- The pair moves higher early in Europe, tests 1.1230.

- The greenback eases from highs and approaches 97.20.

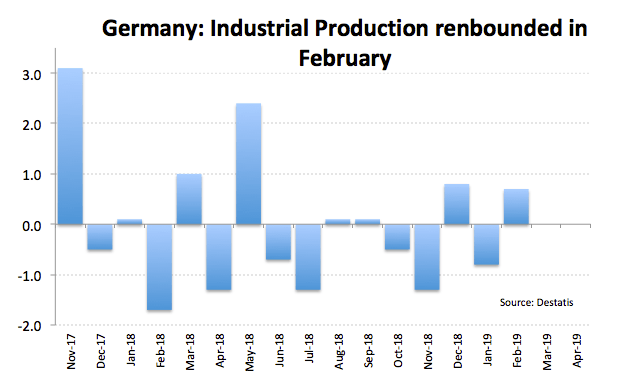

- German Industrial Production expanded 0.7% MoM in February.

The mood around the European currency remains choppy so far this week, with EUR/USD at least managing to stay above the 1.1200 handle in the last sessions.

EUR/USD looks to risk trends, data

Spot is so far reversing Thursday’s pullback amidst a broad-based sideline theme, always navigating the lower end of the weekly range and with gains capped in the 1.1250 region for the time being.

In the meantime, the pair has practically ignored auspicious developments from the US-China trade front, focusing instead in the performance of yields in Germany and the spread vs. their American counterparts.

In the data space, German Industrial Production unexpectedly expanded at a monthly 0.7% during February, coming in above expectations and reversing the previous 0.8% contraction. Later across the pond, Non-farm Payrolls for the month of March are expected to grab all the attention.

What to look for around EUR

Despite the current lack of direction in spot, EUR remains under pressure following poor results in Euroland as of late. In fact, recent disappointing readings in the region somehow confirm that the slowdown in the bloc and the ‘patient-for-longer’ stance from the ECB could be among us for longer than expected. Against the backdrop of souring risk-appetite trend, the greenback should emerge stronger and is expected to keep weighing on spot for the time being. On the political front, headwinds are expected to emerge in light of the upcoming EU parliamentary elections, where the focus of attention will be on the potential increase of the populist option among voters.

EUR/USD levels to watch

At the moment, the pair is gaining 0.10% at 1.1231 and a breakout of 1.1254 (high Apr.1) would target 1.1278 (21-day SMA) en route to 1.1338 (200-week SMA). On the flip side, the next support emerges at 1.1183 (low Apr.2) followed by 1.1176 (low Mar.7) and finally 1.1118 (monthly low Jun.20 2017).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stabilizes around 1.2550 after hitting two-year lows

EUR/USD plunged to 1.0223, its lowest in over two years, as risk aversion fueled demand for the US Dollar. Thin post-holiday trading exacerbated the movements, with financial markets slowly returning to normal.

USD/JPY flirts with multi-month highs in the 158.00 region

The USD/JPY pair traded as high as 157.84 on Thursday, nearing the December multi-month high of 158.07. Additional gains are on the docket amid prevalent risk aversion.

Gold retains the $2,650 level as Asian traders reach their desks

Gold gathered recovery momentum and hit a two-week-high at $2,660 in the American session on Thursday. The precious metal benefits from the sour market mood and looks poised to extend its advance ahead of the weekly close.

These 5 altcoins are rallying ahead of $16 billion FTX creditor payout

FTX begins creditor payouts on January 3, in agreement with BitGo and Kraken, per an official announcement. Bonk, Fantom, Jupiter, Raydium and Solana are rallying on Thursday, before FTX repayment begins.

Three Fundamentals: Year-end flows, Jobless Claims and ISM Manufacturing PMI stand out Premium

Money managers may adjust their portfolios ahead of the year-end. Weekly US Jobless Claims serve as the first meaningful release in 2025. The ISM Manufacturing PMI provides an initial indication ahead of Nonfarm Payrolls.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.