EUR/USD pulls back from day's high, fails to capture 1.0600

- The EUR/USD is seeing a pullback from the day's highs as risk aversion takes a bite on Friday.

- The US Dollar is seeing a recovery heading into the Friday closing bell, bouncing from the day's lows.

- US PCE came in as-expected, investors to turn their eyes toward Fed's next rate call.

The EUR/USD slipped back into the 1.0570 region in Friday's midday, with the Euro falling just short of retaking the 1.0600 handle before the trading week closes out.

The US Dollar (USD) is catching an intraday bid to recover from Friday's lows, with the US Dollar Index (DXY) recovering to the day's opening prices.

The Core US Personal Consumption Expenditure (PCE) Index came in at expectations, with the Federal Reserve's (Fed) preferred method of measuring inflation printing at 3.7% for the year into September, compared to August's print of 3.8%, which was revised down from 3.9%.

Coming up next week: EU GDP, HICP inflation, US Fed rate call

With the week's major data out of the way, investors will be looking ahead to next week which sees EU Harmonized Index of Consumer Prices (HICP) and EU Gross Domestic Product (GDP) on Tuesday, with another rate call from the Fed slated for Wednesday.

Wall Street is expecting European economic conditions to continue deteriorating, and EU GDP is forecast to decline to just 0.2% for the 3rd quarter, compared to 0.5% for 2Q, while EU HICP is expected to show pan-EU inflation dropping from 4.3% to 3.4% for the year into October.

Markets have broadly predicted the Fed to stand pat on interest rates next Wednesday, but traders will be keeping a close eye on the Fed's "dot plot" and Fed Chairman Jerome Powell's speech scheduled for 30 minutes after the rate statement gets released.

Despite money markets' bets on a hold from the Fed, traders continue to remain nervous about a possible rate hike from the Fed at their December meeting as US economic figures continue to print too good for markets to bet on rate cuts coming sooner rather than later.

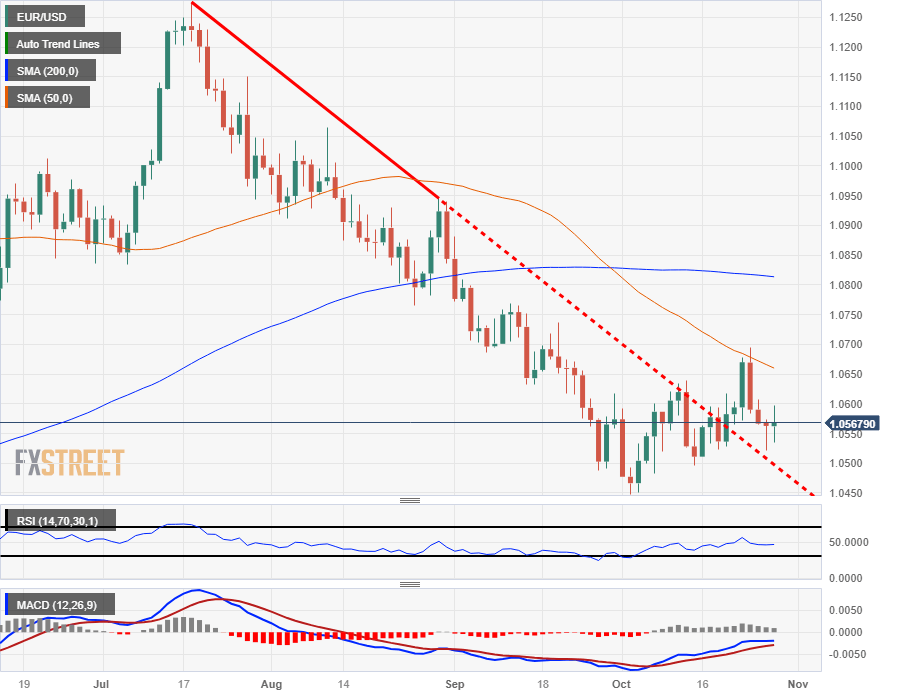

EUR/USD Technical Outlook

The EUR/USD has backed off Friday's highs just below the 1.0600 handle, and the pair is set to round out the week's trading down 1.2% from Tuesday's peak near 1.0695.

On the daily candlesticks, the Euro is seeing limited success staging a rebound from 2023's lows near 1.0450 set in early October, with swing highs from a near-term higher lows pattern running into technical resistance from the 50-day Simple Moving Average (SMA).

EUR/USD Hourly Chart

EUR/USD Daily Chart

EUR/USD Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.