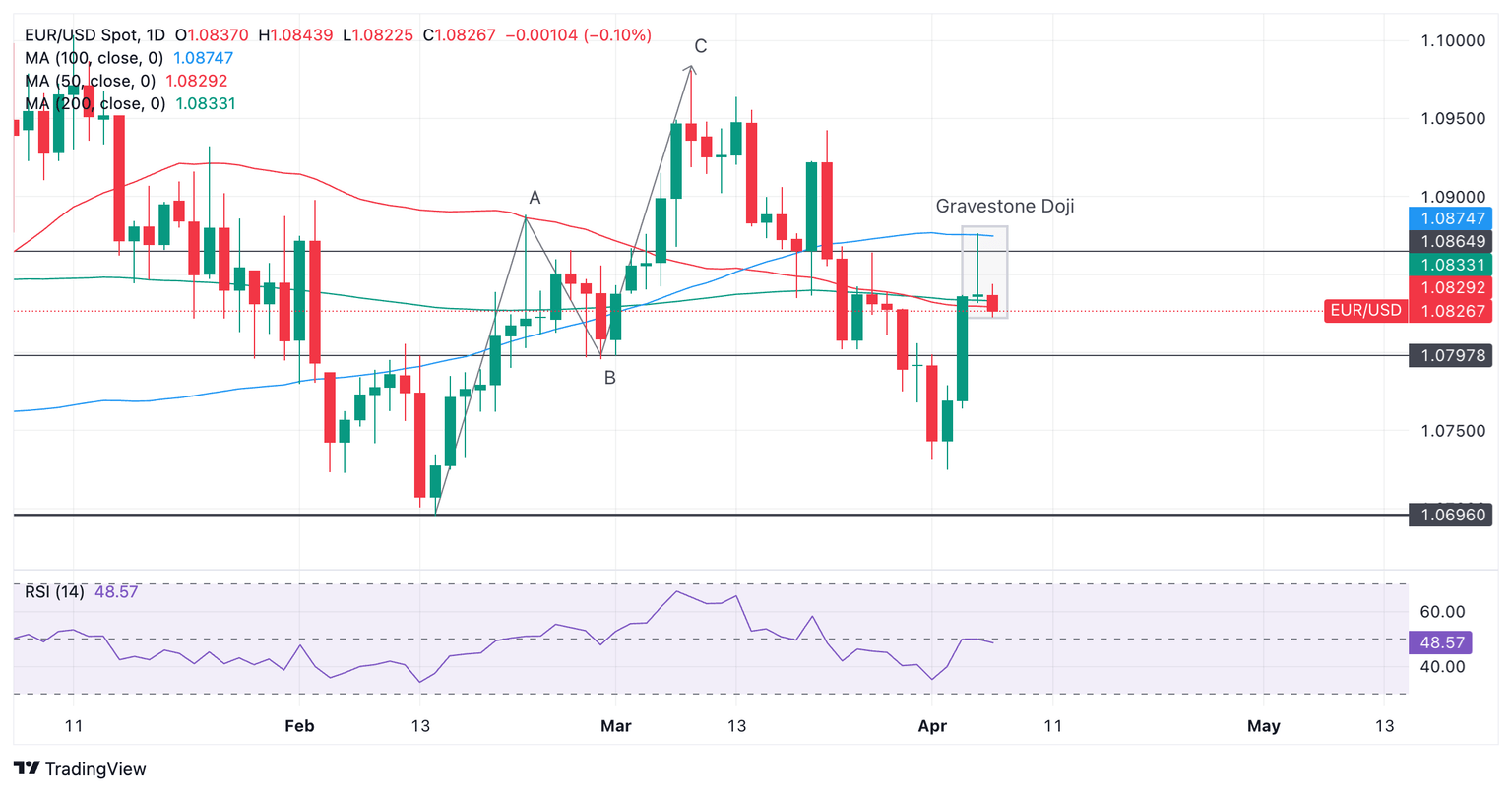

Technical Analysis: EUR/USD ping pongs with no clear direction

EUR/USD rose up to the 100-day SMA at 1.0874 on Thursday before reversing to close flat on the day.

In the process, a Gravestone Doji Japanese candlestick pattern was formed, with potentially bearish implications if followed by a red bearish candlestick on Friday.

EUR/USD Daily Chart

The short-term trend is unclear with risks balanced. The 50-day SMA is providing cushioning support at 1.0827.

A decisive break above the Gravestone Doji candlestick high at 1.0876 would neutralize its bearish implications and solidify the case for a bullish short-term trend and indicate the probability of higher prices. The March 21 high at 1.0942, provides a potential next target.

Alternatively, if the downside continues, a pullback down to support at the previous wave B lows of 1.0798 is also quite possible.

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.